As most of us already know, "cash is the lifeblood of any business". Without cash, survival is difficult - if not impossible.

Again, this may sound obvious, but it is a simple fact that companies go out of business every day because of a lack of cash flow. A company can go on for years in the red, as long as a company has steady cash flow that is managed wisely. But once the company runs out of funds and cannot pay the bills, it is often lights out.

Investing legends Warren Buffet, Peter Lynch and hedge-fund guru Joel Greeenblatt all agree that free cash flow is the one financial metric that they value the most.

I recently came across a company with a strong free cash flow that I am particularly fond of right now. It is one that I am certain Buffett, Lynch and Greenblatt would be proud to own.

AmSurg AMSG, a Nashville, TN based company, operates a network of over 200 ambulatory surgery centers that should benefit greatly from an aging country. With a market capitalization of $820 million, the small cap company has not had an annual EPS decline in over 10 years, despite several difficult economic environments.

But, for this article I am more concerned with the free cash flow of the company and AmSurg stands among an elite group of small caps with a free cash flow yield of 26.3 percent.

In fact, according to Morningstar, Amsurg, is one of the top five healthcare companies as measured by the price to cash flow ratio. In most cases, it is the companies that display the lowest ratios that present the greatest value to investors.

But most important is Amsurg's ability to use its free cash flow effectively. The company's ability to effectively use available free cash flow to drive future returns is why I love this stock.

Amsurg's 22.1 percent earnings yield and staggering 107.1 percent return on capital make it one of the more attractive stocks on my watchlist right now.

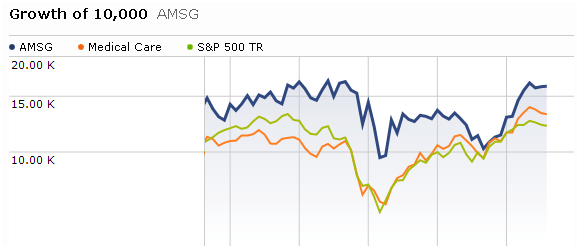

But the proof is in the pudding. Look at how well $10,000 invested in the stock has performed against the S&P 500 and the Medical Care sector over the past five years. It handily outperformed both.

Like any performance metric, pure free cash flow based analysis has its limitations. But it is a good metric to start with when looking for a big winner in the small cap space. And based on its free cash flow, AmSurg has the potential to continue to be one of the best performers.

Market News and Data brought to you by Benzinga APIsAgain, this may sound obvious, but it is a simple fact that companies go out of business every day because of a lack of cash flow. A company can go on for years in the red, as long as a company has steady cash flow that is managed wisely. But once the company runs out of funds and cannot pay the bills, it is often lights out.

Investing legends Warren Buffet, Peter Lynch and hedge-fund guru Joel Greeenblatt all agree that free cash flow is the one financial metric that they value the most.

I recently came across a company with a strong free cash flow that I am particularly fond of right now. It is one that I am certain Buffett, Lynch and Greenblatt would be proud to own.

AmSurg AMSG, a Nashville, TN based company, operates a network of over 200 ambulatory surgery centers that should benefit greatly from an aging country. With a market capitalization of $820 million, the small cap company has not had an annual EPS decline in over 10 years, despite several difficult economic environments.

But, for this article I am more concerned with the free cash flow of the company and AmSurg stands among an elite group of small caps with a free cash flow yield of 26.3 percent.

In fact, according to Morningstar, Amsurg, is one of the top five healthcare companies as measured by the price to cash flow ratio. In most cases, it is the companies that display the lowest ratios that present the greatest value to investors.

But most important is Amsurg's ability to use its free cash flow effectively. The company's ability to effectively use available free cash flow to drive future returns is why I love this stock.

Amsurg's 22.1 percent earnings yield and staggering 107.1 percent return on capital make it one of the more attractive stocks on my watchlist right now.

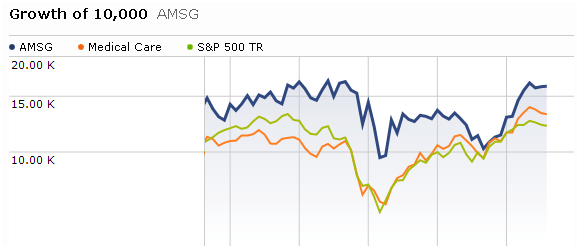

But the proof is in the pudding. Look at how well $10,000 invested in the stock has performed against the S&P 500 and the Medical Care sector over the past five years. It handily outperformed both.

Like any performance metric, pure free cash flow based analysis has its limitations. But it is a good metric to start with when looking for a big winner in the small cap space. And based on its free cash flow, AmSurg has the potential to continue to be one of the best performers.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Loading...

Posted In: Health CareHealth Care Facilities

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in