The following post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga.

Gold’s long-awaited rally finally pushed above it to a new (nominal) all-time in July. And as you might expect, gold miner ETFs have been along for the ride.

Among the top-performing ETFs in this segment are Direxion’s duo of leveraged miner funds. In the five weeks spanning July and the first week of August, the Direxion Daily Gold Miners Index Bull 2X Shares NUGT and Direxion Daily Junior Gold Miners Index Bull 2X Shares JNUG have risen by 45% and 60%, respectively.

While a weak U.S. dollar and persistent uncertainty surrounding the global pandemic are the strongest forces likely a play in driving mining outfits higher, other individual factors are at play in supporting the price performance of NUGT and JNUG.

Gold Glitters

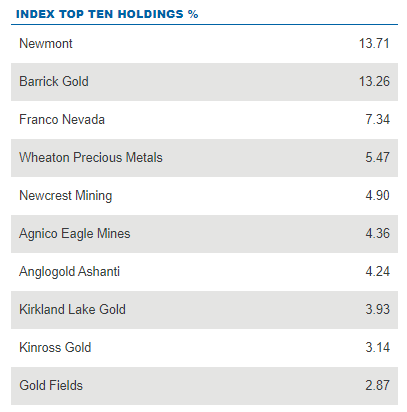

The major mining outfits have managed to have relative strength well in the midst of the pandemic. The majority of large miners have stayed in the black through 2020, with the biggest names like Barrick Gold Corporation GOLD and Newmont Corporation NEM rising about 50% year-to-date.

However, while the precipitous rise in the spot price of gold has lifted the margins of these gold-focused miners, the biggest leaders in the precious metal mining segment are actually those companies with a wider array of metals in their portfolio.

For instance, Newcrest Mining Limited NCMGY and Wheaton Precious Metals Corp. WPM have both gained about 20% in the previous three months. Aside from their primary gold mining operations, 20% and 10% of their respective revenues are tied to other metals like silver, copper and palladium. GOLD and NEM, on the other hand, reap more than 95% of their revenue from their gold mining operations.

Although gold is undoubtedly behind the resurgence of miners, the broad strength among precious metals in general may prove to be a key sustaining factor through the rest of 2020.

Earnings Drive the Juniors

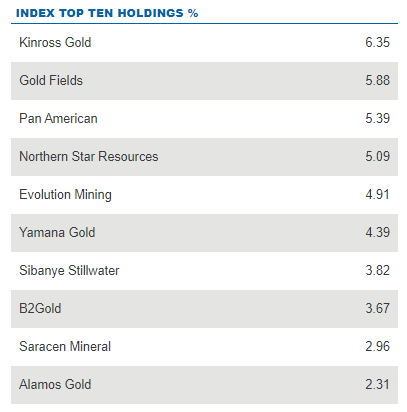

While mining portfolios are dictating which companies outperform among the majors, junior miners are being driven largely by recent financial results.

Two of the top-performing stocks among the junior miners, Pan American Silver Corp. PAAS and B2Gold Corp. BTG are both higher over the previous three months by about 25%. Both companies delivered Q2 earnings results well above analyst expectations, with each showing per share revenue 4-6x analyst expectations.

Widening profit margins proved to be a major factor in this outperformance given the traditionally tighter balancing act required among more concentrated operations. While this does mean that the juniors will likely be more reactive to price changes among the metals, the strong and ongoing rally in gold and silver has provided junior miners some room to run.

Nevertheless, traders should bear in mind that the pandemic could still disrupt the mining operation of some of these mines. Concern has already been raised about worker safety and potential exploitation in the midst of the pandemic, and mine closures remain a real possibility.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost; current performance may be lower or higher than the performance quoted. For the most recent month-end performance go to direxion.com.

Short-term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

These leveraged ETFs seek investment results that are 300% of the return of its benchmark index for a single day. Investing in a Direxion Shares ETF may be more volatile than investing in broadly diversified funds. The use of leverage by an ETF increases the risk to the ETF. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged investment results and intend to actively monitor and manage their investment.

For the funds’ standardized and most recent month end performance click here (www.direxion.com/etfs)

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-301-9214 or visit our website at direxioninvestments.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Market Disruptions Resulting from COVID-19. The outbreak of COVID-19 has negatively affected the worldwide economy, individual countries, individual companies and the market in general. The future impact of COVID-19 is currently unknown, and it may exacerbate other risks that apply to the Funds.

Shares of the Direxion Shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally calculated) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. Absent these reimbursements or recoupments and fee waivers, results would have been less favorable.

Direxion Shares Risks: An investment in the ETFs involves risk, including the possible loss of principal. The ETFs are non-diversified and include risks associated with concentration that results from an ETF’s investments in a particular industry or sector which can increase volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. The ETFs do not attempt to, and should not be expected to, provide returns which are a multiple of the return of their respective index for periods other than a single day. For other risks including leverage, correlation, daily compounding, market volatility and risks specific to an industry or sector, please read the prospectus.

Distributor: Foreside Fund Services, LLC

The preceding post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga. Although the piece is not and should not be construed as editorial content, the sponsored content team works to ensure that any and all information contained within is true and accurate to the best of their knowledge and research. This content is for informational purposes only and not intended to be investing advice.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.