As the stock market continued to rally off of the early June lows, real estate investment trusts definitely seemed to follow suit this morning.

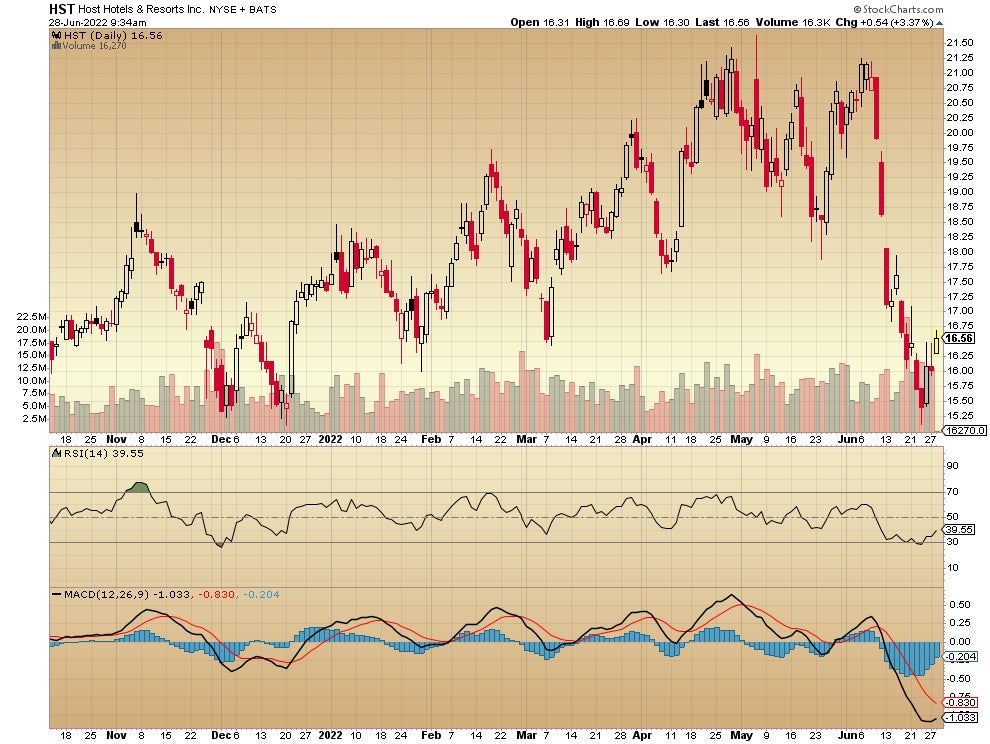

Host Hotels & Resorts Inc HST is kicking off the trading day with a strong gain. It’s up by 3.43%, a much better look than yesterday’s negative day:

Based in Bethesda, Maryland, Host Hotels owns 78 hotel properties with more than 70,000 rooms and calls itself “the world’s largest lodging resort.” At this price, it’s paying a 1.50% dividend.

- Real Estate Investors Can Earn An 18% Target Return In Reno-Lake Tahoe With CrowdStreet's Latest Hotel Offering

- Investors Looking At 17% Target Return In The Red Hot Dallas Ft. Worth Submarket With Offering From RealtyMogul

- Browse more real estate investment offerings

Park Hotels and Resorts Inc PK this morning gapped up above yesterday’s closing price, an indication of definite investor interest in buying:

That’s a 3.9% gain, if gains hold by the close, that would make it 3 up days in a row for this hote REIT with properties in Hawaii, Florida, San Francisco, Boston and other popular travel destinations. Park is paying a small .28% dividend at this price.

Related: 3 Non-Traded REITs To Consider Adding To Your Portfolio

Kimco Realty Corp KIM is up by 2.61% this morning. If that holds, this would be the 5th day in a row of solid gains for the units:

You can see on the chart that it has a long way to go to reach the April high of $26.

The Jericho, New York-headquartered REIT owns and operates what it calls “grocery store anchored shopping centers.” Kimco is paying investors a 3.94% dividend.

All of the major real estate investment trusts we follow are showing gains this morning. We’ll see what it looks like at the close.

Not investment advice. For educational purposes only.

Photo by Vintage Tone on Shutterstock

Charts from StockCharts

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.