Nvidia Corporation NVDA reported third-quarter results that came in well ahead of estimates, thanks to record revenues in Gaming, Data Center and Professional Visualization segments. The company also issued an upbeat forecast for the fourth quarter.

Key Q3 Nvidia Metrics: Nvidia reported third-quarter non-GAAP earnings per share of $1.17, up from 73 cents earned a year ago and the second quarter's $1.04. Analysts, on average, were modeling EPS of $1.11 for the quarter.

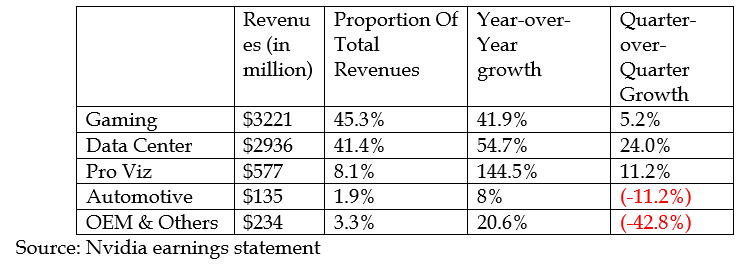

Revenues climbed 50% year-over-year and 9% sequentially to $7.103 billion, exceeding the consensus estimate of $6.83 billion and the company's guidance of $6.80 billion, plus or minus 2%.

Third-quarter non-GAAP gross margin expanded from 65.5% in fiscal-year 2021 to 67% in 2022, in line with the company's guidance. The metric was at 66.7% in the second quarter.

Nvidia's Q3 Segmental Performance: Nvidia's quarterly growth came from broad-based outperformance, with all the business segments, namely Gaming, Data Center, Professional Visualization and Automotive, experiencing year-over-year growth. The former three segments recorded quarter-over-quarter growth as well.

Sales of NVIDIA Ampere architecture products to hyperscale customers for cloud computing and workloads such as natural language processing and deep recommender models, as well as to vertical industries fueled the growth in the Data Center business.

Most analysts were expecting 19% sequential growth for the Data Center business, helped by A100 AI accelerators.

The Gaming unit's outperformance came on the back of strong gaming demand and below-target levels of channel inventories.

"We benefited from strong demand for our NVIDIA Ampere architecture products leading into the holiday season," the company said.

Related Link: Nvidia Rallies With Key Catalysts Ahead: Wil Chipmaker Be The Next To Join $1-Trillion Club?

The 11% sequential decline witnessed by the Automotive segment reflected automotive makers' supply constraints. This segment, however, is expected to be a major pillar of growth for Nvidia going forward. The company has an $8 billion auto revenue pipeline, with inflection expected in 2023 and 2024, Oppenheimer analyst Rick Schafer said in a recent note.

Cryptocurrency mining processor revenue, which is part of OEM and Other revenue, came in at $105 million. The sequential decline of the segment primarily reflected lower CMP revenue.

Nvidia's Q4 Guidance: Nvidia guided fiscal-year fourth-quarter revenues to $7.4 billion, plus or minus 2%. The Street estimates revenues of $6.86 billion for the quarter.

Credit Suisse analyst John Pitzer expected the company to guide to fourth-quarter revenues and EPS, with the midpoint at $7.1 billion and $1.20, respectively. The sequential revenue growth, however, is likely to be below seasonal, due to supply constraints.

The company guided non-GAAP gross margins to 67%, plus or minus 50 basis points.

Wells Fargo Securities analyst Aaron Rakers sees Metaverse presenting Nvidia with a $10 billion incremental market opportunity over the next five years. The company's Omniverse platform is a key enabler/platform for the development of the Metaverse across a wide range of vertical apps—industrial, manufacturing, design & engineering and autonomous vehicles/robotics.

Related Link: Options Market Says Nvidia Could Move This Much Ahead Of Earnings Release

Nvidia Stock: Nvidia's shares have run up sharply this year. In early November, the stock hit an all-time high of $323.10 but has pulled back since then. It's up 124% in the year-to-date period.

Ahead of the earnings results, Pitzer reiterated an Outperform rating on Nvidia and hiked the price target from $225 to $400.

Nvidia shares, which closed Wednesday's session down 3.12% at $292.61, were advancing 3.79% to $303.70 in after-hours trading.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.