Some bearish dynamics are occurring in different parts of the market. They suggest there may soon be a sell-off or correction.

These dynamics can be seen in the SPDR S&P 500 ETF Trust SPY, the Technology Select Sector SPDR Fund XLK, and the Consumer Discretionary Select Sector SPDR Fund XLY.

See Also: Best ETFs and Mutual Funds by Industry

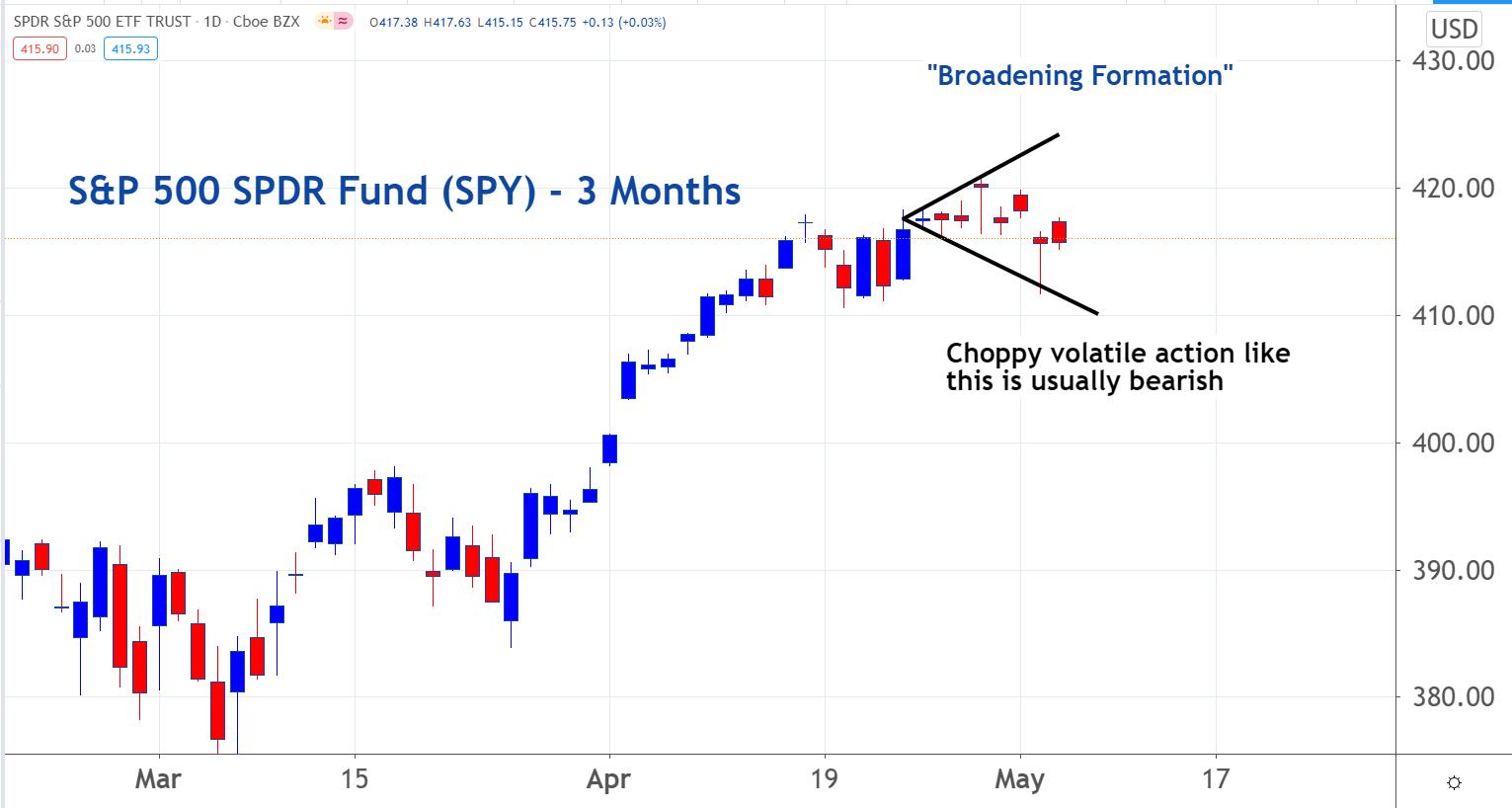

A classic "broadening formation" is forming in the SPY. It illustrates choppy and volatile action, which shows there is no clear leadership in the market. This type of action is usually followed by a move lower.

