For the better part of August, the U.S. cannabis journey remained the same: anemic volume ($15-$20M notional per session) and sentiment, for those who still cared or were still interested at all in U.S cannabis, was on life support.

The week before last, not one but two U.S cannabis-focused funds unwound positions, adding additional pressure as the buyers continued to strike.

All-time lows registered several times as technical levels breached and the ever-present shorts pressed against the latest break at MSOS MSOS $5.

After another long and frustrating summer, most market market participants took the last week of August off to relax and reboot before September.

While some still clung to hope that SAFE would perhaps see progress when congress returned from break, most adopted a wait-and-see attitude after so many false starts and empty promises.

- Click here to get Cannabis Confidential delivered to your inbox daily.

By the time Wednesday, August 30th arrived, there was a dead calm in the markets for most of the session. It had been 931 long days since the sector top; even the most fervent bulls, bloodied and beaten as they were, never saw it coming.

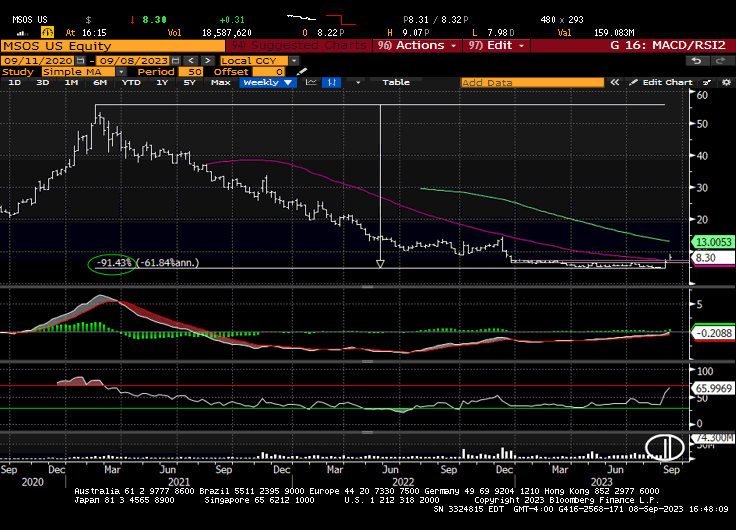

After all, the MSOS U.S. cannabis ETF (which isn’t the U.S cannabis sector but rather a reflection thereof, had lost 91% the prior 2 1/2 years in almost a straight line.

If we can’t count on D.C to come through when they should, why would we expect anything different while they’re on their scheduled recess?

And then it happened:

- BN 12:11 *HHS RECOMMENDS MOVING MARIJUANA TO SCHEDULE III DESIGNATION

- BN 12:11 *HHS MAKES RECOMMENDATION IN LETTER TO DEA

- BN 12:11*HHS CALLS FOR MOVING MARIJUANA TO LOWER-RISK US DRUG CATEGORY

- BN 13:40 *DEA CONFIRMS IT WILL REVIEW CLASSIFICATION OF MARIJUANA

The takeaway for investors is this: if and once the DOJ ratifies this decision, section 280E of the IRS tax code would be removed, U.S plant-touching companies would be allowed to deduct normal operating expenses and as such, they would no longer be subject to a 70%+ effective tax rate.

This comes, naturally, after these companies have optimized the sprinkles out of their operations and are as lean and mean as they could possibly be. Some of them are even making money despite all these fucked-up regulations and tax codes, which tells us a lot about what stellar operators they are.

We shared several notes on what exactly this will mean and encourage all cannabis investors to take a few minutes because August 30th is the day our world changed.

The Feds Move on Cannabis (Aug 30, 2023)

It is estimated that leading U.S plant-touching cannabis companies (Tier1 MSOs) pay $40-$50M per quarter in 280E tax so yeah, today was a massive development.

According to Vangst and their most recent jobs report, cannabis moving from Schedule I to III would immediately create over 100,000 new jobs in the industry.

we’ve been looking for a Schedule III/ Garland Memo/SAFE Banking tri-fecta this fall + heard the HHS recco + Garland Memo would be released around the same time. Memo’s aren’t laws we know, but DOJ clarification certainly wouldn’t hurt, especially if there is specific language aimed at the banks.

The Morning After (Aug 31, 2023)

I was on the phone with Jonathan Sandelman, the Chairman of AYR Wellness AYRWF, talking about how this journey has been longer than any of us thought it would be, as well as the specter of federal reform.

