Zinger Key Points

- Cryptocurrencies follow stocks lower amid China COVID-19 protests.

- Cryptocurrencies still suffering from FTX collapse contagion says OANDA analyst.

- Whales accumulated 44,888 BTC over the last 5 days says Santiment.

Bitcoin and Ethereum were trading in the red on Monday evening as the global cryptocurrency market cap shrank 1.5% to $818.6 billion at 8:22 p.m. EST.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin BTC/USD | -1.1% | 1.9% | $16,182.89 |

| Ethereum ETH/USD | -1.7% | 5.3% | $1,166.97 |

| Dogecoin DOGE/USD | -2.5% | -26.4% | $0.09 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Fantom (FTM) | +7.9% | $0.20 |

| ApeCoin (APE) | +8.1% | $4.10 |

| Chainlink (LINK) | +5.7% | $7.21 |

See Also: Moomoo Vs. Robinhood — Which Is Better For You?

Why It Matters: Risk assets, including cryptocurrencies, were under pressure on Monday following COVID-19-fueled unrest in China. S&P 500 and Nasdaq ended 1.5% and 1.6% lower intraday. U.S. stock futures were seen flat at the time of writing.

Investors will keep an eye on a speech by Federal Reserve Chair Jerome Powell on Wednesday. The next rate decision by the U.S. central bank is expected at the December 13-14 meeting of the Federal Open Market Committee.

On Monday, cryptocurrency lender BlockFi declared bankruptcy as the aftermath of FTX’s collapse continues to play out.

“Bitcoin remains under pressure despite recovering slightly last week.

Cryptocurrencies are still suffering the fallout from the FTX collapse and the still unknown full extent of the contagion,” said Craig Erlam, a senior market analyst with OANDA.

“The fact that risk appetite is weak today also won't be helping and bitcoin is off around 2% as a result and not far from $16,000. While it's seemingly trying to form a base around $15,500-17,000, it may be easier said than done in this environment,” said Erlam, in a note, seen by Benzinga.

