Bitcoin and other major coins traded sharply lower Thursday evening as the global cryptocurrency market cap decreased 0.8% to $2 trillion.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin BTC/USD | -7.8% | -5.6% | $40,567.94 |

| Ethereum ETH/USD | -8.2% | -4.8% | $2,886.69 |

| Dogecoin DOGE/USD | -1.3% | -6.15% | $0.15 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Rally (RLY) | +12.2% | $0.34 |

| Dash (DASH) | +7.9% | $116.260 |

| Nexo (NEXO) | +6.6% | $2.26 |

See Also: How To Buy Bitcoin (BTC)

Why It Matters: A slew of factors led to the decline of cryptocurrencies on Thursday. Geopolitical tensions on the Ukrainian border reemerged, while the release of minutes from the Federal Open Market Committee brought back the focus on possible rate hikes.

The S&P500 and the NASDAQ ended Thursday lower by 2.12% and 2.88% at 4,380.26 and 13,716.72, respectively.

President Joe Biden is expected to issue an executive order next week related to the regulation of cryptocurrencies. The executive order is expected to direct agencies to study both cryptocurrencies and central bank digital currency, according to a report from Yahoo Finance.

Edward Moya, a senior market analyst with OANDA, said that “Wall Street has gone full de-risking mode and Bitcoin is paying the price.”

“Bitcoin is the ultimate risky asset, and a Ukraine invasion would keep crypto selling pressure going another 10-15% over the short-term,” the analyst said, in a note seen by Benzinga.

Moya noted, pointing to the news of the upcoming Biden executive order, that uncertainty for stablecoins is a “short-term negative for cryptos, but overall long-term growth for the cryptoverse will embrace US regulation.”

Moya’s colleague Craig Erlam said in a note that $45,500 is a “major barrier of resistance” for the apex coin.

“A break above here could be a very bullish development for bitcoin,” said Erlam.

Cryptocurrency trader Justin Bennett tweeted that “everyone is getting bearish at support again, huh?”

So everyone is getting bearish at support again, huh? $BTC weekly time frame: pic.twitter.com/NsFgZLIjsp

— Justin Bennett (@JustinBennettFX) February 17, 2022

Pseudonymous analyst Kaleo urged prudence on Twitter. He said, “ it'd be foolish not to proceed w/ caution here.”

#Bitcoin / $BTC

— K A L E O (@CryptoKaleo) February 17, 2022

As much as I'd like my optimism from last week to play out, it'd be foolish not to proceed w/ caution here.

This structure has signaled a local top too many times since the bearish trend began in early November.

If lows break, looking for 37.5 (HTF diag retest) pic.twitter.com/OYIdbkP1X9

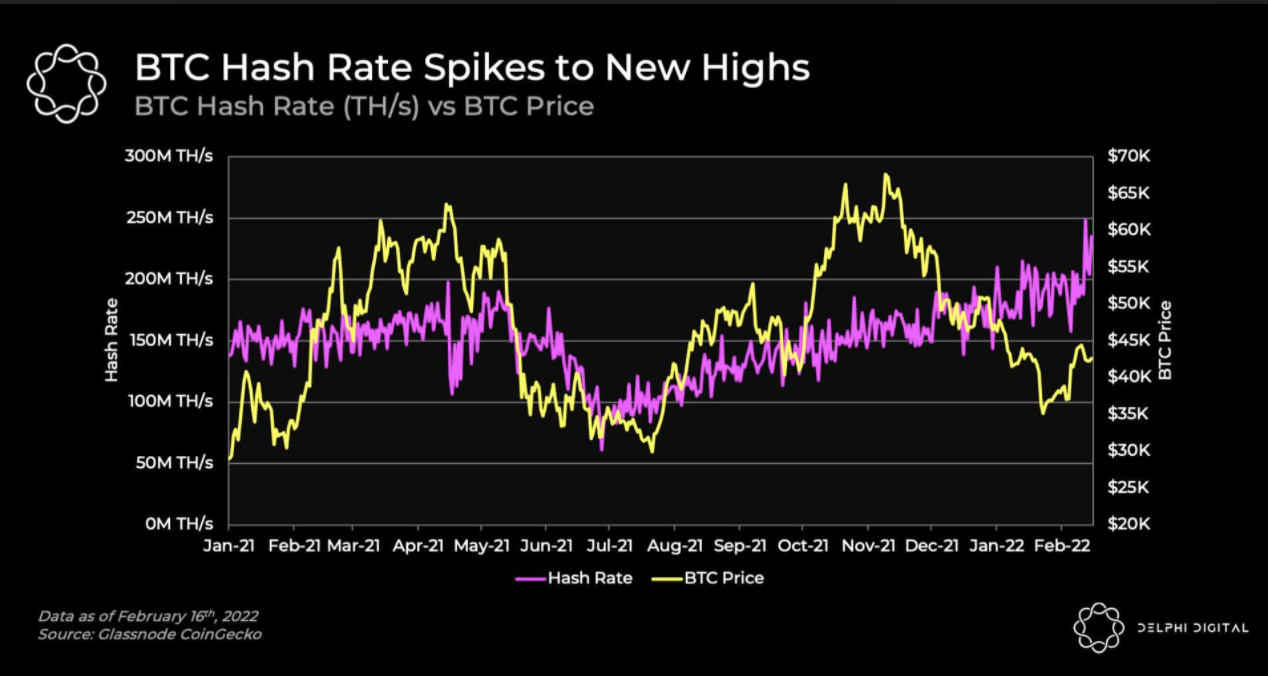

Delphi Digital said in a recent note that Bitcoin hash rate — the total combined computational power used for mining and processing of transactions on the network — has soared.

BTC Hash Rate (TH/s) — Courtesy Delphi Digital

BTC Hash Rate (TH/s) — Courtesy Delphi Digital

Since the hash rate dipped last year after China imposed a mining ban, it has recovered — hitting 248M TH/s this week. This is the highest it has ever been. The United States now accounts for the largest share of BTC global hash rate at 35.4% as of August 2021, as per the cryptocurrency research firm.

“This means that the number of miners has been growing even as some move out of China. This spike could be a result of miners finishing the migration of their farms from China to other countries and starting to operate again,” wrote Delphi Digital.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.