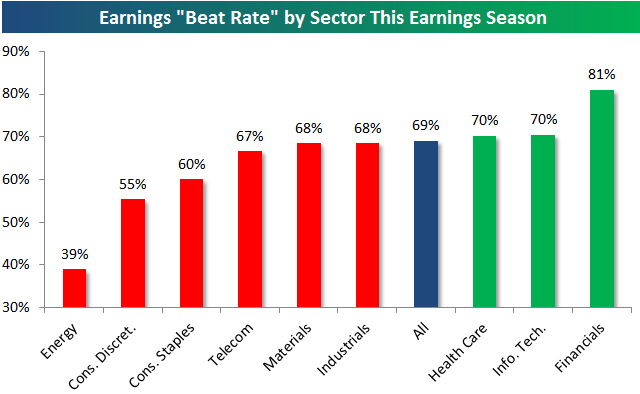

Yesterday, I presented you with some stats to show how good first quarter earnings reports are. Today, I'm giving you some more, but this time in a handy and colorful chart...

This chart is from Bespoke Investment Group. It shows which sectors are beating earnings forecasts. Tech earnings have been great, no surprise there. But the financials, now there's a surprise...

It's a surprise because net revenue at the six biggest U.S. banks -- Bank of America BAC, JPMorgan JPM, Citigroup Inc. C, Wells Fargo WFC, Goldman Sachs GS - is down 13% year over year, according to Bloomberg.

And if you look at "pretax, pre-provision profits", which excludes taxes, loan loss reserves and one-time items, profits fell 40% year over year.

That's clearly not a good trend for the banks. So how did banks post such good "headline" profits? Loan loss reserves, as we have discussed. Banks have been aggressively moving loan loss reserves back to the asset side of the balance sheet. And that's accounted for the lion's share of 1Q earnings. It also leaves the banks less protected if the economy tanks again...

*****One might wonder if the banks will ever return to the profitability they enjoyed before the financial crisis. My answer is: hopefully not. Clearly, those earnings were not sustainable. They were "bubble" earnings derived from over-leveraging, excessive risk-taking and the housing bubble.

What we are seeing is banks returning to a more normal level of profitability.

I should add the banks don't look particularly expensive at current levels. It's just that the upside is likely limited.

*****Tech earnings, on the other hand, are for real. Blowout quarters from Intel INTC and IBM IBM was followed up by Apple AAPL last Wednesday.

I've written about the virtuous tech cycle that's been a very important driver for stock prices for the last year. Powered by huge demand for smart-phones and tablet PCs, semiconductor stocks, wireless network stocks, and data stocks have been star performers.

I've recently added a couple companies that are smack in the middle of the smart-phone/tablet boom to the Top Stock Insights portfolio. One is an $11 chip stock that supplies both the iPhone and iPad. The other is a $6 wireless network equipment stock that's testing new wireless antenna technology with Sprint.

Each stock has significant upside. If you are so

inclined, you can get the details HERE.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.