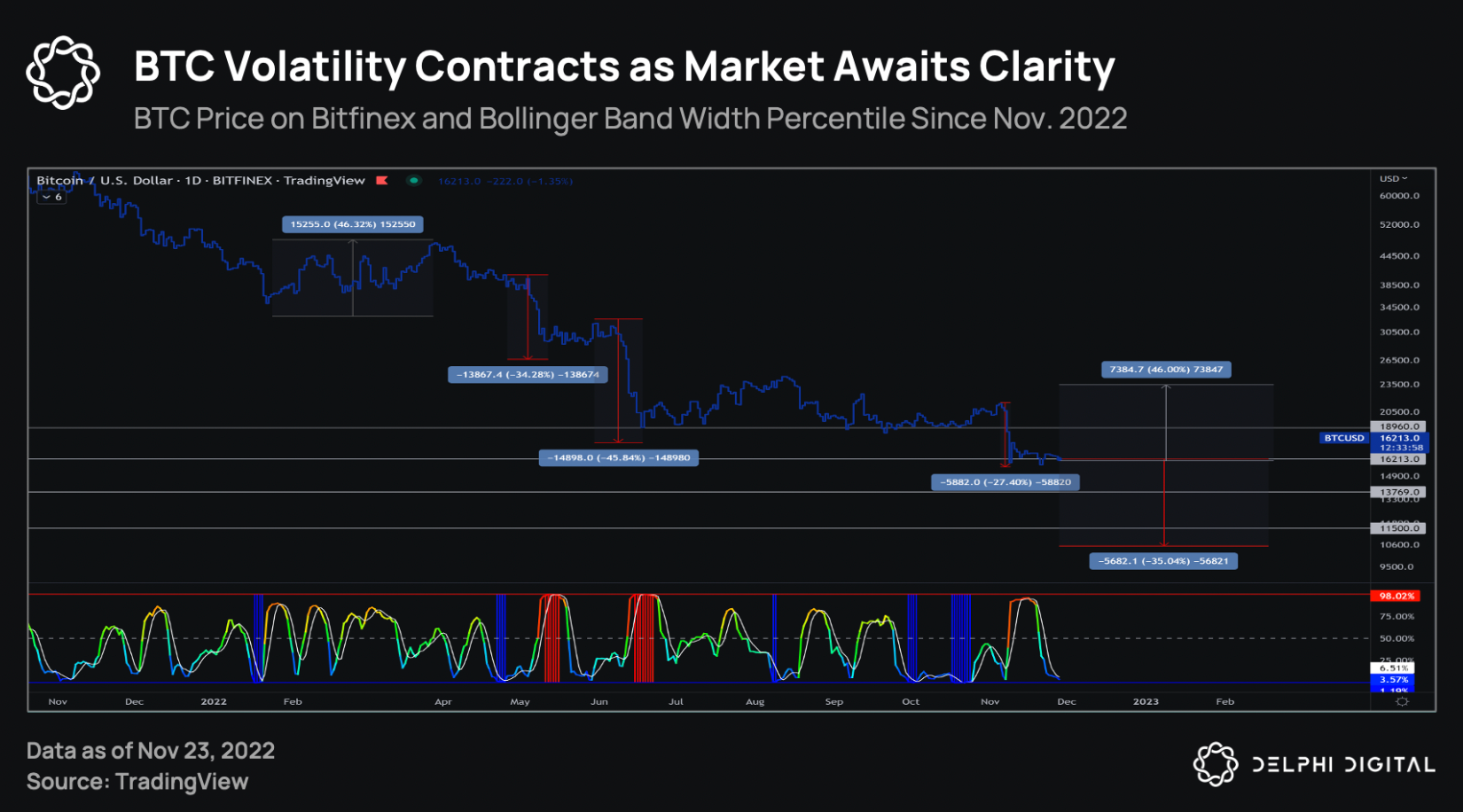

As the market awaits clarity, BTC volatility has contracted said Delphi Digital, citing a metric known as Bollinger Band Width Percentile.

The market intelligence platform said in a note that BBWP has reached 3.57 amid the FTX collapse during Nov. 5-10, a period when BTC price shrank by over 27%.

“The last four instances of similar moves in the indicator have led to one upside move of 46% and three downside moves of -35% on average. Such a downside move from current price levels takes BTC to $10.5K,” said Delphi Digital.

BTC Price On Bitfinex and BBWP Since Nov. 2022 — Courtesy Delphi Digital

BTC Price On Bitfinex and BBWP Since Nov. 2022 — Courtesy Delphi Digital

The BBWP is a second-order derivative of the Bollinger Bands, a volatility-based indicator compromising of three lines with the middle line being the 20-day simple moving average and the upper and lower lines being two standard deviations away.

