Ever hear the expression, “Everyone gets their 15 minutes of fame?” It appears the longtime practice of “short selling” is having its moment in the sun.

Huge “short squeezes” in shares of companies like GameStop Corp. GME and AMC Entertainment Holdings Inc AMC dominated the headlines in January 2021, leading many to wonder just what short selling is in the first place. Here, we’ll answer some of the most common questions people have about short selling and explore why this practice—despite its reputation—can sometimes serve a helpful purpose in the market.

Short selling actually plays a role in price discovery and liquidity—two components of healthy and efficient markets. It’s also not for everyone, as there are numerous risks, and the mechanics are somewhat complex. But by understanding the basics of short selling and short interest, investors can maybe get some insight on companies and market dynamics.

What Is Short Selling A Stock?

A short position is essentially a trade that aims to profit from a decline in the value of a share of stock or another asset. That may seem straightforward enough, but short selling stocks can quickly get complicated and risky. Before you consider initiating a short position, it’s important to understand the basics.

But even if you have no intention of becoming a short seller, getting a handle on what short sellers are doing and why, and what that activity might say about a company, industry, or broader market, could give you some added perspective as an investor.

What Does It Mean To Short A Stock?

With stocks, you can’t sell it if you don’t have it. So to sell short, an investor—typically with help from a broker—needs to “borrow” the stock from someone else, and then sell those shares in the open market. At some point, the investor closes the short position by buying back the same number of shares in the open market and returning the borrowed shares to the owner.

If the price drops, the investor can buy back the stock at the lower price and pocket the difference. For example, if a stock shorted at $50 is bought back at $40, the seller realizes a $10 per-share profit (minus transaction costs). On the other hand, a short seller holding a losing position (stock was shorted at $50 and is now trading higher than $50) may receive a margin call and be required to put up more money, or your short position could be closed out by your broker without regard to your profit or loss.

Granted, this is an oversimplified explanation of the process of short selling stocks, so before you jump into such a trade, learn about the specifics, such as margin accounts, margin calls, so-called “hard-to-borrow” shares, and other unique characteristics of short selling. The short answer: It’s not for the fainthearted.

Who Are The Short Sellers?

Short selling tends to be in the realm of hedge fund traders and other experienced market professionals with large amounts of capital and the capacity to absorb losses when the market moves against them. Typically, some professional traders might sell short if they’re bearish on a certain stock or industry, or they may be angling for a management shake-up at a company or some other change.

Just like long-only professional money managers, fund managers who engage in short selling do their homework. They use fundamental analysis, poring over financial statements and other data in search of opportunity. Again, it’s all part of the price discovery process.

Additionally, market makers—including those professional option traders that provide liquidity to those markets—often need to sell short to hedge their exposure (what option traders call delta risk.)

Is Short Selling Riskier Than Short Options Strategies?

Some options strategies have open-ended risk while others limit risk to a certain dollar amount. For example, one popular options strategy is the covered call, a short call against a stock you own in your portfolio. If the stock price rallies through the options strike price and stays there through expiration, the worst case scenario is you’d deliver your stock to the option buyer. (Reminder that short options can be assigned at any time up to expiration regardless of the in-the-money amount.)

But if you were to sell a call option outright—with no stock in your portfolio—that’s called a “naked short call” and just like a short sale of a stock, your risk is unlimited. As such, margin requirements are typically high, and many accounts aren’t approved for naked call selling. To limit risk in a call-selling strategy, many traders opt for a short call vertical spread—the sale of a call and the simultaneous purchase of another call with a higher strike price. For a short call vertical, the risk is limited to the difference between the strikes, minus the net premium you received, minus transaction costs. (Here’s an overview of these and other basic options strategies)

An alternate way to get short exposure to a stock by using options is to buy a put option. A put allows the buyer the right—but not the obligation—to sell the underlying stock at the strike price on or before the options expiration date. With a long put, the most you could lose is the premium you paid for the option (plus transaction costs).

