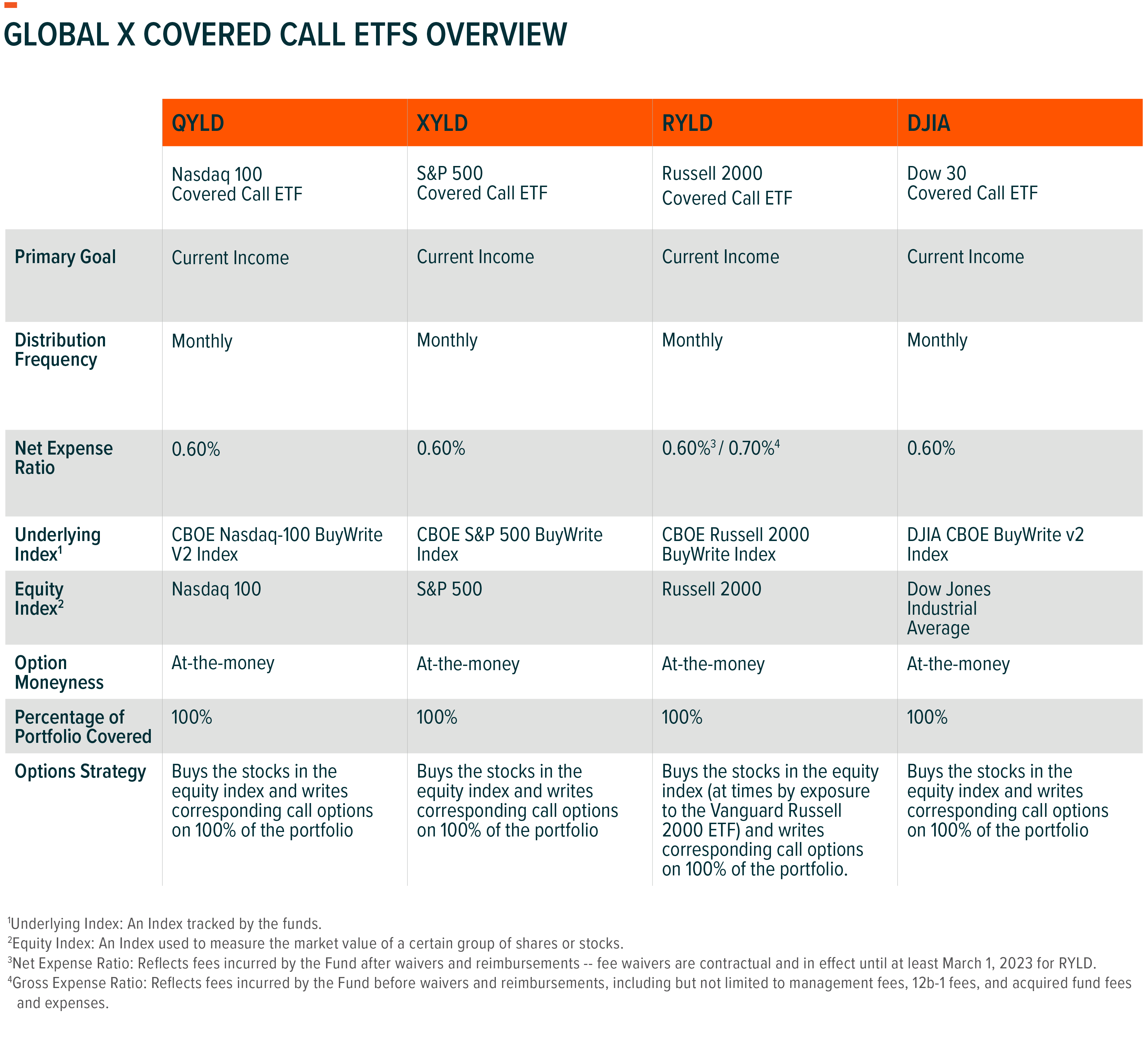

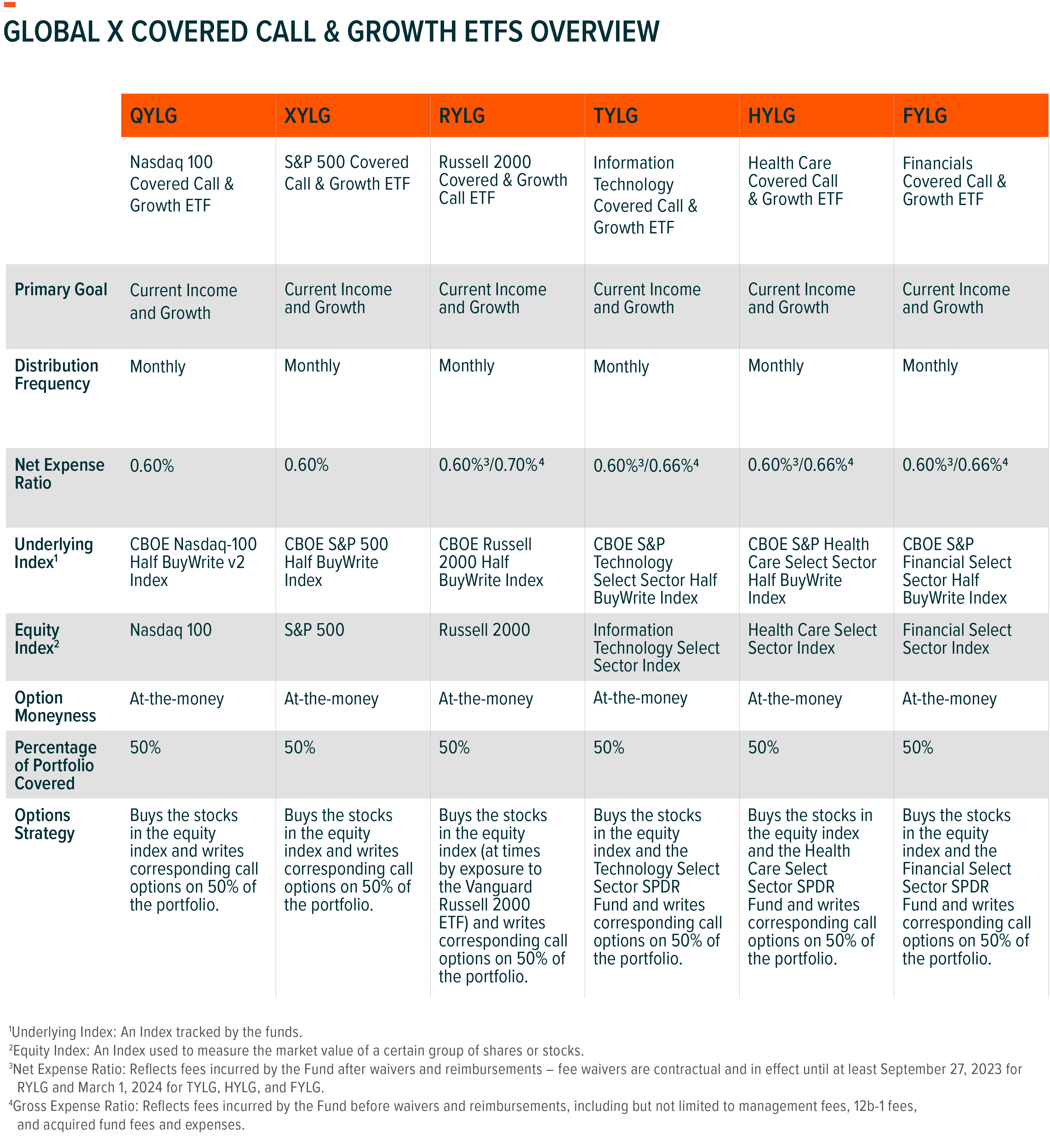

The Global X Research Team is pleased to release the distribution and premium numbers for our covered call ETFs for January 2023. Global X’s Covered Call suite of ETFs generally invest in the underlying securities of an index and sell call options on that index or an ETF tracking the underlying equity index. These strategies are designed to provide investors with an alternative source of income, while offering different sources of risks and returns to an income-oriented portfolio.

