Zinger Key Points

- Deere settles SEC bribery probe for $9.93M, stock down 4.49% YTD but flashing bullish signals.

- Analysts see 8.62% upside despite legal woes; strong fundamentals and cost-cutting could spur growth.

- Our government trade tracker caught Pelosi’s 169% AI winner. Discover how to track all 535 Congress member stock trades today.

Deere & Co. DE, doing business as, John Deere, might be famous for its green tractors, but it's seeing red as news broke of a $9.93 million settlement with the SEC.

The charge? Violations of the Foreign Corrupt Practices Act through improper payments made by its subsidiary, Wirtgen Thailand, to foreign officials, including those from Thailand's Royal Air Force, reported Reuters.

The stock has been dragging too, down 4.49% YTD and 4.37% over the last year. But despite the legal drama, Deere's fundamentals may have what it takes to power through.

A Rocky Road To Growth

Sure, the bribery probe leaves a mark, but analysts are optimistic about Deere's long-term outlook. The third quarter wasn't pretty—a 16.8% sales drop—but it wasn't the disaster everyone feared either. Deere's earnings are still strong enough to keep investors hooked, with a pledge to keep those dividends rolling and a share buyback program still in play.

Read Also: Deere Reports Q3 Earnings: What Key Metrics Have to Say

That said, Deere's key segments—Production & Precision Ag, Small Ag & Turf, and Construction & Forestry—all posted double-digit declines, raising questions about future growth.

However, cost-cutting measures are expected to help mitigate some of the damage, and investors are holding out for a rebound in 2025 when the Federal Reserve is expected to cut rates.

The Technicals Are Green, But Is Deere Overbought?

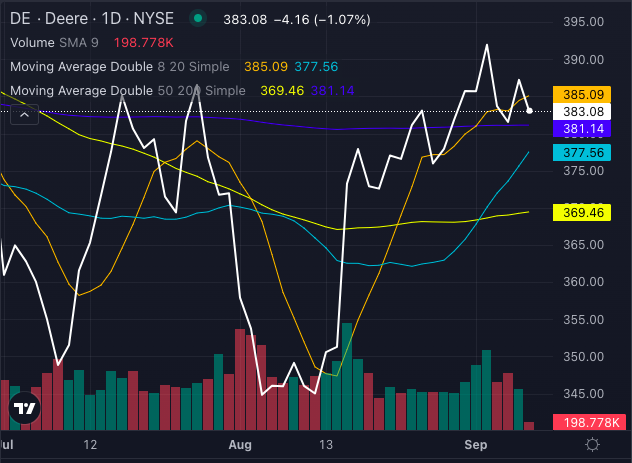

Technically, John Deere stock shows a bullish trend. It's trading above its 20, 50, and 200-day moving averages, signaling more upside potential.

Chart created using Benzinga Pro

At a price of $387.08, it's flashing all sorts of bullish signals. Though with the stock trading below the eight-day moving average, the short-term may see some strain.

Chart created using Benzinga Pro

The MACD (Moving Average Convergence/Divergence) stands at 5.20, and with an RSI (Relative Strength Index) of 55.24, it's in neutral territory—showing upward movement but not approaching overbought levels yet.

Bollinger Bands suggest there's room to climb.

With an average analyst price target of $426.33, there's an implied 8.62% upside for John Deere stock. But investors should keep an eye on market sentiment, as a mix of technical indicators and the bribery settlement could make for a bumpy ride in the near term.

Read Also:

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.