When markets are rallying, levels that had been resistance turn into support. This happens because sellers regret selling stocks that subsequently move higher and they try to buy them back. If this conversion process doesn’t happen, it’s usually a bearish signal.

The $138.50 level was clear support for XLK in February. But as you can see on the following chart, XLK hit little if any support there during the recent sell-of. This could mean there will be more selling ahead.

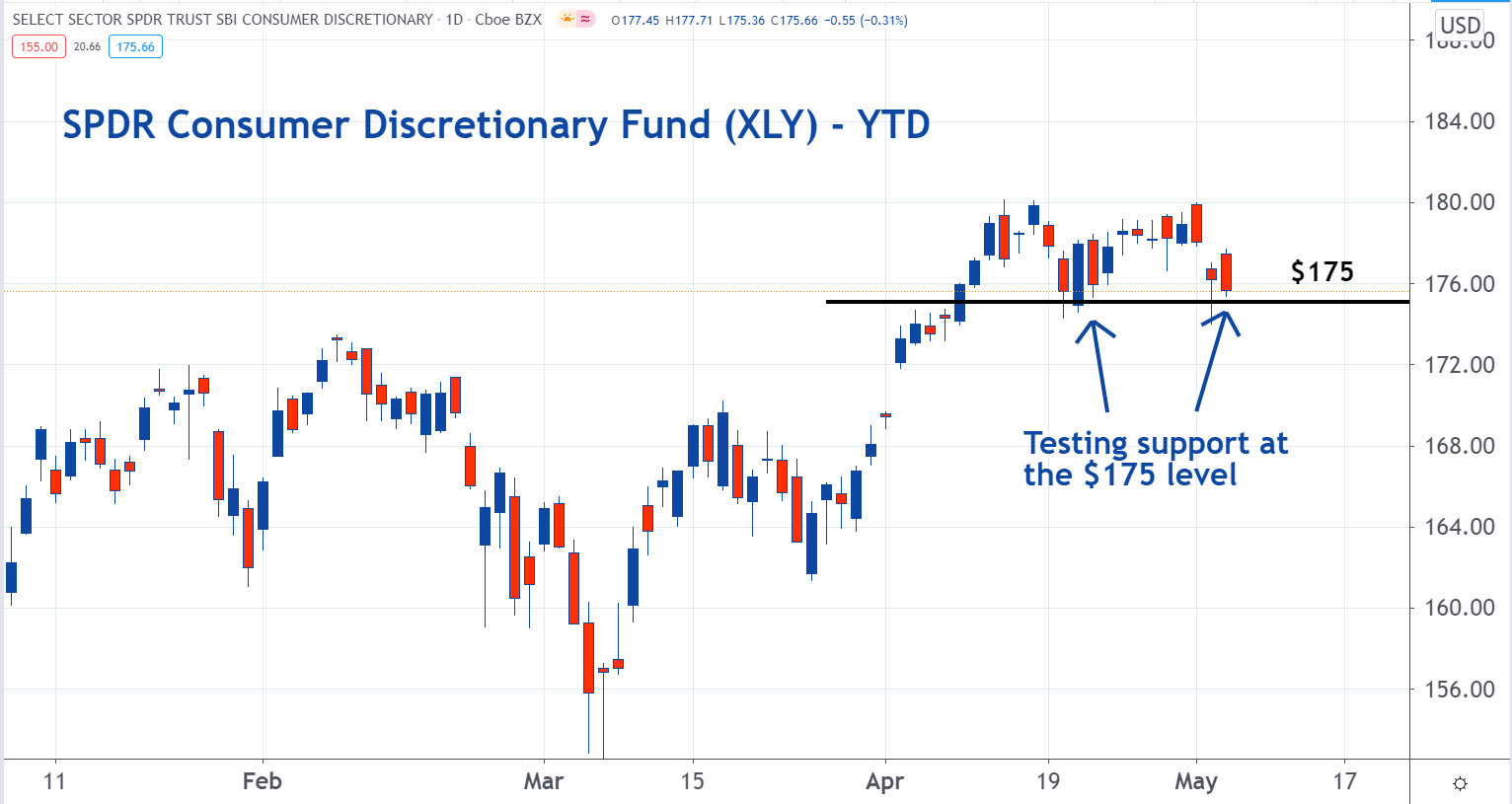

XLY is testing support at the $175 level. There is more demand, or buyers, for the stock than there is supply, or sellers, at this level. That’s why it’s been a floor for XLY over the past month.

If XLY breaks down through this level, it will mean the tide has turned. There will be more supply than demand, which could result in a significant drop in the share price.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.