Major coins continued to bleed Thursday evening as the global cryptocurrency market cap declined 2.3% to $2 trillion.

What Happened: Bitcoin BTC/USD traded 2.5% lower over 24 hours at $39,856.72 over 24 hours. For the week, it is down 5.7%.

Ethereum ETH/USD was down 2.9% at $2912.60 over 24 hours. Over a seven-day trailing period, it has lost 9.5% of its value.

Meme cryptocurrency, Dogecoin DOGE/USD fell 3.4% to $0.16 over 24 hours. Over the week, it has declined 8.7%.

Shiba Inu (SHIB) dropped 3.1% to $0.000027 over 24 hours. For the week it plunged 12.4%.

The three top gainers over 24 hours were Cosmos (ATOM), Klaytn (KLAY), and Celsius (CEL), according to CoinGecko data.

See Also: How To Buy Bitcoin (BTC)

Why It Matters: U.S. Treasuries stalled Thursday. The benchmark 10-year note yields were at $1.8325%, down from the 1.902% two-year high levels seen a day prior, according to a Reuters report.

This downwards movement of Treasuries could be a good thing for the apex cryptocurrency, according to Edward Moya, a senior market analyst with OANDA.

“Cryptos remains the perennial risky asset and if Treasury yields continue to decline, that should be good news for Bitcoin,” Moya wrote in a note.

On the news front, Russia’s central bank, the Bank of Russia, called for a ban on cryptocurrencies, while Meta Platforms Inc FB is planning to allow users of its social media platforms Facebook and Instagram to mint and sell non fungible tokens.

A Russian ban could spell trouble for Bitcoin, according to Moya.

“The Russian ruble has been steadily declining over the past couple decades, which made Bitcoin an attractive investment for many Russians in recent years. Russia has been a top three country for Bitcoin mining, so if this proposal passes, Bitcoin could slide below the $40,000 level.” the analyst said.

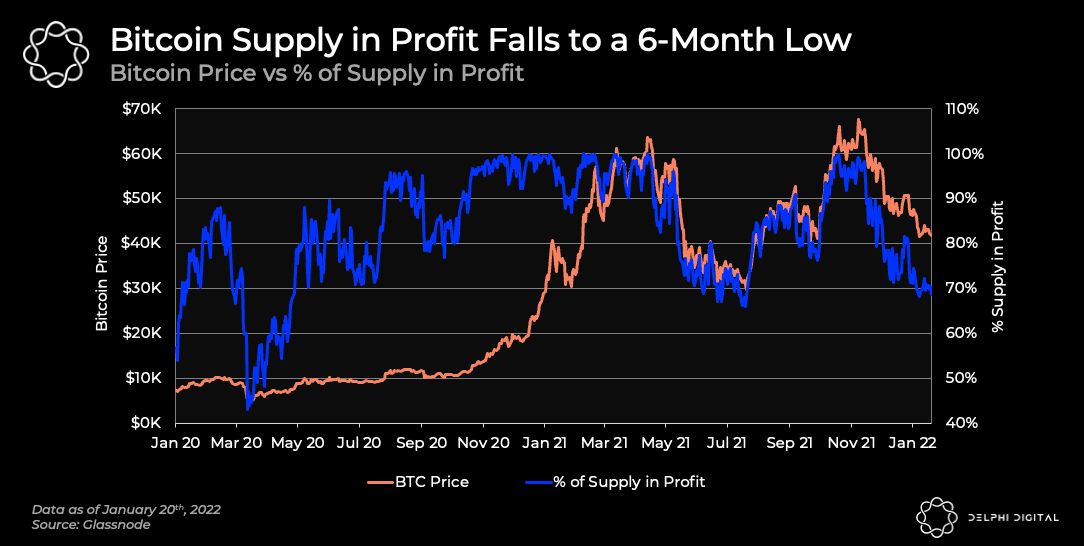

The percentage of Bitcoin in profit has fallen to levels not seen since July this year and stands at 68.7% currently, according to Delphi Digital, an independent cryptocurrency research firm.

