2021 was the busiest year for deals since 2000, with a record-breaking IPO rush of 1,035 listings in the US, with the biotech and healthcare sectors leading the way, accounting for 36% of all IPO activity.

While most investors are busy reviewing stocks in their current portfolio, it may come as a surprise which company came in first for stock return. Although it is currently not a household name, any savvy investor should keep this stock on their radar: Regencell Bioscience RGC. RGC is the top performing stock of all 2021 IPOs according to stockanalysis.com/ipos/2021/. As of August 1, 2022, RGC is still ranked #1 with a 237% return above its IPO price of $9.50.

A June 2022 article mentioned that RGC’s total cumulative short volume is over 19 million shares. While the stock has suffered from short sellers’ attacks since its listing, RGC has performed well. RGC has approximately 2.6 million tradable ordinary shares in the market and has maintained a low float as the founder and CEO has repeatedly purchased RGC ordinary shares from the open market.

RGC’s Solid Foundation

As mentioned above, RGC is closely held by the CEO who owns over 81% of the company. He has used $5.9 million of his personal funds to purchase RGC shares from the open market since its IPO.

His consistent share purchases convey his confidence, commitment and conviction in the company and is putting his money where his mouth is. There are few companies that have the CEO owning this much of the business. The company’s entire management team has also extended the lock-up period of their share options, which shows they are collectively committed to their goal and mission, which is to save and improve lives.

Comparison to 2022 IPO Top Performer

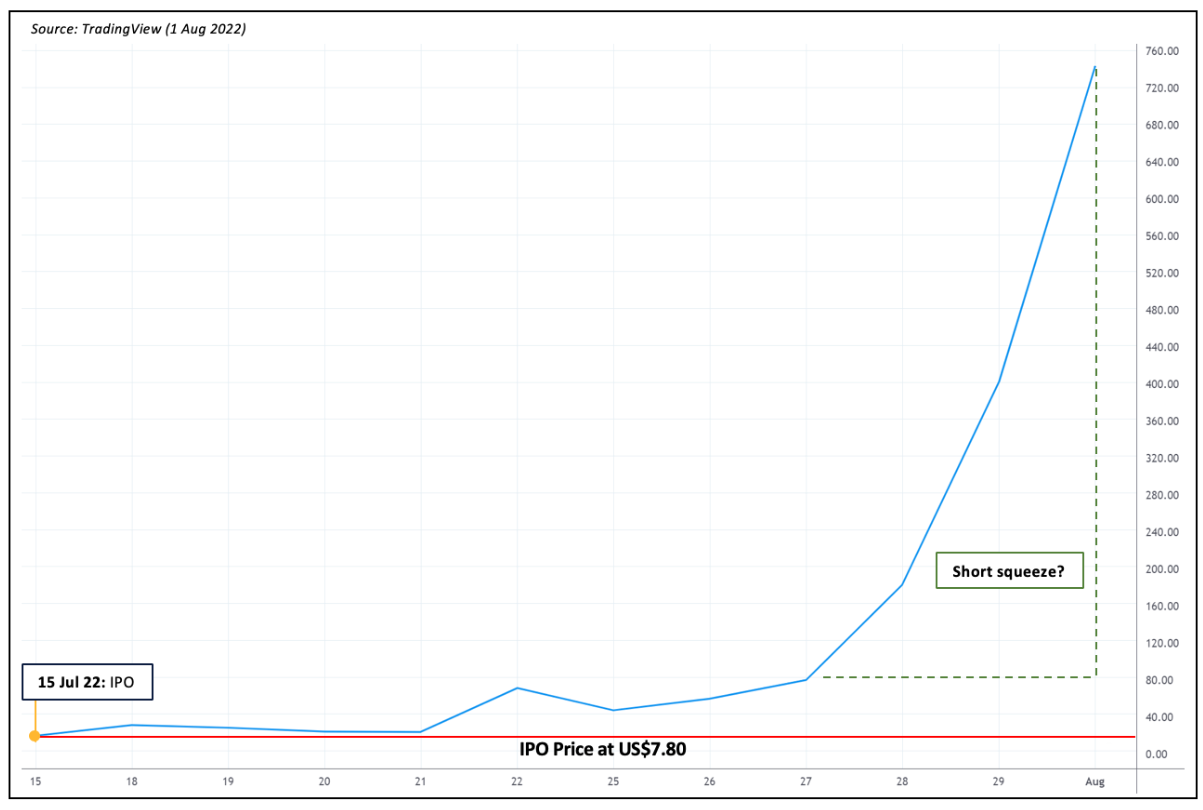

A recent stock that has gone to the moon since its mid-July 2022 IPO is AMTD Digital HKD. The controlling shareholder, AMTD Group Company Limited, was founded by billionaire Li Ka-shing’s CK Hutchison Holdings Limited in 2003. HKD’s IPO price was $7.80 and has gained over 9,000% since, closing at $742.00 on August 1, 2022. Although RGC is the #1 performer of 2021 IPOs, this pales in comparison with the current performance of HKD.

