If you are interested in silver and silver-related stocks it would be in

your best interest to take notice of the current extremes that have moved

into the silver market and understand what it means for the future of

silver. Bears beware!

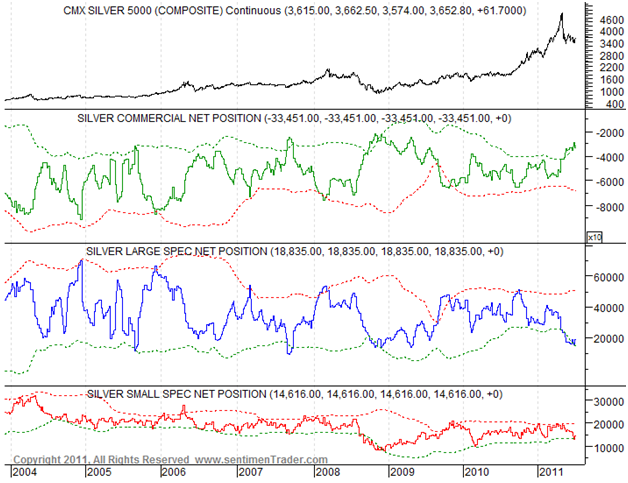

Every week, the Commodity

Futures Trading Commission (CFTC) releases telling data to the

trading public. The data provides a breakdown of long and short positions

of three groups of traders - commercial traders, large speculators and

small speculators. The report is known as the Commitments of Traders

(CoT).

The data provided by the CFTC provides some of the best intermediate to

long-term directional indicators available, particularly when an extreme

is hit.

Currently, all three groups are in an extreme. This is a rare event and

one that should be taken seriously as it is highly accurate in predicting

the future trend in the market.

Below is a silver chart and three CoT charts provided by Jason Goepfert

of SentimenTrader.com, one of the best sites I know for

providing accurate sentiment and seasonal data.

As you can see, all three groups have moved into extremes; commercial

traders are extremely bullish, whereas both large and small speculators

are extremely bearish. In the past when this has occurred silver has

rallied over the intermediate to long-term.

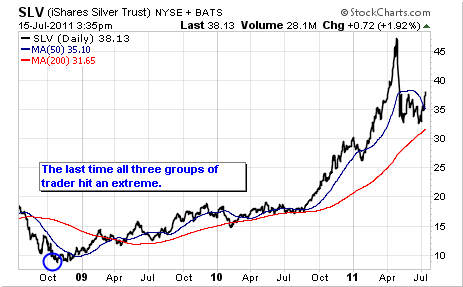

In fact, it is the first time all three have moved into extreme territory

since late 2009. In the below chart you can see how well silver performed

the last time all the groups hit an extreme. The performance was

staggering, to say the least, as silver rallied from below $10 an ounce

to over $40 an ounce over the subsequent 30 months.

If that wasn't enough, silver is also moving into one of the best

seasonal periods during the year, as evidenced by the below chart from

Sentimentrader.com.

September has by far been the best performing month for the precious

metal, with average gains of 4 percent over the sample period above. But,

what is most impressive is the percent of time positive. Over 90 percent,

or 30 out of 34 years, silver has had a positive return in September.

That is a staggering statistic and one that should not be ignored.

So, if the seasonal winds live up to their historical billing we could

see a slight pullback in August, which could afford the next big buying

opportunity for silver.

This could also mean buying opportunities in the silver miners, including

Mag Silver MVG, Great Panther Silver GPL, or Silvercorp

Metals SVM.

If you are not comfortable with the volatility that is inherent in junior

silver miners then I would suggest buying the iShares Silver Trust (NYSE:

SLV).

There you have it. There is no doubt that the current price action in

silver is bullish and the sentiment indicators are overwhelmingly

supportive of a bullish move. I would expect to see a short-term decline

in silver, but in my opinion this would only fuel a buying opportunity

that investors should take advantage of.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.