Our discussion eventually turned to the recent chatter that the HHS was going to recommend moving cannabis to a schedule III.

“When we get that red headline,” I said, repeating a statement that has cost me a lot more money than it’s made, “If you’re not already on the cap table, have fun chasing.”

[note: as I was tell him that, the headlines leaked across Bloomberg in all-caps.]

If it was leaked, it would be the most bullish set-up possible given the holiday-thinned ranks into the last few days of August. There was zero warning for the abundance of bears caught short, pressing the most recent technical failure. No head’s up for any interested longs, most of whom were in wait-and-see mode heading into September.

“We believe that rescheduling to Schedule III will mark the most significant federal cannabis reform in modern history," said Ed Conklin of the U.S. Cannabis Council.

“This is the best-case scenario for advancing U.S. cannabis reform for the U.S. MSOs,” said Andrew Semple at Echelon. “Current price targets don’t assume any federal cannabis reform and there’s ample room for further price appreciation.”

The Year-End Cannabis Wish List (September 4, 2023)

The back-of-the-envelope analyst math suggests a 2-3X turn for U.S cannabis plant-touching securities and that’s before any short squeezes or animal spirits, the latter of which have been scattered on dawn's highway bleeding, ghosts crowding their young fragile eggshell minds.

Word on the street for the last two years was that a cabal of Canadian hedge funds had been algorithmically pressing these stocks lower as banks and custodians systematically restricted investors from accessing any U.S. cannabis plant-touching securities.

The only thing better than a one-off positive would be a steady drumbeat of good news and evolving conditions, which could look like this:

- HHS recommends cannabis move to a Schedule III (8/30/23);

- SAFE Banking moves through Senate Finance Committee (September);

- SAFE Banking moves through the full Senate (October);

- Garland Memo. (Sept/ Oct);

- PREPARE Act in Senate (regulatory framework);

- DEA response to HHS; SAFE through U.S House of Reps;

- Amplification via MSM/ WSB;

- Uplisting to NYSE/NASDAQ;

- CPG M&A;

- Ohio/Florida/Pennsylvania—'24 electoral swing states—all flip green.

Adult-Swim (September 5, 2023)

Short interest continues to rise, indicating both skepticism and future demand.

Lower tier MSOs have the most beta because they were left for dead; Tier 1 MSOs will be the first to attract institutional capital and CPG interest first.

Our year-end wish list yesterday had a glaring omission, one that was immediately amplified when Green Thumb announced a share repurchase program out of this morning’s gate.

While short-term overbought conditions are starting to scream for attention and we get that past performance isn’t a precursor to future price action, we would be wise to remember where we came from while observing the technical proxies, such as 200-day moving averages.

Bank Shot (September 6, 2023)

Senate Banking Committee Chairman Sherrod Brown (D-OH) told Punchbowl News that the SAFE Banking Act is one of the top bills on his fall legislative agenda.

“We want to get RECOUP. We want to get SAFE Banking. We already have the FEND Off Fentanyl Act in the NDAA. All three of those are my priorities.” Sen. Sherrod Brown (D-OH)

“In the remaining months of this year, we also have an opportunity to advance legislation on a number of critical issues.” He listed ten specific priorities, including “safeguarding cannabis banking.” Senate Majority Leader Chuck Schumer (D-NY)

Cannabis Benchmarks: “280E tax relief would be a game-changer for cannabis businesses,” and “a senior DEA official noted he’s not aware of a single instance in the agency’s history the DEA deviated from a scheduling recommendation from HHS.”

In terms of flow, we’re told there’s been minimal to no institutional buying, which makes sense given, ex-TerrAscend, none of these stocks can be held at Wall Street banks (and presumably won’t be able to until SAFE Banking is passed). We’re also told legacy funds and momo guys aren’t chasing after being burned so many times.

If you’re trying to better understand the machination currently in play and why the price action has the potential to get super-spicy, I dusted off this column from May, 2022 that lays out structural stuff presently in play.

PoliticoPro: SAFE Banking is ‘Imminent’ (September 6, 2023)

We think there is an agreement imminent that they’ll be general agreement on,” the Ohio Democrat told reporters Wednesday. “We know that some members of the committee are going to vote no regardless, but we think there’ll be something good that gets a good majority.

