Even with the catastrophic events in Japan I am still a believer in the "Nuclear Renaissance".

Over the past couple of weeks I've written a number of articles about the uranium market, including "Why I Continue to be a Uranium Bull" and "Is Now the Time to Buy Uranium Miners?"

The article generated a slew of questions from loyal readers asking about the fundamentals of the uranium market, uranium ETFs and small cap uranium mining companies.

I've selected a few of the most repeated questions to answer today because doing so will highlight exactly why this market is poised to rebound, and how investors can benefit.

So, let's get to it.

Reader Don asks:

"I think I remember an uranium ETF available. Am I right? If there is an ETF for Uranium, would you please identify it?"

Your memory is sound and intact Don. There are actually several ETFs that track the uranium sector. These are the Global X Uranium ETF (NYSE: URA), PowerShares Global Nuclear Energy (NYSE: PKN), iShares S&P Global Nuclear Energy (NASDAQ: NUCL) and Market Vectors Uranium + Nuclear Energy ETF (NYSE: NLR).

The only pure uranium play of these four ETFs is the Global X Uranium ETF (URA). The other three ETFs scatter their sector holdings among not only nuclear energy, but industrials and utilities as well.

I'm most interested in the best way to gain exposure to uranium. Some might want to be diversified across the different facets of the nuclear industry, which is what PKN, NUCL and NLR offer, but I am only interested in the best way to invest in the other yellow metal. This is where URA differentiates itself from the other ETFs.

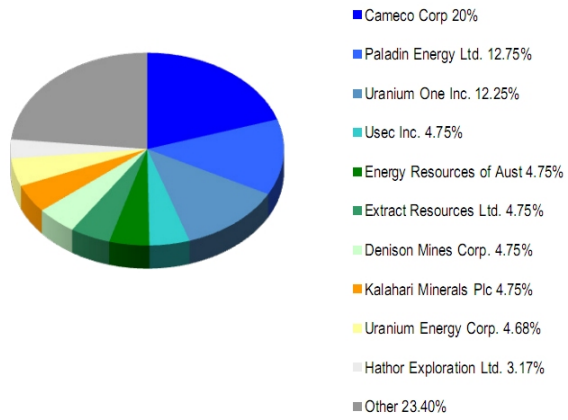

As you can quickly see in the pie chart below, provided by Global X, URA is concentrated in the biggest publicly traded uranium miners across the globe. It is by far the most concentrated uranium themed ETF among the four mentioned above.

URA is a concentrated ETF comprised of 23 uranium stocks ranging from the only blue-chip uranium stock, Cameco CCJ, to junior miners including Denison Mines DNN, Uranium Resources URRE and Uranium Energy (AMEX: UEC).

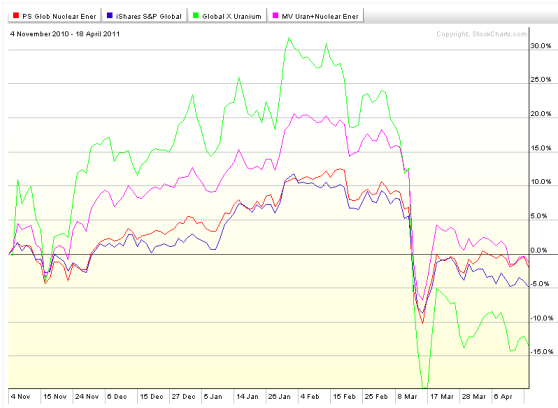

As for the performance of the four ETFs, a comparison chart of their performance over the past six months shows significant volatility. You can clearly see that URA outperformed the other three ETFs since URA's inception on November 4, 2010. That is, until the natural catastrophe and subsequent nuclear disaster occurred in Japan.

This is what happens when an ETF is so highly concentrated in one area, and something cataclysmic occurs within the sector.

But this exposure does not concern me because these types of cataclysmic events are anomalies. They occur once, maybe twice in a lifetime. And too much diversification reduces exposure to a particular sector - as I mentioned above I'm most interested in exposure to uranium, so that's why I like the URA.

It also bears mentioning that a longer term chart of many of URA's holding shows significant gains, despite the most recent drop in this ETFs share price.

In my opinion, events like the one in Japan offer investors some of the best investment opportunities of a lifetime because they are based on fear, not fundamentals

Now this chart actually addresses another question from a loyal reader.

Reader Frances asks:

"Which ETF would you recommend holding long term in spite of volatility as you mention may happen in the next few months?"

As you can see from the chart above the Global X Uranium ETF is far more volatile than the other three funds. This should be expected given the niche-oriented goals of URA.

For those who have a shorter time horizon, volatility is certainly something to beware. Short-term investors can't afford to have markets dip when they need money.

But long-term investors have the luxury of time which helps to reduce any short-term volatility in these ETFs. I am long-term bullish on uranium and for a long-term investor volatility should not be a risk factor. Remember, volatility does not equal risk.

So to answer your question Frances, I am a long-term bull on uranium which means URA would be my ETF of choice for uranium exposure.

I want targeted exposure to leverage the supply/demand dynamics that, as I've mentioned numerous times in my previous articles, should lead to higher prices long-term for uranium.

Thanks for sending in your questions, and I'll try to answer more in a future issue. My address is: editorial@smallcapinvestor.com.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.