Click here to download the January 2023 Covered Call Report

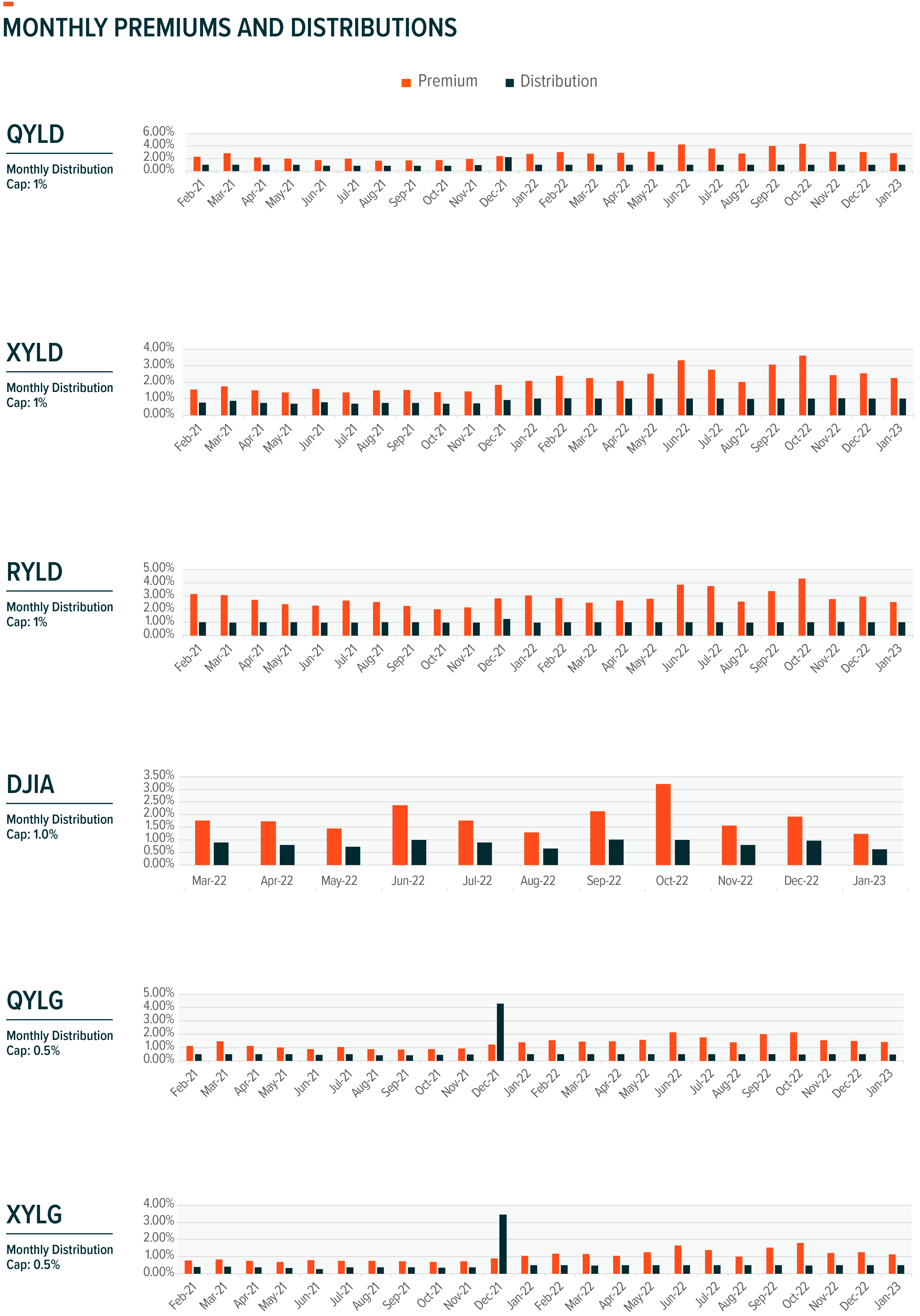

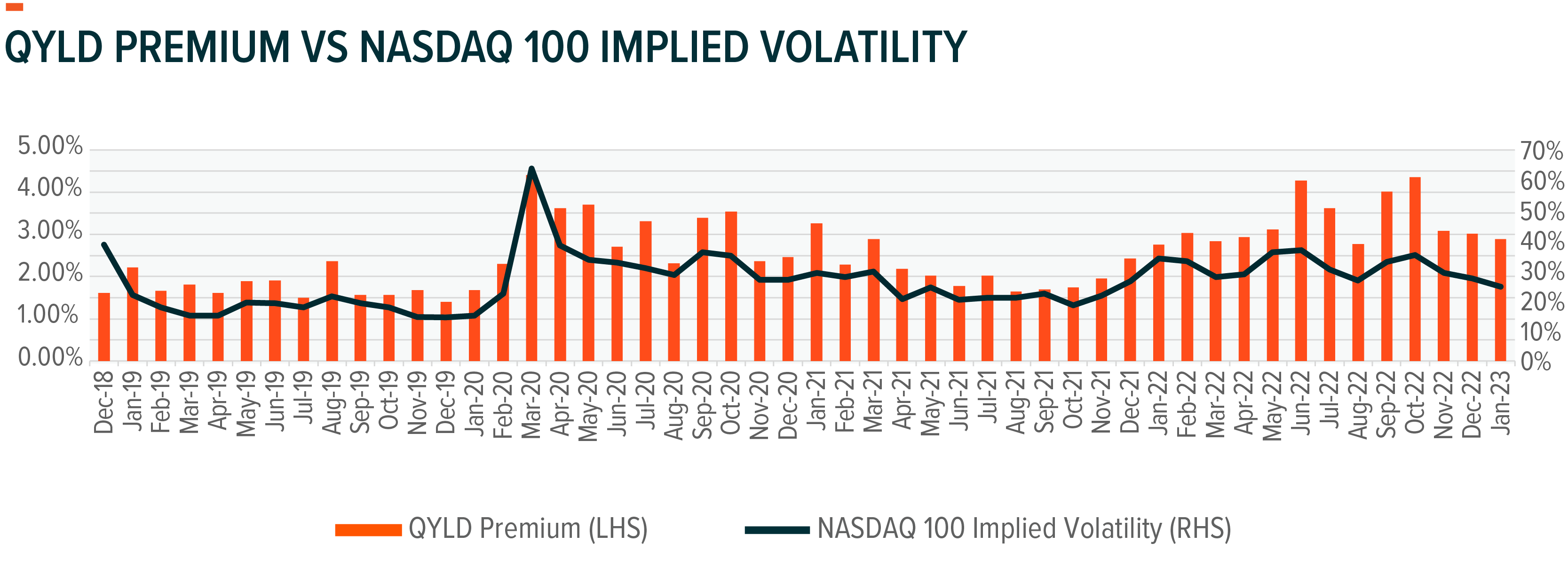

Historically, the VIX has demonstrated a level of inverse correlation to the S&P 500. For example, from 12/31/2013 to 12/31/2022, the correlation between these two indices was -0.71.1 This dynamic occurs based on a concept we discussed in our last covered call report regarding the VIX’s role as an equity market “fear gauge”. When equity markets are trending upward, investor “fear” tends to trend downward, and vice versa. Over the course of the covered call suite’s outcome period measured from each funds’ respective contract’s initiation date of 12/16/2022 to the day before contract expiry of 01/19/2023, we saw a short-term reversal of investor fears in which the VIX fell from 27.33 to 25.28.2 As seen within the report, this trend occurred for implied volatility levels across other implied volatility indices which resulted in lower premiums for the month of January, when compared to the previous month. However, S&P 500 returns were slightly muted and this index only increased 0.22% over the same timeframe.3 This was an attractive scenario for XYLD & XYLG, who implement covered call strategies on the S&P 500 Index, as both outperformed this equity index over the aforementioned timeframe.4 Technology sector-leaning equity indices such as the Nasdaq 100 and the Information Technology Select Sector Index saw a similar occurrence in which QYLD, QYLG and TYLG all outperformed their underlying equity indices over this same timeframe too.5 With the Bureau of Labor Statistics reporting a decline in the U.S. Unemployment Rate in January, the potential for optimism in equity markets may continue to ensue.6

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance current to the most recent month- and quarter-end, please visit XYLD, XYLG, QYLD, QYLG and TYLG.

