Tilray, Inc TLRY closed the trading session on Monday up 4.71% higher.

A report by Reuters said a U.S. District Court in Manhattan dismissed a lawsuit that accused Tilray Inc TLRY of embellishing the value of a marketing and revenue-sharing agreement with Authentic Brands Group Inc.

Judge Paul Crotty wrote that while Tilray “certainly appears to have overestimated, by orders of magnitude, both the value of the ABG Agreement and the likelihood of fortuitous regulatory change," lawyers for the claimants failed to prove the Canadian-based cannabis giant willfully deceived shareholders.

In the premarket on Tuesday, Tilray was trading down about 1.5% lower amid overall market weakness. The stock has been attempting to reverse to the upside since putting in a bullish double bottom pattern at the $11 level on Sept. 20 and 21.

See Also: How to Buy Tilray Stock Right Now

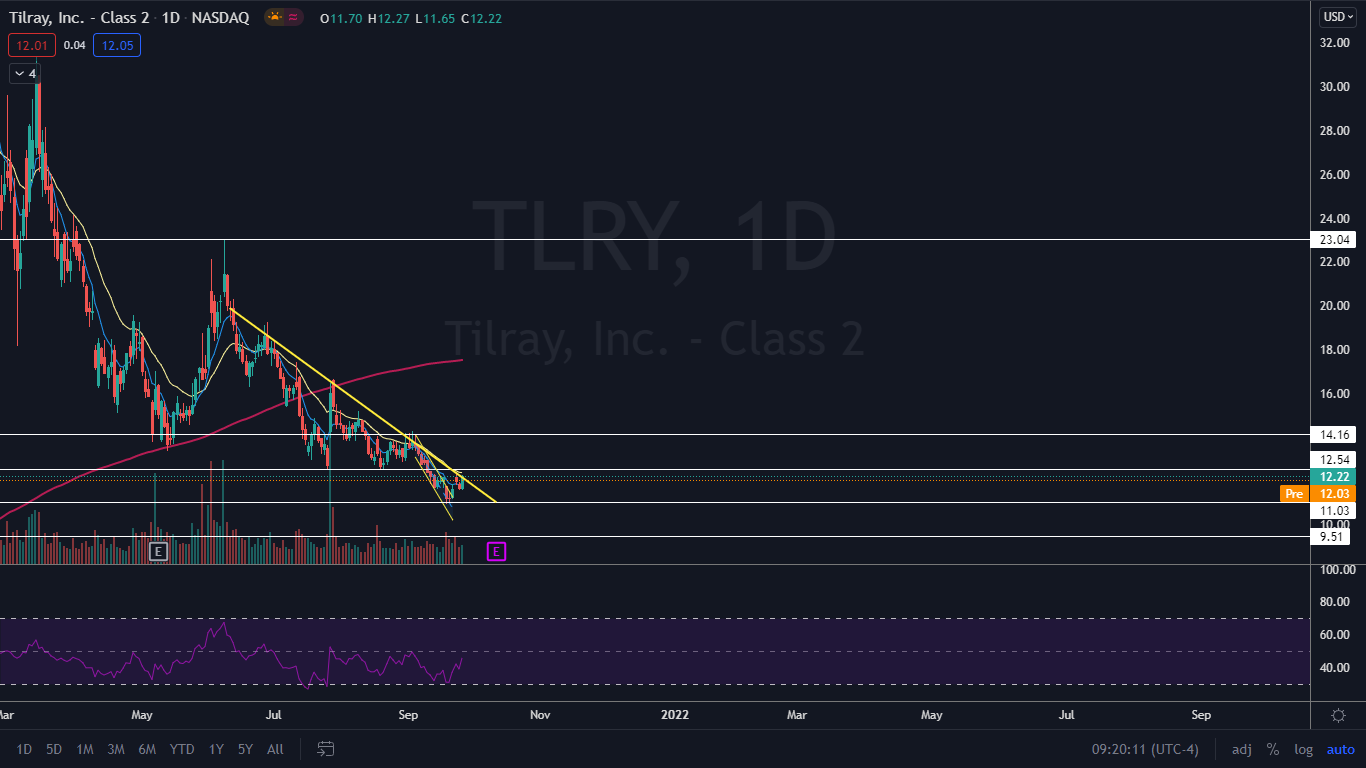

The Tilray Chart: Before creating the double bottom pattern, Tilray had been trading in a falling channel which began Sept. 3. A falling channel is a trend where a stock creates a series of lower highs and lower lows between two parallel lines. The pattern is considered bearish until the security breaks up from it.

Tilray broke bullishly from the channel on Sept. 22 and by Sept. 23 the stock had run over 10% higher before slamming into resistance at a descending trendline that has been holding the stock down since June 11. On Monday, Tilray was able to close just slightly above the trendline. If the stock can make a break through the trendline on big bullish volume, bulls may have confirmation Tilray is in for a larger run to the upside.

Tilray is trading slightly above the eight-day exponential moving average (EMA) but below the 21-day EMA with the eight-day EMA trending below the 21-day, which indicates indecision. Tilray’s stock is trading over 30% below the 200-day simple moving average, which indicates overall sentiment is bearish.

- Bulls want to see big bullish volume break Tilray up from the descending trendline and through a resistance level at $12.54. If the stock can regain the levels as support it has room to trade up toward the $14.16 level.

- Bears want to see Tilray continue to reject the trendline and for big bearish volume to drop Tilray down below a key support at $11.03. If the level becomes resistance the stock could fall toward a psychological support level at $10.

Image by Eugenio Cuppone from Pixabay

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.