How Can Short Selling Be Measured, And What Is “Float”?

Market professionals follow key metrics, including “shorts as a percentage of float,” which reflects the number of short-sold shares in proportion to the “float,” or the total number of shares available for trading in the public markets.

Most stocks have a small amount of short interest, usually in the single digits. The higher that percentage goes, the greater the bearish sentiment might be surrounding that stock. If the float reaches 10% or higher, some market pros consider it a red flag.

Where Can I Find Information On Short Selling And Short Interest?

Data on short interest—the number of shares outstanding that have been sold short—is available for most U.S. companies listed on major exchanges. The New York Stock Exchange (NYSE) releases a short interest compilation every two weeks.

A glance at these reports often reveals familiar names. Examples might include a pharmaceutical company that’s awaiting regulatory approval for a new drug, or a retailer struggling to develop a viable long-term strategy. During a slump in commodity prices, you might find energy or mining companies ranked among the most-shorted companies.

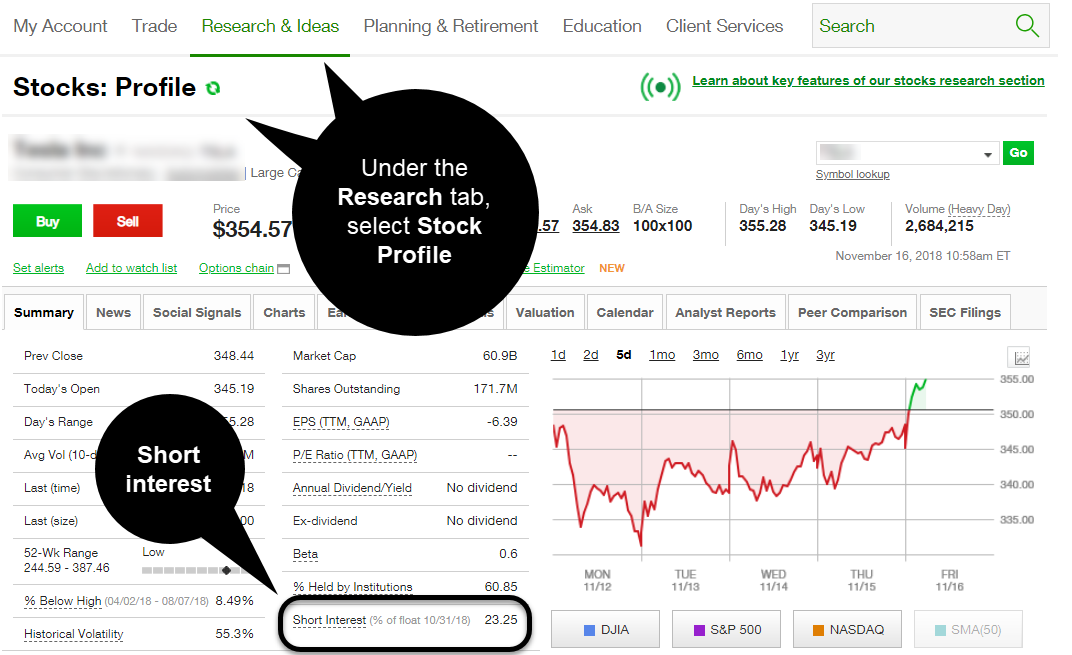

There are often stories beyond the numbers. Do you see any stocks you’re considering as investments, or that are currently in your portfolio? Think about why other people may have opposing viewpoints. Check recent earnings reports or listen to conference calls for color and context that may have implications for shareholders. Short interest readings are also available when you log in to your account at tdameritrade.com (see figure 1).

FIGURE 1: INTERESTING? To view short interest as a percentage of available float, log in to your account at tdameritrade.com, look under Research & Ideas > Stock Profile, and type in any symbol. At 23.25%, the short interest percentage in this example stock is quite high relative to the broader market. Source: tdameritrade.com.