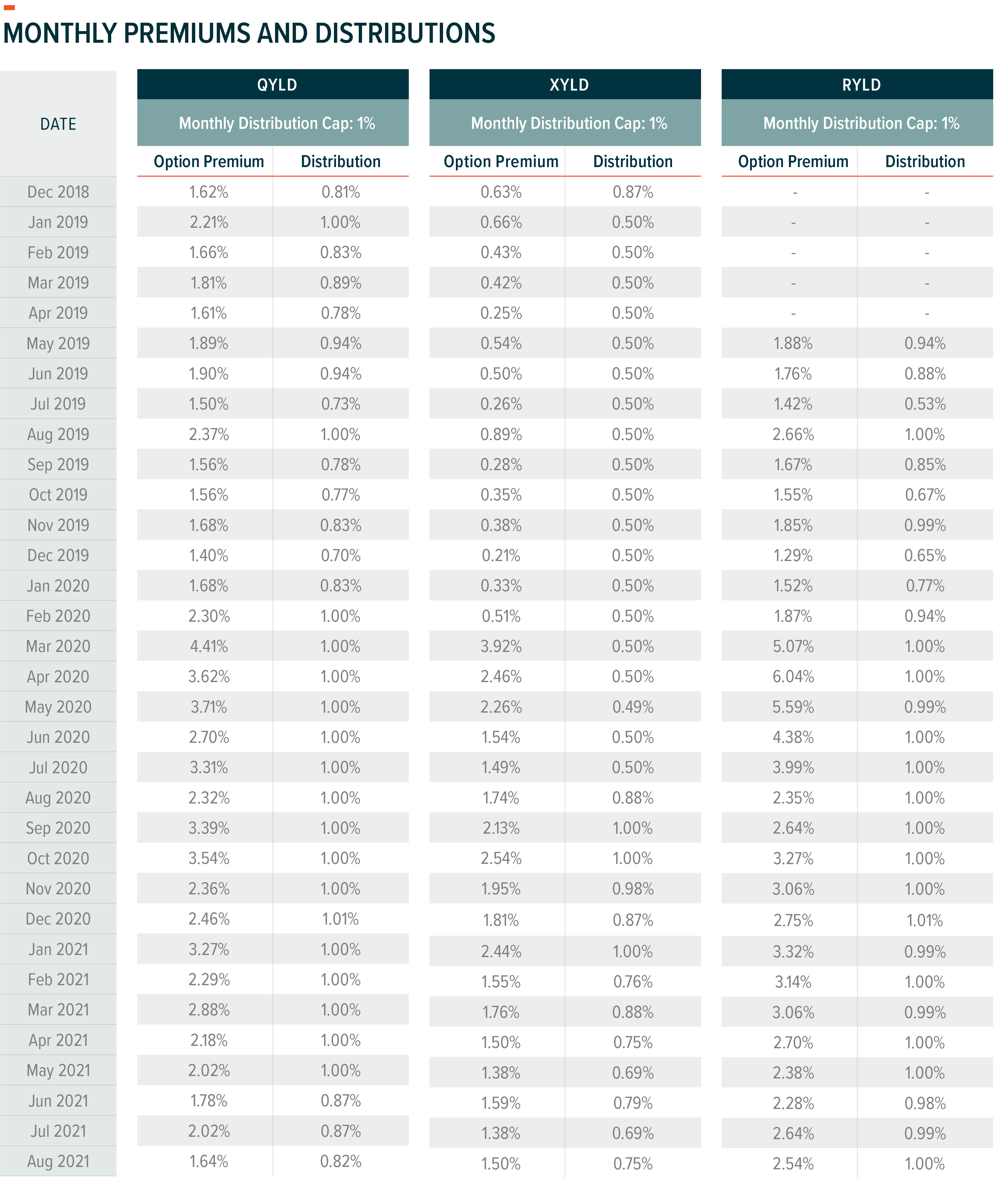

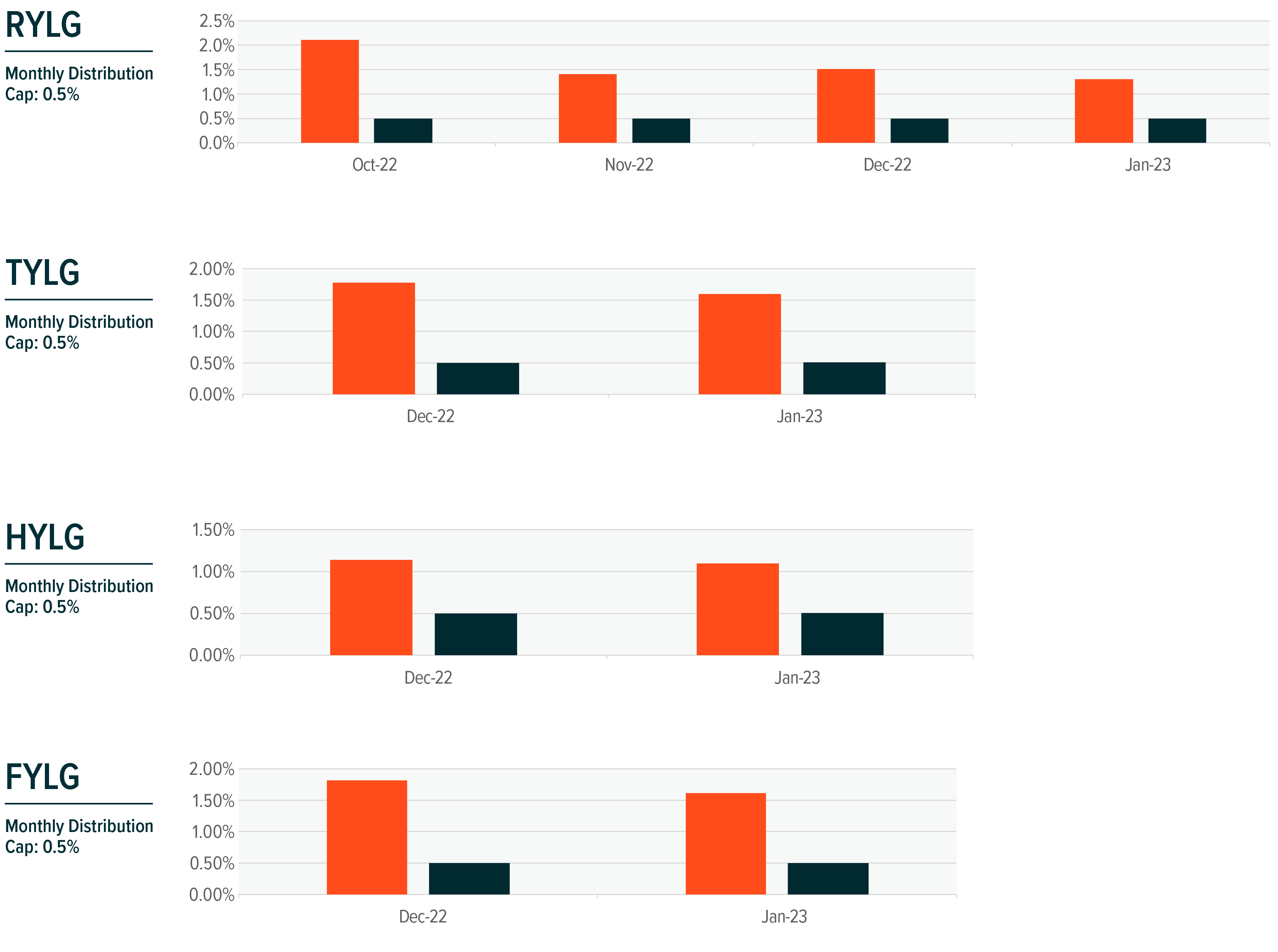

As a general guideline, the monthly distribution of each fund is capped at the lower of: a) half of premiums received, or b) 1% (for QYLD, RYLD, XYLD and DJIA)/0.5% (for QYLG, XYLG, RYLG, TYLG, HYLG, and FYLG) of net asset value (NAV). The excess amount of option premiums received, if applicable, is reinvested into the fund. Year-end distributions can exceed the general guideline due to capital gains that are paid out at the end of the year.

Fund Premiums and Implied Index Volatility

Disclaimer: Options Premiums vs. Implied Volatility graphs include implied volatility for the Nasdaq 100, S&P 500, Russell 2000, and Dow Jones Industrial Average Indexes. QYLG, XYLG, and RYLG write covered calls on these same, aforementioned equity indices, thus, their premiums are not displayed here. TYLG, HYLG, and FYLG have only rolled their options portfolios once, therefore Options Premiums vs. Implied Volatility graphs are currently not displayed for these ETFs and are expected to be added once more option premium data is received.

KEEP UP WITH THE LATEST RESEARCH FROM GLOBAL X

To learn more about our covered call options, read the latest research from Global X, including:

- Introducing the Global X Sector Covered Call & Growth ETFs (TYLG, FYLG, HYLG)

- Covered Call Strategies, Explained

- RYLD: A Covered Call Strategy for Rising Rates

Image sourced from Shutterstock

This post contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.