Zinger Key Points

- AMD's accelerated AI roadmap signals bullish momentum, but Nvidia's technical strength keeps it ahead.

- Both AMD and Nvidia stock show strong buying pressure, but Nvidia’s AI leadership holds a clear edge.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

The AI supercycle is fueling a heated competition between Advanced Micro Devices Inc AMD and Nvidia Corp NVDA, with both tech giants racing to capture the growing AI market.

While AMD stock has gained 39.98% over the past year, Nvidia has surged 161.90%. Year-to-date, the gap is even wider, with AMD up 8.80% and Nvidia soaring 147.33%. After all, Nvidia’s first-mover advantage in the AI space has helped it amass over $2.9 trillion in market cap, with AMD left playing catch-up at around $245 billion.

AMD's CEO, Lisa Su, recently reaffirmed that AMD's AI roadmap is accelerating, while Nvidia confirmed a strong outlook for its upcoming Blackwell AI GPUs. But how do the two stocks compare on the technical front?

AMD's Bullish Momentum

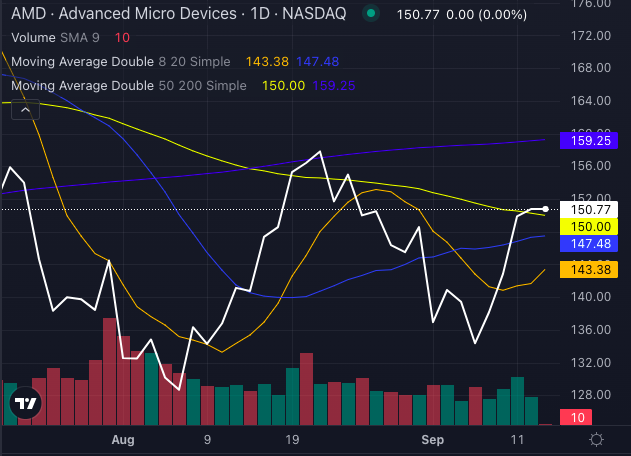

Chart created using Benzinga Pro

AMD stock has been on a bullish run, with its share price of $150.77 sitting above its five, 20 and 50-day exponential moving averages (EMAs), signaling strong buying pressure.

AMD's eight-day simple moving average (SMA) of $143.38 and its 20-day SMA of $147.48 both indicate a bullish signal, while its 50-day SMA of $150.00 reinforces the short-to-medium term bullish sentiment.

However, a slight caution flag is raised by AMD's 200-day SMA of $159.25, which sits above the current stock price, creating a long-term bearish signal.

While long-term indicators show potential resistance, the short-term outlook remains positive, making AMD stock an attractive pick in the AI space for the near term.

Nvidia's AI Dominance, Bullish Trend

Chart created using Benzinga Pro

Nvidia continues to lead the AI race, and its technical indicators show a bullish trend as well. With its share price at $119.11, Nvidia stock is currently trading above its five, 20 and 50-day EMAs, signifying slight buying pressure. Nvidia stock's eight-day SMA of $110.75 and 20-day SMA of $118.74 both flash bullish signals, with the 50-day SMA at $117.55 further supporting this bullish view.

Unlike AMD, Nvidia's 200-day SMA stands at $90.74, well below its current price, providing a strong bullish signal for the long term. The stock is positioned for continued strength, boosted by its upcoming Blackwell chips and AI leadership.

Both AMD and NVIDIA are showing bullish momentum in the short term, with strong technical support. While AMD is making aggressive strides to catch up with Nvidia's AI dominance, Nvidia's leadership in the market remains secure, backed by robust technical indicators and an advanced product roadmap.

Investors may find opportunities in both stocks, but Nvidia currently holds the edge.

Read Also:

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.