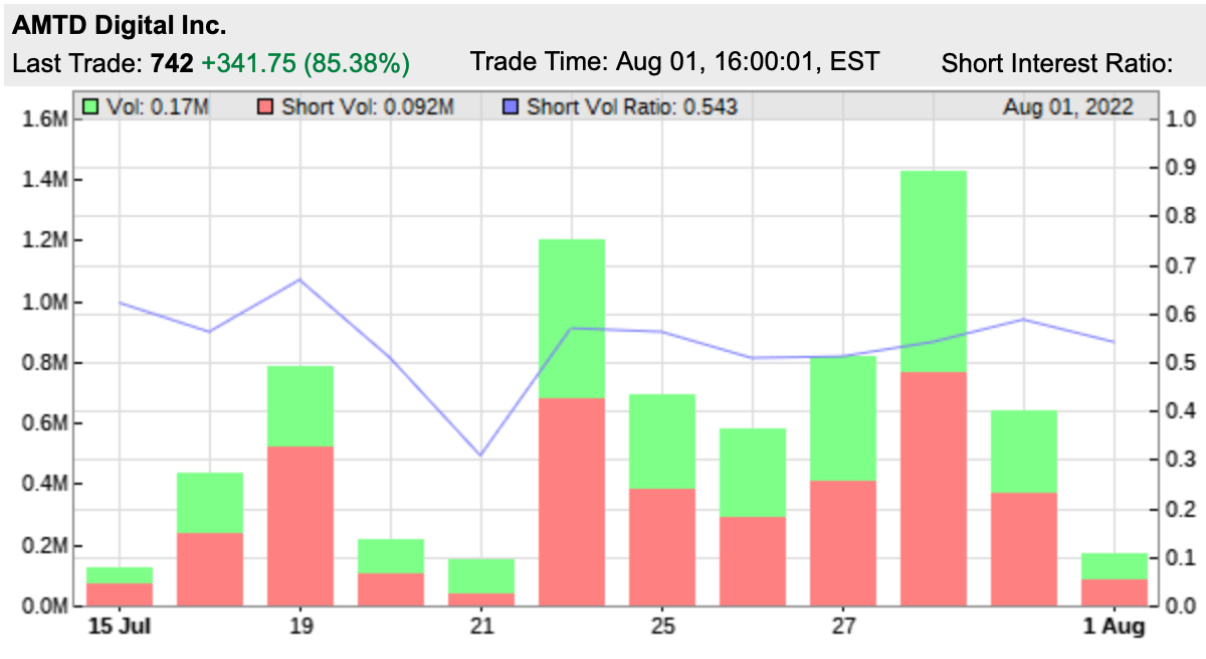

HKD’s upward trajectory which has delivered an incredible 90 times bagger in a short amount of time has also attracted many short positions against the company. Below is a table outlining the key metrics:

