A typical couple enjoying their (presumably) debt-financed breakfast in bed (image via Affirm).

Economy-Wide Inflation

As Washington Post economics correspondent Heather Long pointed out on Twitter recently, inflation is now hitting Americans everywhere from rental cars to rent.

And It Might Not All Be Transitory

And Kraft Heinz Company KHC CEO Miguel Patricio suggested earlier this week, that much of the inflation may turn out to be permanent, rather than transitory.

Profiting From Inflation

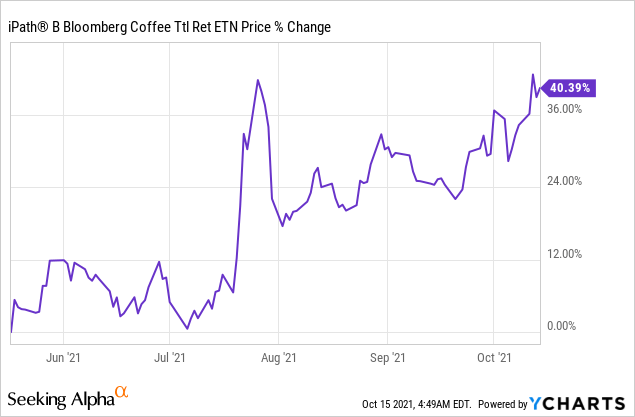

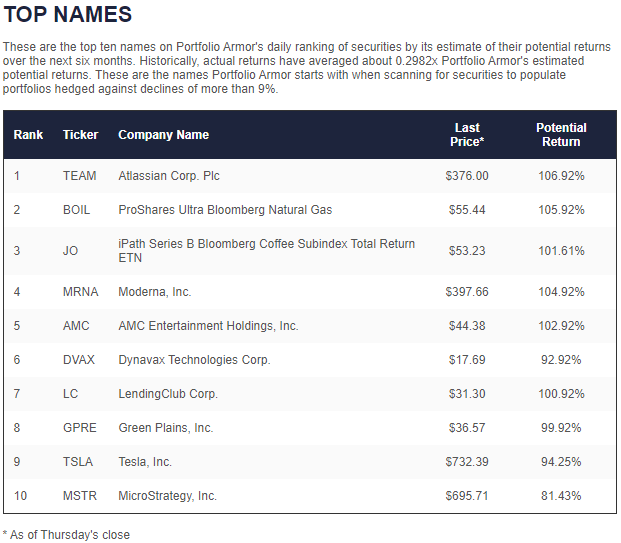

Over the last several months, we've written about ways investors can profit from the inflation trade. In May (Too Much Crypto, Not Enough Stuff), we suggested our top name at the time, the iPath Series B Bloomberg Coffee Subindex Total Return ETN JO. Since then, it's up about 40%.

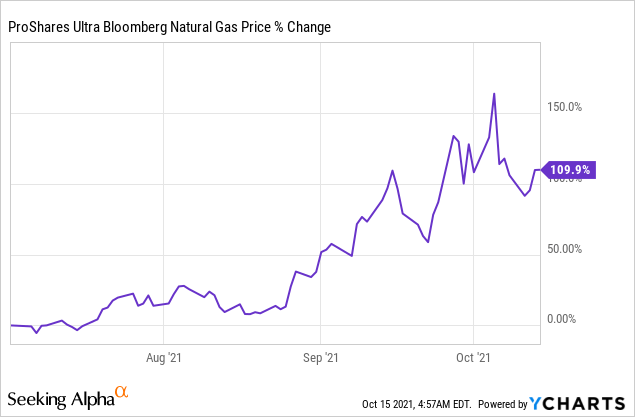

In July (A Structural Inflation Shock), we wrote about our top name the ProShares Ultra Natural Gas ETF BOIL. It's up about 110% since.

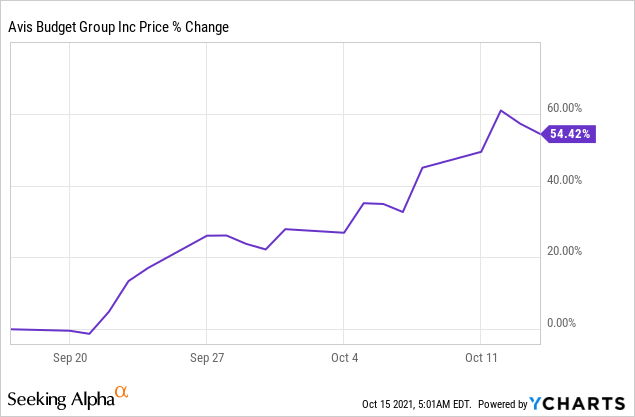

And in September (An Airbag For Avis), we wrote about our rental car top name, Avis Budget Group, Inc. CAR. It's up about 54% since.

Another Way To Play Inflation

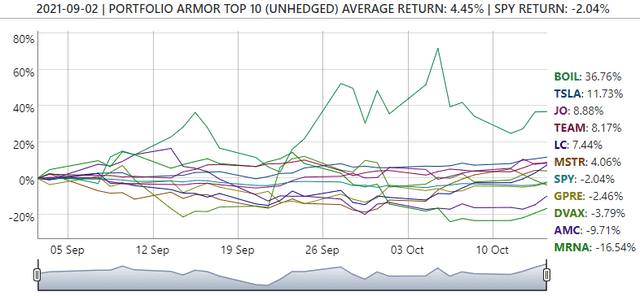

Last month, another kind of inflation trade started to hit our top names: companies that help consumers buy things they can't currently afford with debt financing. The first example of this was LendingClub Corporation LC. It appeared in our top ten on September 2nd.

Screen capture via Portfolio Armor on 9/2/2021.

Since then, Lending Club is up about 7% versus the SPDR S&P 500 Trust SPY, which was down about 2% over the same time frame.

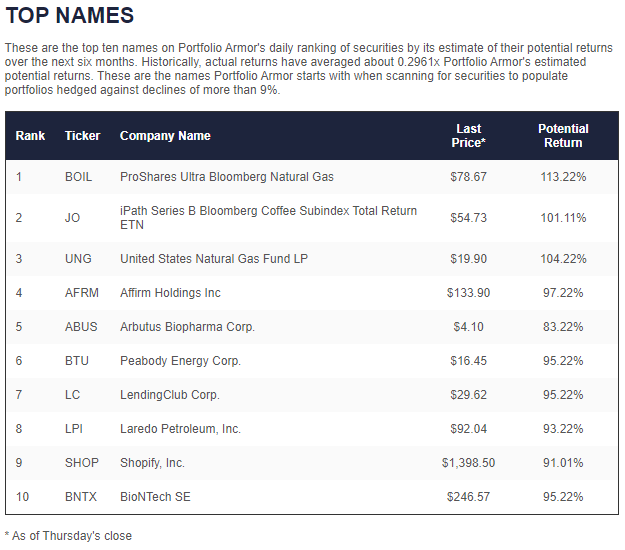

Last week, another consumer finance company hit our top ten, Affirm Holdings, Inc. AFRM.

Screen capture via Portfolio Armor on 10/7/2021.

Either stock might be worth considering for investors looking for another angle besides energy and other commodities to profit from current inflation.

Safety First

As always, we suggest readers who decide to buy any of our top names consider hedging them, as they can be volatile. You can use our website or our iPhone app to scan for optimal hedges to provide the lowest-cost protection, given your risk tolerance.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.