Zinger Key Points

- Super Micro shares soared 15% after announcing shipments of over 100,000 GPUs per quarter for AI, only to plummet back by noon.

- Despite the rally, SMCI remains down 50% since March, facing legal probes and bearish technical indicators.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Super Micro Computer Inc. SMCI has been riding the AI wave for some time, and its latest announcement sent the stock soaring again.

Shares jumped 15% after the company revealed it’s shipping over 100,000 GPUs per quarter, a figure that could translate into billions of dollars in potential revenue, with GPUs being the core hardware behind AI development and deployment.

But while the stock got a short-term boost, questions about its sustainability loom large. It soon receded and was down by about 7% by 1:30 PM ET.

AI Infrastructure Powers Stock Surge

Super Micro has been a major player in supplying AI infrastructure, and the latest GPU shipment announcement highlights its role in powering some of the biggest AI data centers. The company's new liquid cooling technology also caught Wall Street's attention, as it promises to reduce costs and optimize hardware for data centers that run constantly.

But there's a wrinkle: Super Micro has been dealing with investigations, including a Department of Justice probe following short-seller allegations of accounting issues.

Headwinds Persist Despite Rally

Even with this impressive GPU announcement, Super Micro is battling broader headwinds.

Despite the recent rally, the stock remains down over 50% since peaking in March, and technical indicators suggest the path ahead could be rocky.

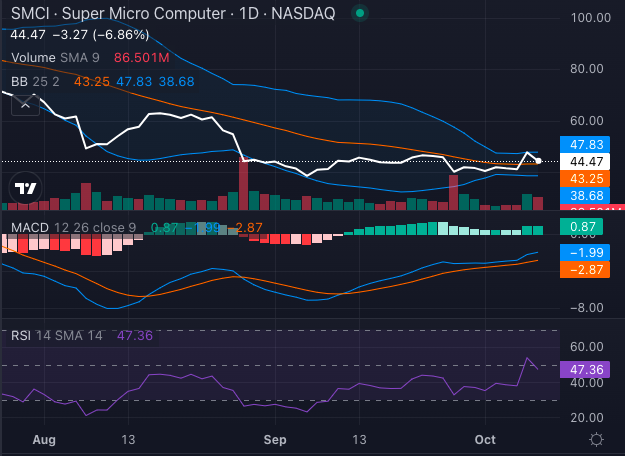

Chart created using Benzinga Pro

Currently trading at $44.44, the stock is below both its 50-day and 200-day simple moving averages ($50.23 and $70.92, respectively), which are typically bearish signals.

Read Also: What’s Going On With Super Micro Computer Stock?

Bullish Signs, But Uncertainties Remain

Still, the stock price sits above its eight-day and 20-day SMAs, signaling near-term bullish potential.

Chart created using Benzinga Pro

The MACD, however, remains negative, and while the RSI at 47.36 isn't in overbought territory, it suggests that investor enthusiasm could face hurdles.

The AI demand boom has propelled Super Micro, but with ongoing legal and financial uncertainties, the real question is whether this surge can last.

For now, it seems like investors are still very much along for the ride.

Read Next:

Image: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.