Digital currencies are trending, and they are complex. That’s due in part to the existence of “competing cryptocurrencies, considerable price volatility, and the coming involvement of central banks,” explains Blu Putnam in the latest episode of The Economists.

Just as bitcoin and ethereum seem to be attracting the greatest attention and spawning the most conversations, they’re also the cryptocurrencies grabbing the most market share. But that story is also shifting as bitcoin’s share has fallen from about 70% at the beginning of 2021 to just under 50% in four months. Meanwhile, ether is gaining steam, reaching about 15% of the market share.

Recognizing key differences between the two is a good place to start to understand how each works and where they fit into the market. “Created in 2009, bitcoin is the original cryptocurrency, and investors seem to treat it as a sort of digital gold due to its extremely limited supply,” says Erik Norland. No more than 21 million bitcoins can ever be created; so far, about 18.5 million exist.

Meanwhile, ether is viewed more like an industrial metal due to the fact that it has more commercial applications than bitcoin. It also doesn’t have a lifetime supply limit. Each year, up to 18 million new coins can be created.

Though both digital assets have seen volatility lately, the difference between the two in their supply process suggests that volatility levels may not always be the same. “When you have tight control of supply, that often leads to more price volatility,” says Putnam. “When demand shifts, and supply cannot respond, then the demand shift may be reflected in larger price swings compared to commodities.”

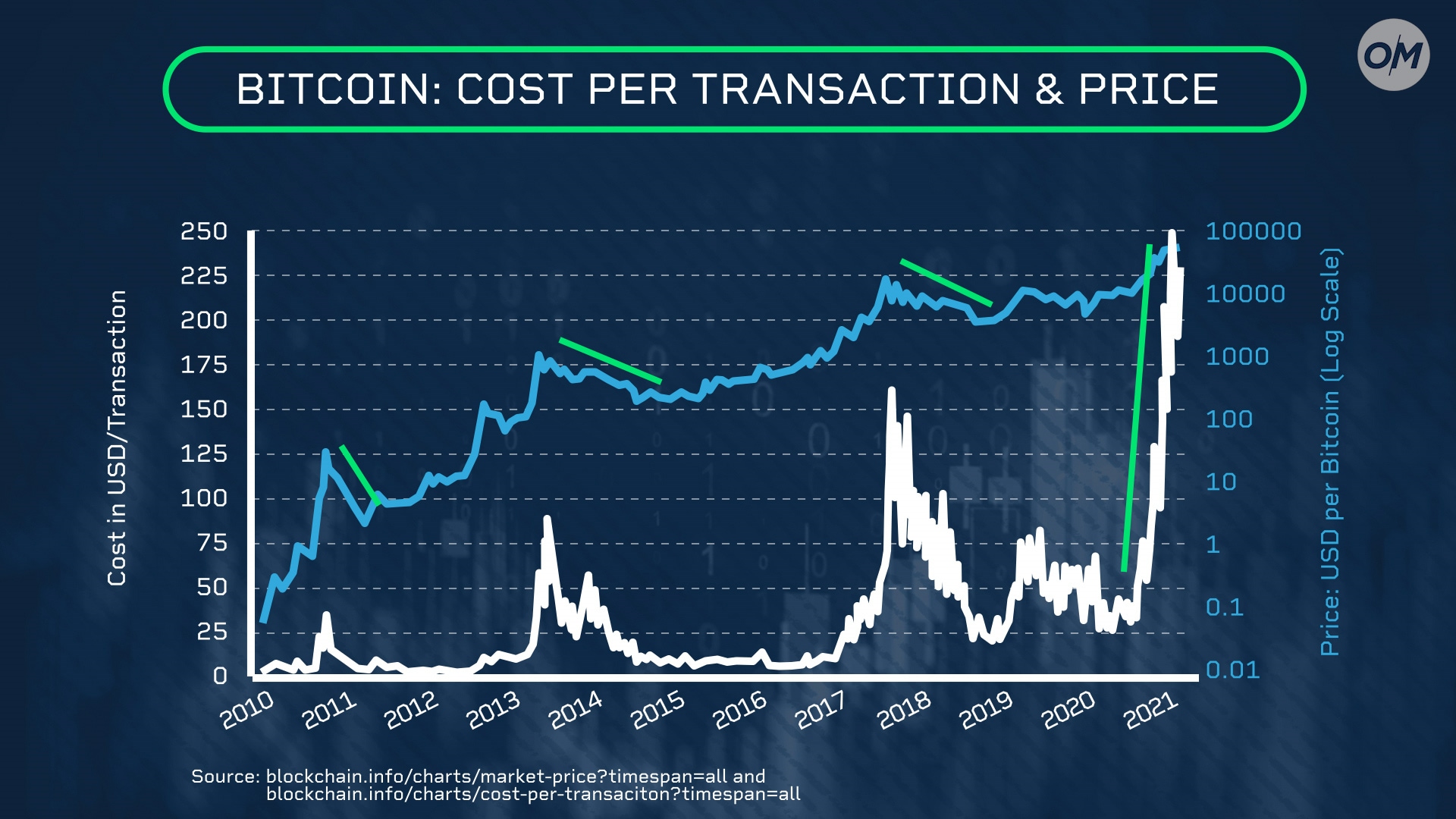

Transaction costs may also factor into price volatility. Anytime the cost in transacting bitcoin has spiked – which has happened three times – the price of bitcoin has subsequently dropped more than 80% each time. As of May 2021, bitcoin transaction costs were again on the rise.

So what’s next when it comes to trading and price volatility? More complexity, says Putnam, “given all the choices of venues, from a variety of crypto exchanges, exchange-traded funds (or ETFs), and futures on cryptocurrencies in both large institutional and small bite sizes.”

Watch Putnam and Norland’s full discussion of the market for digital currencies above.

Image Sourced from Pixabay

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.