Happy Friday Everyone! 👋

With the Merge approaching, Ethereum ETH/USD Name Service saw 378,000 new domain registrations last month. There are now over 1.8 million .eth addresses owned.

Bitcoin maximalist Michael Saylor is stepping down as CEO of MicroStrategy MSTR so he can focus more on the cryptocurrency. The enterprise-software maker reported a loss of over $1 billion related to its Bitcoin BTC/USD holdings in Q2.

The Solana SOL/USD ecosystem was targeted by hackers on Wednesday but the price of SOL has held support levels. The token was likely shielded by demand stemming from an announcement that the blockchain’s premier NFT marketplace—Magic Eden—was expanding to Ethereum.

Having said that…let’s get to it!

-

An unlikely match

-

Bank of America flags 2 catalysts for crypto

-

Eurodeals

1. An unlikely match

Coinbase COIN has had a rough 2022.

A year filled with insider trading schemes and SEC probes amid borderline contagion in a Crypto Winter has been reflected in COIN shares down 65% YTD (vs. S&P -13% and Bitcoin -52%).

This week the stock surged after the crypto exchange announced a partnership with the world’s biggest asset manager.

The move is part of a larger strategy for BlackRock BLK —which commands over $8 trillion in AUM—to expand its presence in the space and cater to an increasing appetite for exposure to digital assets among its institutional investors.

Coinbase will provide crypto trading, custody, prime brokerage, and reporting capabilities to BlackRock’s Aladdin (institutional investor portfolio management platform) clients.

Institutional adoption continues to accelerate – hedge funds, corporate treasuries, and asset managers accounted for ~75% of Coinbase’s trading volume in Q1.

2. Bank of America flags 2 catalysts for crypto

“We disagree that blockchains and the applications that run on top of them have no intrinsic value – a comment we hear regularly”

Bank of America (BoA)

Preach, BoA.

In its July Global Cryptocurrencies and Digital Assets report, BoA not only informed the haters, but it also flagged a pair of catalysts for further bullish crypto momentum.

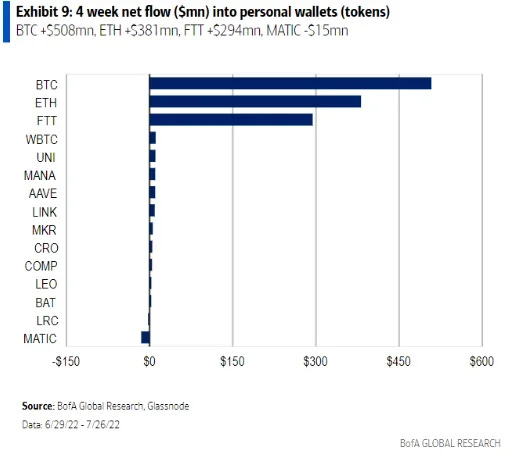

From June 29 to July 27 investors have increasingly moved their crypto—particularly Bitcoin, Ethereum, and FTX’s token FTT)—off of exchanges and into personal wallets.

Over the same period, crypto exchanges experienced 3 straight weeks of inflows.

This movement suggests investors are inclined to buy more crypto (with stablecoins) while safeguarding—or HODL’ing—their current holdings.

It’s worth noting, on the other hand, that the buying over the last 2 weeks has been driven primarily by short-term holders, which suggests a potentially weak rally.

3. Eurodeals

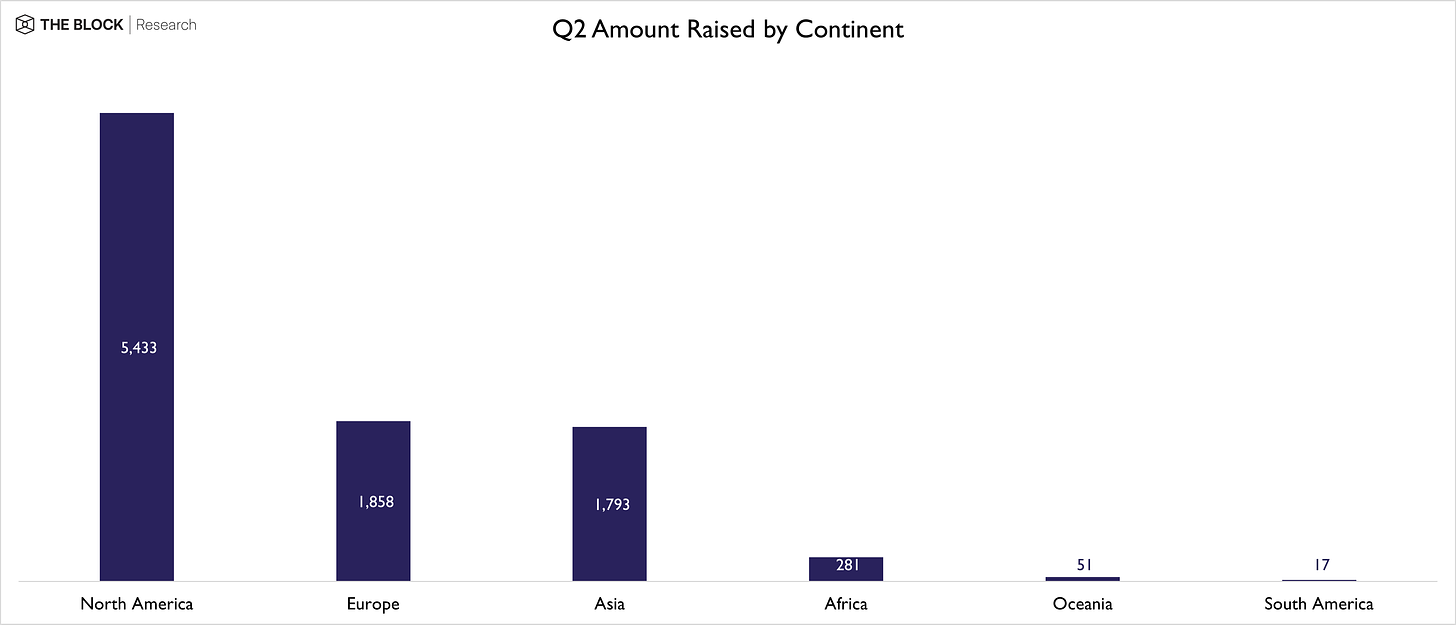

After 7 consecutive quarters of growth, global blockchain venture funding declined in Q2 for the first time since 2020.

Total funding dropped 22% from Q1, led (?) by Asia and the US which raised 43.4% and 23.8% less dollars, respectively.

Swimming against the current was Europe which saw a 25% increase in blockchain venture funding with $1.8 billion raised for the quarter—good enough for second-most after leapfrogging Asia.

Animoca Brands, Coinbase Ventures, GSR, Jump Capital, and Polygon Studios were among the most active in the region.

Besides Europe, Africa saw a boost of 189% in funds raised from Q1. No other regions increased.

Halfway through July, we wrote that “crypto was ripe for M&A”.

We are on pace to hit 212 M&A transactions this year. Last year’s total was 204.

Expect more activity in the coming months.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.