AUD/USD Current Price: 0.7789

- Australian inflation unexpectedly contracted in the first quarter of the year.

- Investors buy the Aussie as the Fed will maintain QE despite its optimistic view.

- AUD/USD trades just ahead of a strong static resistance level at 0.7820.

The AUD/USD pair fell to 0.7724, its lowest for the week, with the AUD undermined at the beginning of the day by worse-than-anticipated local inflation figures. According to official data, inflation in the first quarter of this year was up by 0.6%, well below the previous 0.9% and missing expectations of 0.9%. The RBA Trimmed Mean CPI came in at 0.3%, missing the expected 0.5% and contracting from 0.4% in the final quarter of 2020. The poor inflation figures hint at lower rates for longer in Australia.

The pair recovered as the day developed, extending its gains toward the 0.7800 price zone after the US Federal Reserve’s decision boosted demand for high-yielding assets. Looking ahead and during the upcoming Asian session, Australia will publish Import Prices and Export Prices for Q1.

AUD/USD Short-Term Technical Outlook

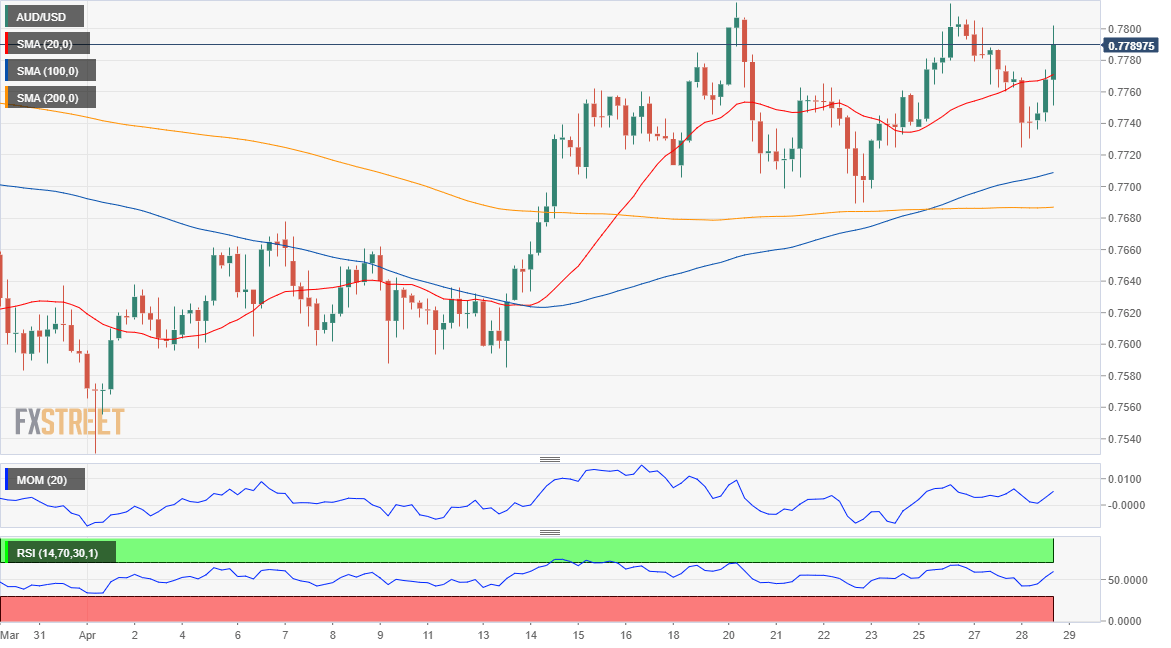

The AUD/USD pair hit 0.7800 and trades near the level as Asian traders reach their desks. The near-term picture favors a new leg north, although the pair still needs to clear the 0.7820 resistance. The 4-hour chart shows that the price is above a bullish 20 SMA, while the Momentum indicator struggles to cross its midline. On the other hand, the RSI heads firmly north at around 61, in line with a bullish extension.

Support levels: 0.7800 0.7730 0.7690

Resistance levels: 0.7820 0.7850 0.7890

View Live Chart for the AUD/USD

Image Sourced from Pixabay

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.