By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

On Monday 28 February, the Brent price is rising. Of course, it’s not breaking news because the key trigger for the commodity market remains market expectations of the global oil supply shortage. As the geopolitical tensions escalate, this catalyst becomes more stable.

Brent has already reached $103 and may go higher.

The global commodity market would feel a little bit relieved if the Iran oil returned and added about 1 billion bpd every month until the end of the year. However, the US-Iran talks are currently on the back burner, although they retain their relevance and significance.

Last Friday’s report from Baker Hughes showed that the Oil Rig Count in the US added 2 units. At the moment, shale drillers are focused on the completion of works with the wells drilled earlier.

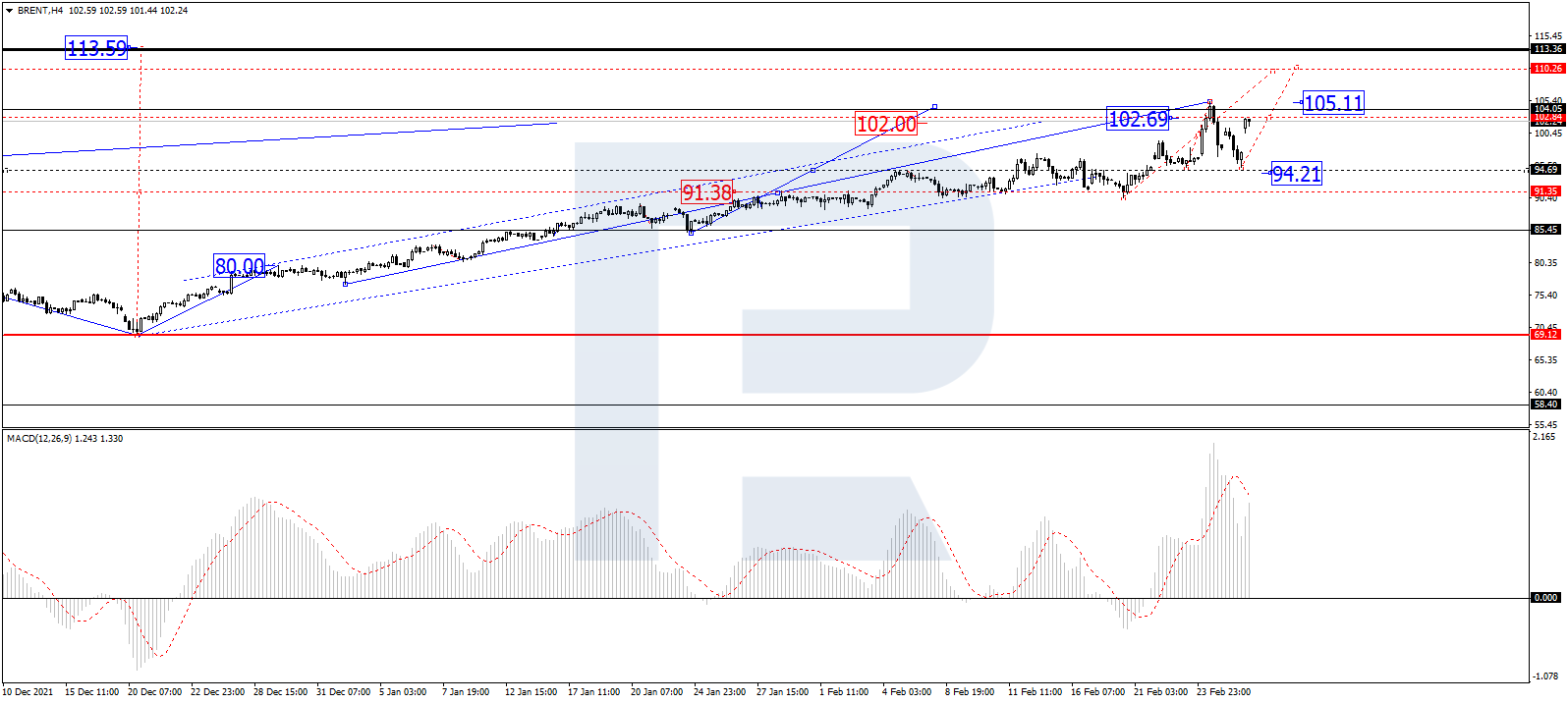

In the H4 chart, having rebounded from 95.15, Brent is growing towards 103.00 and may soon break it. After that, the instrument may continue trading upwards with the short-term target at 110.30. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is moving above 0 and may re-enter the histogram area, thus indicating a further growth towards new highs.

As we can see in the H1 chart, after finishing another ascending impulse and forming a new consolidation range around this level, Brent is expected to break it and resume trading within the uptrend towards 105.10 or even extend this structure to reach the short-term target at 109.00. On the other hand, if the price breaks the range to the downside, the market may correct towards 99.00 and then resume growing towards the above-mentioned target. From the technical point of view, this idea is confirmed by the Stochastic Oscillator: after returning to 80 and breaking it to the downside, its signal line is expected to continue falling towards 50. After that, the line may resume its growth to reach 80.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.