Bitcoin Supply Vs Percentage Of Supply In Profit — Courtesy Delphi Digital

Bitcoin Supply Vs Percentage Of Supply In Profit — Courtesy Delphi Digital

“This suggests that over 30% of Bitcoins have exchanged hands within the last year, when the cryptocurrency was trading above current prices, and these entities are holding on to an unrealized loss,” Delphi wrote in an emailed note.

Bitcoin touched an intraday low of $40,994.23, while ETH touched a low of $2,994.93 in a similar period.

Amsterdam-based cryptocurrency trader Michaël van de Poppe tweeted that the $42,400 to $42,700 range was important to hold for Bitcoin because there is an “Instant nuke to the other side of the range.”

That's why $42.4-42.7K was so important to hold for #Bitcoin.

— Michaël van de Poppe (@CryptoMichNL) January 20, 2022

Instant nuke to the other side of the range.

Full analysis:https://t.co/k8HrqajQGV pic.twitter.com/HqIeZQMcEy

Despite Bitcoin’s 38.4% from its November highs, the 5-year returns of the coin are 47.5x higher than the S&P500 index in the same period and 84.5x higher than gold, said the financial market and content platform Santiment in a tweet.

#Bitcoin is now -38.4% from its November 10th #AllTimeHigh of $68.7k. Yet $BTC's returns over the past 5 years are still 47.5x higher than the #SP500 during this time, and 84.5x higher than the price of #Gold. When in doubt, zoom out. https://t.co/SYSOOBVPml pic.twitter.com/ngb2uRLVzm

— Santiment (@santimentfeed) January 20, 2022

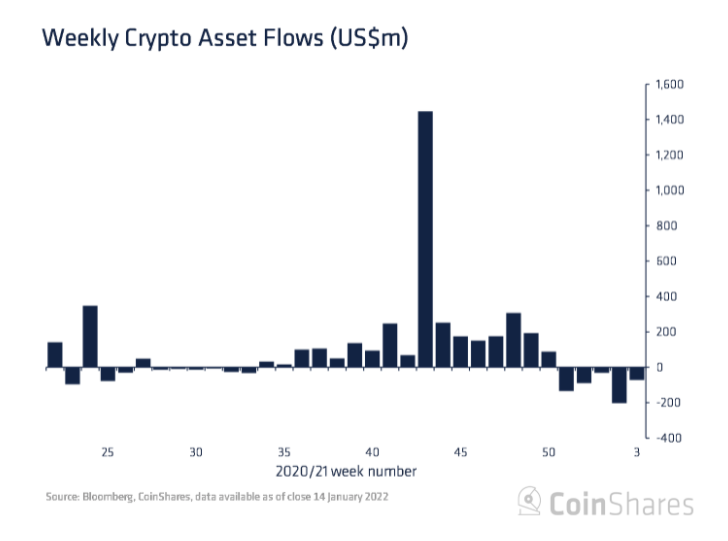

Meanwhile, sharing data from the digital asset investment firm CoinShares, Marcus Sotiriou, an analyst at the United Kingdom-based digital asset broker GlobalBlock said that there were $73 million in digital asset investment product outflows last week, making it the 5th consecutive week of outflows but the outlier to this trend was Solana (SOL).

Weekly Crypto Asset Flows — Courtesy CoinShares

Weekly Crypto Asset Flows — Courtesy CoinShares

“Solana is an anomaly with $5.4 million in inflows last week, whilst Bitcoin funds have had outflows for 4 out of the past 5 weeks. Total outflows over this period for the whole crypto market totals to $532 million, which is the sharpest outflows since 2018,” noted Sotiriou.

Read Next: Dogecoin Bull Elon Musk Takes A Dig At Cryptocurrency Volatility — With A Meme, Of Course

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.