|

RGC(1) |

HKD(2) |

|

|

IPO Date |

July 16, 2021 |

July 15, 2022 |

|

IPO Price (USD) |

9.50 |

7.80 |

|

As of August 1, 2022 |

31.97 |

742.00 |

|

Share performance since IPO (multiples) |

3.4 |

95.1 |

|

IPO Ranking 2021(3) |

1 |

N/A |

|

IPO Ranking 2022(4) |

- |

1 |

|

Office Location |

Hong Kong |

Hong Kong |

|

Major shareholder (%) |

81.2(5) |

88.7(6) |

|

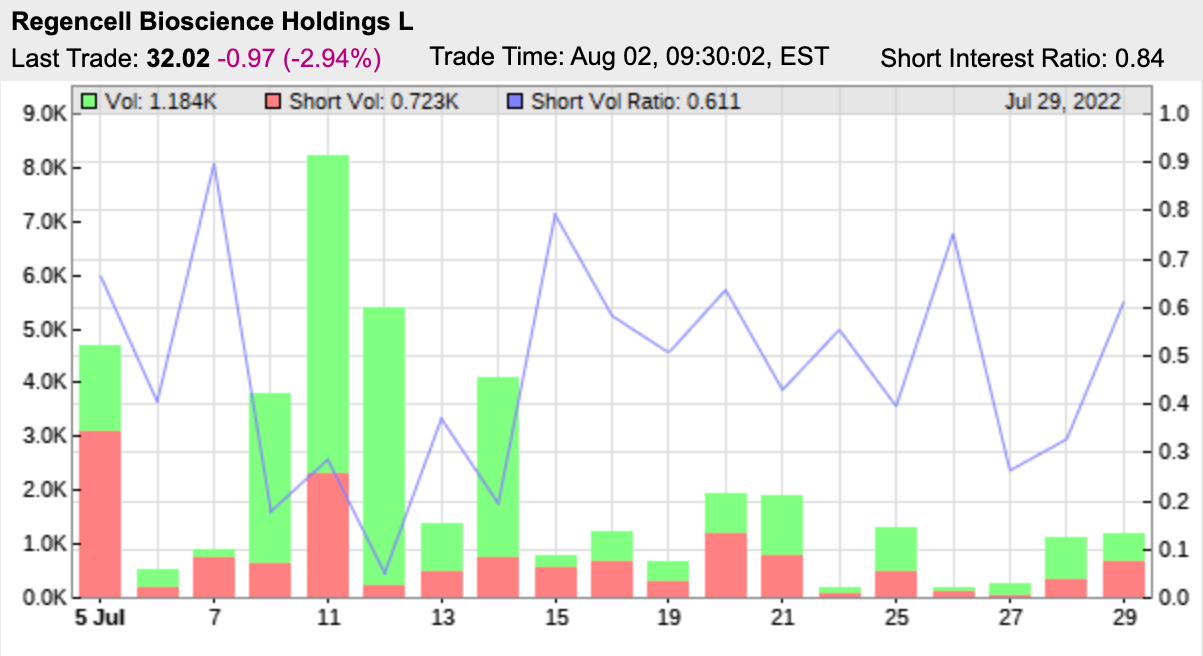

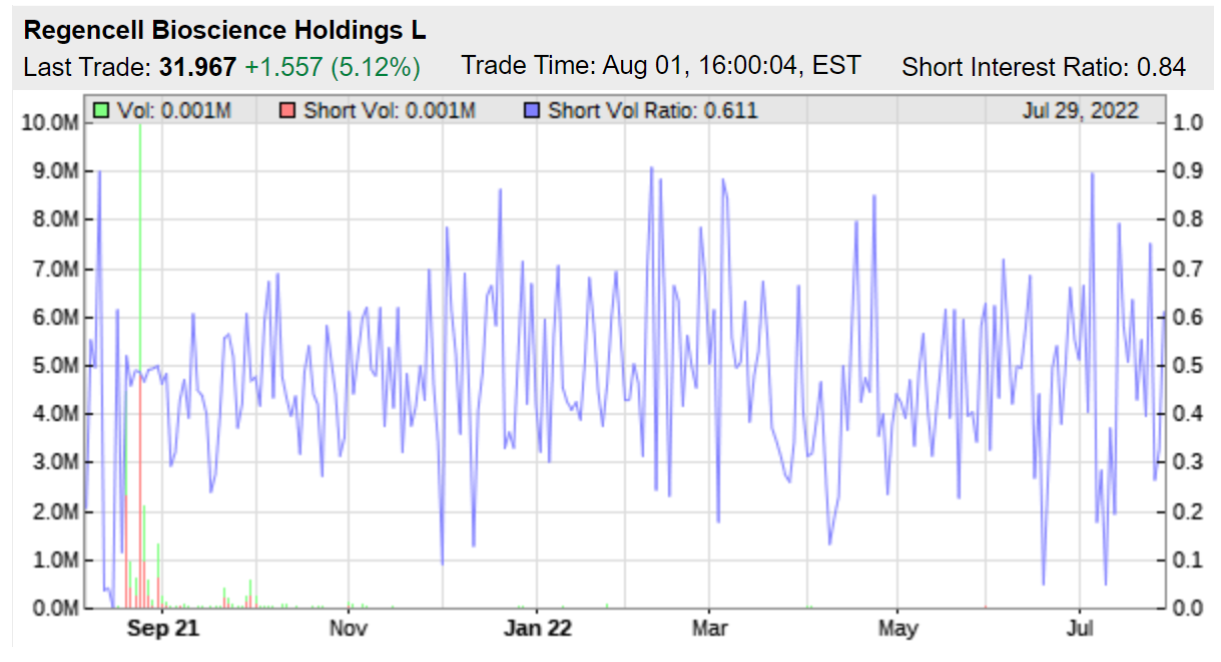

Daily short volume ratio (1 month) (%) (refer to charts below) |

5-90(7) |

31-68(8) |

|

Daily short volume ratio (1 year) – Highest (%) (refer to charts below) |

91(7) |

N/A |

Daily short volume (%) refers to the number of shares that have been shorted as compared to the total daily volume traded.

RGC and HKD Comparison Chart

RGC’s Stock Chart Since IPO:

RGC’s Daily Short Volume Ratio (1 month) (7):

RGC’s Daily Short Volume Ratio (1 year) (7):

HKD’s Stock Chart Since IPO:

HKD’s Daily Short Volume Ratio (1 month) (8):

Source:

(1) https://www.nasdaq.com/market-activity/ipos/overview?dealId=1151577-96813

(2)https://www.nasdaq.com/market-activity/ipos/overview?dealId=1160165-97666

(3)https://stockanalysis.com/ipos/2021/

(4)https://stockanalysis.com/ipos/2022/

(5)https://www.sec.gov/Archives/edgar/data/1829667/000121390022041491/ea163338-13da5regen_regen.htm

(6)https://www.sec.gov/Archives/edgar/data/0001809691/000119312522194790/d943653d424b4.htm#rom943653_19

(7)https://shortvolume.com/?t=rgc

(8)https://shortvolume.com/?t=hkd

Featured image sourced from Shutterstock

This post contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.