Seismic Shifts (September 7, 2023)

Bipartisan talks over a marijuana banking bill were “very productive” over the August recess, the office of the lead GOP Senate sponsor told Marijuana Moment, and a key Democratic chairman said an agreement on advancing the legislation is “imminent.”

Senate Banking Chair Sherrod Brown (D-OH) confirmed that lawmakers are closing in on a bipartisan agreement to move ahead with the legislation (PoliticoPro), which follows similar assurances from Senate Majority Leader Chuck Schumer last week.

Maryland canna retailers sold a record $92M of product during their second month of adult-use—that’s $2.8M per day—while Massachusetts hit the $5B milestone in canna sales after The Bay State generated consecutive record breaking months.

Medical cannabis patients saw an improved quality of life and lower pain, anxiety and depression after three months of use, a study shows and I can confirm, and that’s all before (potential) rescheduling allows for research that will help to demonstrate the efficacious agility of this magical plant.

The news cycle of this past week hasn’t been lost on the forgotten tribe of canna bulls as the upside price action and massive volume awoke long-dormant animal spirits.

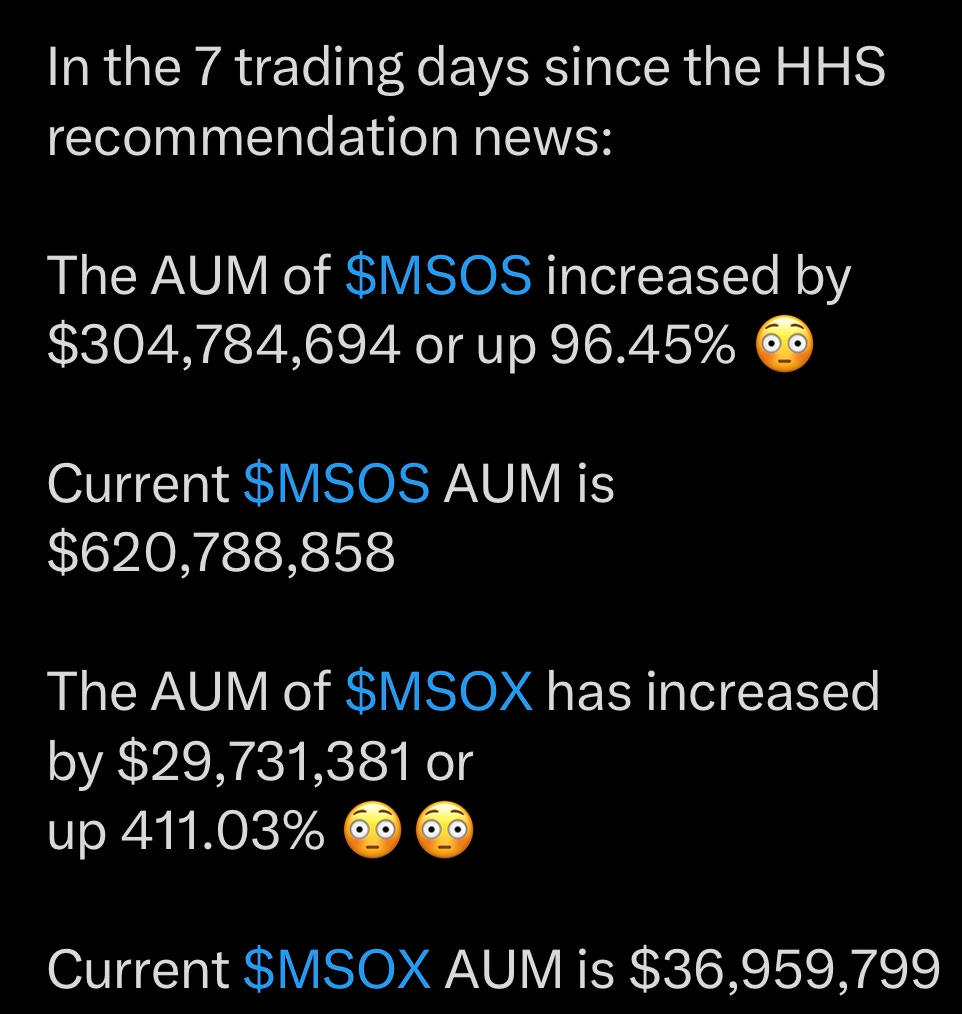

Total notional volume for the entire U.S plant-touching publicly traded universe was $18M last Monday. The last four sessions averaged more than $275M.