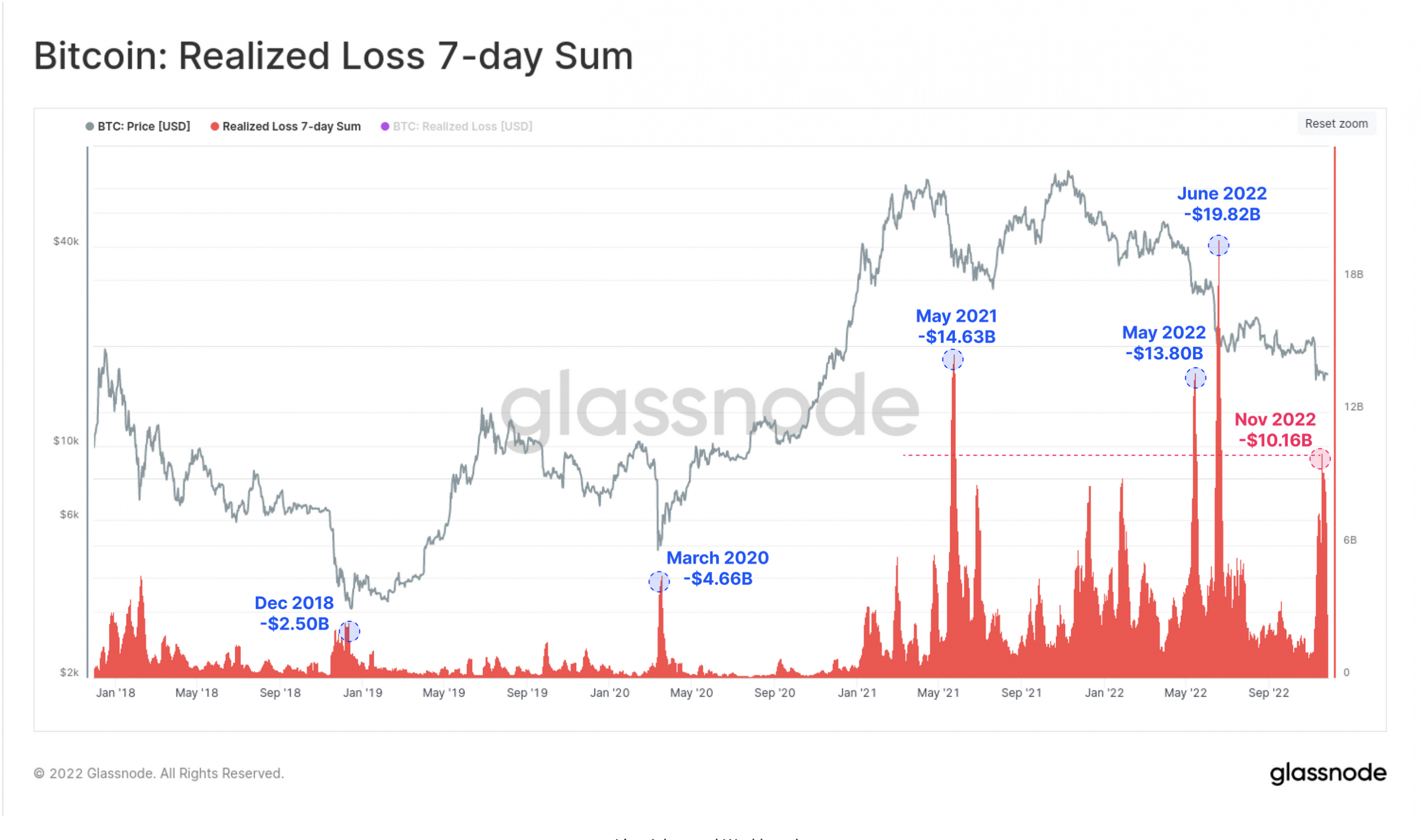

Glassnode said that the FTX fallout has “triggered one of the largest capitulation events in Bitcoin history.”

“This sell-off saw significant statistical deviations outside the mean on investor losses. The current unrealized loss held by the actively traded coin supply is effectively at an all-time low, rivaling only the very pico-bottoms of the 2015 and 2018 bear cycles,” said the on-chain analysis company.

Bitcoin: Realized Loss 7-Day Sum — Courtesy Glassnode

Bitcoin: Realized Loss 7-Day Sum — Courtesy Glassnode

Glassnode said that November was the fourth-largest capitulation event on record with a 7-day realized loss of negative $10.16 billion.

“This is 4.0x larger than the peak in Dec 2018, and 2.2x larger than March 2020.”

Meanwhile, traders are pointing out an opportunity for accumulation. Michaël van de Poppe said that the total altcoin market capitalization is resting at the all-time high of 2017. “It's also on support. Not the worst spot to look for entries on your investment bags”

Total #altcoin market capitalization resting on the ATH of 2017.

— Michaël van de Poppe (@CryptoMichNL) November 28, 2022

It's also on support.

Not the worst spot to look for entries on your investment bags. :) pic.twitter.com/J88gfbyOeF

Justin Bennett said that “Most will leave just before the buy of a lifetime, which is getting closer.” The cryptocurrency trader told his followers on twitter that “Patience pays.”

Crypto Twitter feels more dead than ever.

— Justin Bennett (@JustinBennettFX) November 28, 2022

Ironically, most will leave just before the buy of a lifetime, which is getting closer.

Patience pays.

On the Whale front, 47,888 BTC has been accumulated in a span of the past 5 days, said market intelligence platform Santiment. This comes after Bitcoin whales spent 13 months dumping their cumulative holdings as the price of the apex coin dropped.

#Bitcoin's whales have now spent 13 months dumping their cumulative holdings as prices have slid. However, following a big push down in the first 3 weeks of November as #FTX news broke, 47,888 $BTC has been accumulated back in the past 5 days. https://t.co/pQZ6PHY5tW pic.twitter.com/VqTFHOvNY3

— Santiment (@santimentfeed) November 29, 2022

Read Next: Crypto Analyst Who Predicted Bitcoin's Collapse Pegs New Price Target: 'When It Breaks Below 16k…'

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.