More investors became Bitcoin millionaires this year than ever before. With institutional investments from publicly traded giants like Tesla TSLA and PayPal PYPL, big money is confidently entering the cryptocurrency markets.

The chart above shows the number of Bitcoin wallet addresses with over $1 million in the digital asset in orange (just under 16 Bitcoin at the time of writing). The grey line shows the price of BItcoin on a logarithmic scale. Of course, the number of Bitcoin millionaires increases as the price of Bitcoin appreciates.

What’s more interesting, however, is the number of Bitcoin millionaires when Bitcoin reached its peak just shy of $20,000 in 2017. At this time, there were just 28,744 unique wallet addresses that held at least $1 million worth of Bitcoin.

Fast forward to 2021, and there were around 68,000 unique wallet addresses owning at least $1 million in Bitcoin when the coin hit $23,000 –– a 15% higher price than its previous all-time highs yet over double the millionaires! As of October 2021, Bitcoin millionaires are approaching a new all-time high of over 100,000 unique addresses that own over $1 million in Bitcoin.

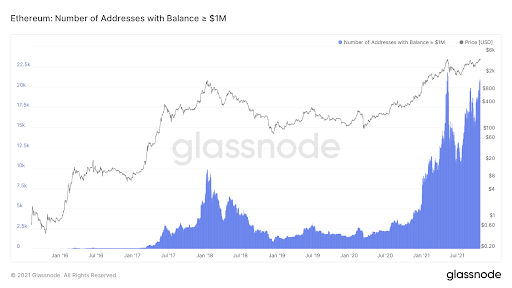

Ethereum, the second largest cryptocurrency by market capitalization, has followed a similar trend to that of Bitcoin’s. However, there were about the same number of ETH millionaires in early 2018 (when ETH hit $1400) and early 2021 when the token reached new all-time highs. This data suggests that big money and institutional investors may be more focused on Bitcoin, at least for the time being.

As of October 2021, there are roughly 20,000 unique ETH addresses with more than $1 million in the digital asset. This is over 100% higher than the amount of Ether millionaires at the token’s prior peak in January 2018.

Data provided by Glassnode Studios.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.