We used to contemplate what might happen if SAFE passed/ 280E went away/ stocks could list on major exchanges/ CPG M&A was back on the table/ institutions ungated/ MSOS trended on WSB/ there was insider buying and stock buybacks—but I’m not sure that anybody contemplated these catalysts potentially happening all at once.

The timing of last week’s leak into the barren wasteland of summer’s end + the (listed and naked) short base + potentially seismic catalysts + napkin math suggesting a 2-3X fundamental turn sans 280E = perhaps the single best set-up I’ve seen in my 34 years on Wall Street.

And some would say the real buyers haven’t even entered the room yet.

Channel checks suggest there’s been minimal to no institutional buying, which makes sense given, ex-TerrAscend, none of these stocks can be held at Wall Street banks (and presumably won’t be able to until SAFE Banking is passed).

We’re also told that legacy funds and momo guys aren’t chasing after being burned so many times before.

Meanwhile short interest on U.S. cannabis ETF MSOS increased 4% coming into today.

We continue to hear that a cabal of evil Canadian hedge funds have been pressing and defending their short bets after getting trapped by the late-August announcement.

[we obviously can’t confirm whether that’s true but worth noting MSOS traded ~$15 in December on speculation that only SAFE would pass before the wish-list was in play]

[note/caveat: I’ve been bullish on U.S cannabis for well over a decade]

[note/caveat: this isn’t a call for the day/ week/ at all and is catalyst-dependent]

MSOS $8.80, which was the December low, has managed to halt the advances the last two sessions, largely bc these names are so short-term extended and they’re up against other technical lines across various horizons.

Grassy Knoll

Anyone who’s followed this space for any meaningful amount of time would offer that there’s been an almost unnatural predilection to close/ print/ press these stocks lower day-after-day-after-day… (repeat 931 times).

We dove into the machination here; some stellar takeaway quotes:

"never seen anything like it,”

"being pressed to dangerous levels”

“only so far they can go before it blows up in their face”

A year and a half later, here we are; and while we genuinely don’t know who’s short what where, word on the street is that there’s been a funky flow of funds involving Canadian hedge funds routing naked short orders through European bourses, which evidently have loopholes that allow for such things.

It is difficult to know if that motherfucker is real but if so, one would expect sunlight to disinfect these names over time.

Walking on the Moon (September 8, 2023)

The first week of September is in the books and if it’s any indication of how the rest of this year might unfold for the until-recently-beleaguered U.S. cannabis complex, we best hold on to our hats.

Suffice to say reports of the U.S. canna sector’s demise have been greatly exaggerated.

That’s not to say the industry wasn’t in trouble—it was, and will continue to be until these onerous conditions subside—but amazing things are possible when you’re not paying an effective tax rate of 70+% (what was/is as a Schedule I narcotic under 280E).

That inflection warrants a 2-3x turn on math alone—if and when it is codified by the DOJ—but as you know, if you’ve been reading this space of late, it’s the structural set-up, short-base and animal spirits that are spicing up the September price action.

IDK if we get our full-on wish list—there’s a healthy debate/ skepticism surrounding everything from The Single Convention on Narcotic Drugs to the appetite/ ability to pass SAFE through the House to underlying fundamentals themselves—so, we’ll see.

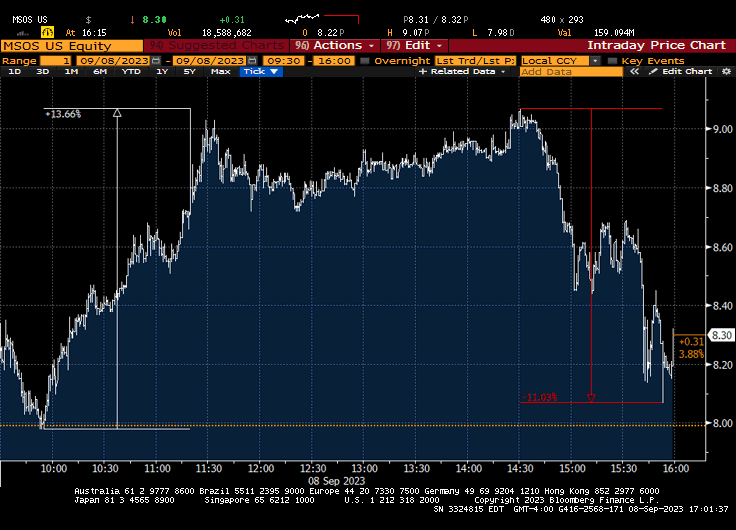

MSOS $8.80 remains a Battlestar Galactica level for the U.S cannabis ETF. After buy-stops were triggered on the upside breach this morning around 11AM, the bulls and bears battled until death—or at least the close—in a session that featured not one but two 10%+ swings. Zooming all the way in to the daily, for those with a steel stomach:

