Zinger Key Points

- Micron stock is approaching a Death Cross, signaling potential downside despite recent buying pressure and strong fundamentals.

- Analysts, including Jim Cramer, see Micron’s dip as a potential buying opportunity ahead of fourth quarter earnings.

- How to Spot the Market Bottom: Matt Maley has navigated every major market turn in the last 35 years, and on Wednesday, March 26, at 6 PM ET, he’s revealing how to recognize when the worst is over, the trades to make before the next bull market takes off, and the stocks and sectors that will lead the recovery.

Micron Technology Inc. MU is approaching a critical technical event that traders dread—the infamous Death Cross.

After a strong performance over the past year, with shares up 28.93% year-over-year and 10.09% year-to-date, the stock has slid 4.22% in the past month.

Investors are now bracing as the stock flirts with a bearish pattern that signals potential downside.

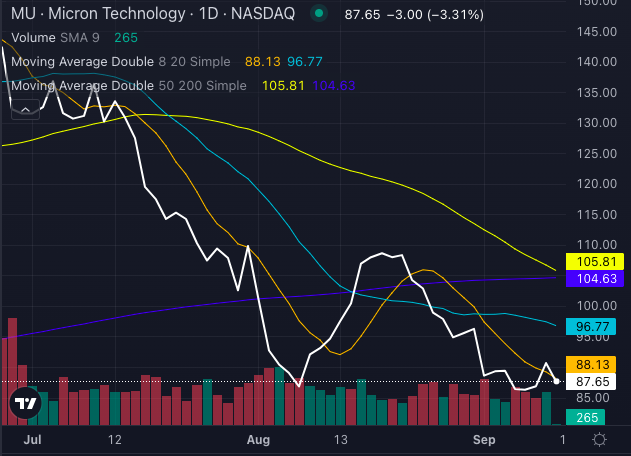

Chart created using Benzinga Pro

The Death Cross, a moment when the 50-day moving average crosses below the 200-day moving average, looms large for Micron stock. Despite the recent sell-off and Micron losing more than $70 billion in market value since June, some analysts are seeing opportunity rather than doom.

Read Also: Why Micron (MU) Stock Is Falling

The Case For Buying The Dip

In a recent CNBC appearance, Jim Cramer offered his bullish take, stating that Micron stock would be a "buy right there” if it drops to $98 or $99.

Cramer's enthusiasm for the stock echoes sentiments shared by BofA Securities' Vivek Arya, who notes that while the broader semiconductor market has been volatile, the fundamentals for Micron remain strong.

Arya believes that Micron is one of the best-beaten-down tech stocks presenting an attractive entry point. He argues that most of the recent declines in the semiconductor sector are temporary, driven by external factors rather than any weakness in Micron's core business.

If volatility cools off in the industry and market sentiment improves, Arya predicts Micron will be one of the standout performers.

Micron Stock Faces Bearish Technicals, Bullish Buying Signals

From a technical perspective, Micron stock's short-term outlook looks bearish, with the stock trading below its five, 20, and 50-day exponential moving averages. However, there's a silver lining—the stock is still seeing buying pressure, which could signal a bullish reversal ahead.

- Current Price: $87.65

- Eight-Day Simple Moving Average (SMA): $88.13

- 20-Day SMA: $96.77

- 50-Day SMA: $105.81

- 200-Day SMA: $104.63

With shares currently priced at $87.65, Micron is a mixed bag for technical traders.

While the near-term indicators may scream bearish, buying pressure is mounting as it heads into earnings, creating an intriguing dynamic for investors.

Q4 Earnings & The Road Ahead

Micron's upcoming fourth quarter earnings on Sept. 25, after the market close, could be a major turning point. As the semiconductor industry grapples with volatility, these results will provide much-needed clarity on Micron's trajectory.

Investors betting on a comeback will be closely watching the numbers—and whether the Death Cross leads to a deeper dip or the start of a reversal.

For now, the Death Cross may signal danger, but it's clear some see this as a golden opportunity to buy Micron stock at a discount.

Read Next:

Image: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.