Zinger Key Points

- Uber's stock nears a Death Cross, but bullish sentiment persists as technicals show mixed signals.

- Expanded safety features and countercyclical strength bolster Uber's long-term growth, despite economic concerns.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get Matt’s next trade alert free.

Uber Technologies Inc. UBER stock has had an impressive run this year, up a stellar 25.37% year-to-date and a whopping 57.36% in the past year.

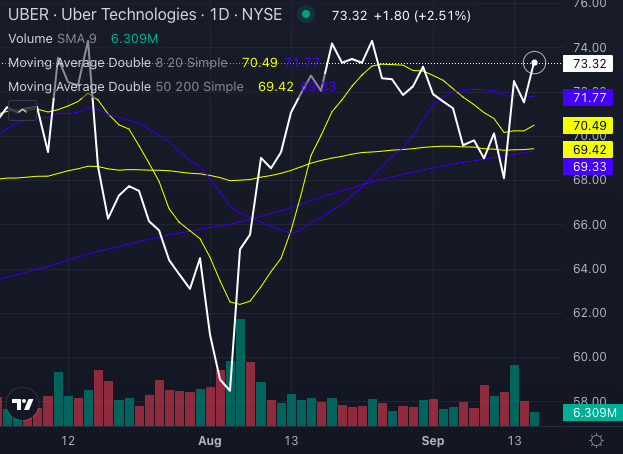

The ride-hailing giant continues to dominate its competition, but some technical indicators suggest a potential slowdown as the stock nears a Death Cross. Yet, bulls remain undeterred, betting on Uber's unique position in the market.

Chart created using Benzinga Pro

Uber Expanding Safety Features

On the operational front, Uber has expanded its safety features, rolling out enhanced rider verification across the U.S. The new rider ID program and Record My Ride tool mark a shift in Uber's focus from riders to drivers, enhancing their safety while dealing with the ever-growing demand.

Drivers can now feel more secure knowing riders have passed additional verification steps, earning a “Verified” badge.

Uber’s scale and tech lead in a winner-take-all market, especially with partnerships like Waymo in the robotaxi space, giving the company a unique advantage. Plus, it has proven itself as a countercyclical business, with CEO Dara Khosrowshahi reaffirming during the latest earnings call that Uber can thrive even during economic downturns. However, concerns around interest rates and the potential disruption of robotaxis persist.

Read Also: Uber Stock Spikes As CEO Praises Waymo’s ‘Fully Autonomous Trips’

Uber Stock Nears A Death Cross

Technically, Uber's stock is sending mixed signals.

Chart created using Benzinga Pro

Uber stock is trading above its eight, 20, and 50-day exponential moving averages, suggesting a bullish trend. Yet, as the stock nears a Death Cross, with the 50-day moving average converging toward the 200-day moving average, traders should exercise caution.

Chart created using Benzinga Pro

With Uber stock’s price hovering around $73.32, signals are mixed. The MACD (Moving Average Convergence/Divergence) indicator stands at 0.42, pointing to a bullish sentiment, while the RSI (Relative Strength Index) is neutral at 57.54 but heading north towards overbought conditions.

Traders should keep a close eye on the Bollinger Bands and momentum, but for now, bulls seem ready to ride the wave, trusting Uber's long-term growth potential.

Read Next:

Photo: Daniel Fung/Shutterstock.com

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.