[don’t feel too bad for the index; it sported a 22% gain over the four-session week and is +72% vs. last Monday]

This tape still trades super-trappy, as in, IMO, shorts are trapped.

MSOS short interest continued to climb on Thursday in a telling sign Pavlov’s bears won’t go quietly into the night. Who can blame them? They’ve made so much money so consistently for so long, a green tape must feel funnier than that rope in gym class.

- 8/23: 10.77M (total outstanding shares: 72.1M)

- 9/1: 11.46M (+6.4%)

- 9/5: 11.01M (-4%)

- 9/6: 11.62M (+6%)

- 9/7: 11.87M (+2%), or 16% of the float.

Will again say, that’s just the stuff we can see; the stuff we can’t see, the naked stuff, is the question that everyone is asking but nobody seems to know.

We can confirm that Canadian bankers have been frantically calling on U.S cannabis companies raise capital into this rally.

The cynic in me senses Canadian hedge funds want/need to cover their short positions into those raises, which is full circle vs. their ‘press-our-shorts-until-they-break-and-then-cover-them-on-a-cap-raise-in-a-down-tape' strategy that has printed money, literally for years.

So it’s clear, we believe that companies will and should raise capital as needed; there’s no sense in grinding through hell if you can’t eat on the other side. But the timing—days, weeks, months—and the source will most certainly matter.

We’ve been thinking through the virtues of backend beta as we watch lower-tiered MSOs, which were left for dead—AYR traded slightly higher than their cash balance early last week—and weigh ‘em against the mighty tier ones, which’ll be first up when institutions and CPG come knocking.

We understand that much of the recent price action is due to short-covering but in 34 years watching markets, I can also share that short-covering often dominates the first phase of a bull market, which is precisely where I believe we are for this space]

MSOS weekly chart

While the rising tide will lift even the broken boats for a while, we’re gonna stick to the knitting we know in terms of core holdings, at least for the foreseeable future.

You can learn a lot just by watching who did what when the going got—and stayed—tough for a lot longer than any of us thought it would or possibly could.

Yes, I’m talking about corporate execution/ optimization—pulling the right levers and making difficult decisions to navigate an organization through a genuine depression—but I’m also referring to the people, which is important if you believe, as I do, that the jockeys are more important than the horses when it comes to investing.

I’m talking about the Z’s/ JW’s at TerrAscend TSNDF, or George/Darren/Aaron at Verano VRNOF; Kyle and Graham at Glass House GLASF, AT & crew at 4Front FFNTF, JS/DG/RV at AYR, BM/SA at C21 CXXIF… yes, there are more and sure, some are clients but that’s not even the point.

People are people and a lot of people have invested time, money and yes reputation on this space and when it all went to hell in a bucket—not once, but twice over a five-year period—it required, and continues to require, a true grit + genuine passion to succeed.

We remain conscious that any road to redemption will be littered with alotta false hope and empty promises, and we expect to see scary headlines, more bear raids, and numerous air pockets as we find our way to better days and easier trades.

But after the last several years and all that fuckery, I don’t know of an industry that is better prepared or more deserving of success than U.S cannabis.

Bonus courtesy, the first from must-follow Jane of the Jungle.

…and the second from a robot:

We’re sharing this content with best intents + an educational lens. If you would like to join our Cannabis Confidential community and receive this newsletter on a regular basis, please sign up here. Top-line news updates are free + analysis below the fold.

Thank you, enjoy the NFL opening day and o Raiders.

- Click here to get Cannabis Confidential delivered to your inbox daily.

/end

The Benzinga Cannabis Capital Conference, the place where deals get done, is returning to Chicago this Sept 27-28 for its 17th edition. Get your tickets today before prices increase and secure a spot at the epicenter of cannabis investment and branding.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.