“Days to cover,” also referred to as the short interest ratio, indicates how long it would take to cover, or buy back, all the shorted shares. This is calculated by dividing the number of shares sold short by the average daily trading volume, and some view it as a measure of the future buying pressure on a stock. Some short sellers look for about seven days to cover or fewer before shorting a stock.

What Could Short Selling Activity Indicate?

Across the broader market, short interest has recently had a resurgence after a few years where it was relatively low. Among the Russell 3000, there were 68 stocks with at least 25% short interest as of late January 2021, according to FactSet. Besides GME and AMC, some other well-known stocks with high percentages of short interest were Bed Bath & Beyond Inc. BBBY, SunPower Corporation SPWR, Beyond Meat Inc BYND, and National Beverage Corp. FIZZ.

During the heady days of the 2008-09 financial crisis, short interest topped 19 billion shares. A couple years later, as markets recovered and began their multi-year march higher, it fell to below 12 billion shares. As of mid-January 2021, before the crazy action in GME, AMC and other stocks later that month, total short interest at the New York Stock Exchange stood at 13.7 billion shares, the NYSE reported.

What Is A “Short Squeeze?”

A short squeeze can happen when bullish news pushes a stock price higher, prompting short sellers to head for the exits all at once. As the shorts scramble to buy back and cover losses, upward momentum builds upon itself and the stock can move sharply higher. The longer the days to cover, the more pronounced this effect can be. In 2020, Tesla Inc TSLA shares went through a short squeeze, while 2021 saw GME and AMC go through this process.

Short interest can also be applied alongside chart indicators, such as moving averages, for signals on when it may be time to get out of a stock. For example, a combination of high short interest and a drop below the 52-week low or the 200-day moving average might indicate “look out below.”

Long and Short: They’re Both Part Of Price Discovery

Some people ask if short selling is ultimately positive or negative for the market, but that’s not quite the right question. Short selling, like going long, can be a key part of price discovery, and in the “long” run (no pun intended), price discovery is why we have markets in the first place.

One potentially positive aspect of short selling is how it can sometimes serve as a check on management. Consider a biotech company that’s pinned all its future revenue hopes on a drug still in clinical trials, which often happens in this industry. The hedge funds and big banks deciding whether to go short or long on that particular biotech firm often include doctors and scientists very familiar with the biotech’s particular field of medicine.

If these professional traders and analysts think the biotech company’s management is too optimistic about getting regulatory approval or seeing positive trial results, they might go short. In cases like that, the short sellers are playing a role in price discovery and also sending a signal to possible buyers that the company may be getting over its skis.

A more dramatic example of short selling being a flashing light is the case of Enron 20 years ago. Short interest built up in the stock because many investors didn’t think the energy company’s business model made sense. They went through the company’s earnings and regulatory filings, didn’t like what they saw, and shorted its shares. They ended up being right, and Enron’s business exploded in a scandal that led to bankruptcy. High-flying Enron shares ended up worthless. This isn’t something that happens often, but fraud is one potential danger when you invest in a company, and short sellers can sometimes help spotlight it.

Of course, short selling can have its negative aspects, too. It’s a complex strategy that’s not for everyone, and could expose you to quick losses if a trade goes against you. It’s also not a good idea to short a stock out of spite against a company, something some traders have been accused of over the years.

Like any trade, successfully shorting a stock depends on correctly assessing the fundamentals, doing your research, and paying very close attention to the market. Even then, the strategy could easily fail. Also, as in any trade, it’s important to enter with an exit strategy in mind—for better or worse. Have a profit target as well as a pain point.

So when you add it all up, what’s the short answer about short selling? Even if you have no intention of short selling stocks, you might find value in understanding, and keeping an eye on, short selling metrics and dynamics—especially after how 2021 started out.

The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. There is no guarantee the brokerage firm can continue to maintain a short position for an unlimited time period.

TD Ameritrade® commentary for educational purposes only. Member SIPC.

Photo by Maxim Hopman on Unsplash

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.