Over the past decade, Bitcoin has shone as a leading asset. However, its fluctuating prices highlight the crypto market's early-stage nature, similar in size to tech giants like Apple. As traders pursue profits beyond just trading Bitcoin, it has spurred speculative projects, often with lofty goals but lacking real-world utility.

The cryptocurrency landscape, characterized by its intense volatility, witnessed Bitcoin's value peak at over $60,000 in late 2021 before plummeting, wiping out over $2 trillion in value across the entire market.

Adding to the instability is the significant leverage in the crypto market, fueled by both centralized lending and decentralized finance on the blockchain. Platforms like Rollbit now allow users to leverage up to 1000x on BTC and ETH, amplifying risks to unprecedented levels.

Seasonal Tokens address the issue of volatility and speculation by using a token system inspired by price seasonality, a concept common in industries like agriculture, ensuring trading stability and sustainability.

The Genesis Of Seasonal Tokens

Seasonal Tokens offer a more stable and ethical approach to wealth accumulation in cryptocurrencies, anchored in the principle of price seasonality. This concept can be understood through a simple analogy.

Think of a strawberry or watermelon farm. Throughout the year, crop prices shift predictably due to factors like demand, harvest timings and production quantities. Abundant harvests lead to price drops, while scarcity during off-seasons causes prices to rise.

Such seasonality benefits many stakeholders. Predictable supply and demand changes lead to expected price changes, allowing traders to make informed buying or selling decisions. This regularity promotes a transparent, fair and efficient market, reducing speculation and valuing knowledge over chance.

Unpacking Seasonal Tokens

Seasonal Tokens blend the predictability of seasonality, common in sectors like agriculture and retail, with a decentralized structure. This system includes four tokens – Spring, Summer, Autumn and Winter – each symbolizing a distinct stage in the crypto market cycle.

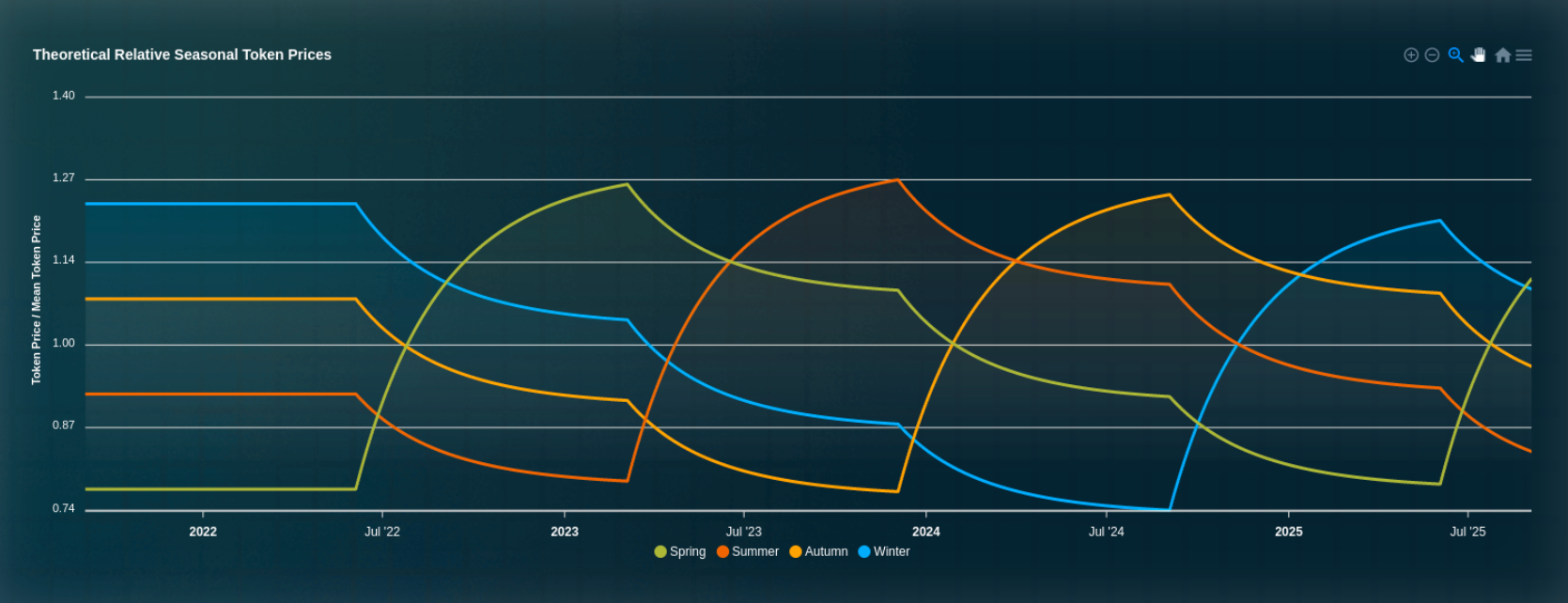

Every nine months, a Seasonal Token experiences a planned decrease in production, reflecting nature's seasonal shifts. This causes regular supply and demand variations, influencing token prices. Theoretically, each token progresses from being the least to the most valuable, as illustrated below:

Source - Seasonal Tokens

Leveraging blockchain and smart contracts, Seasonal Tokens offer consistent transparency, fair operations and decentralized oversight – effectively avoiding issues tied to human error.

Seasonal Tokens: The Next Trading Revolution?

Seasonal Tokens are a novel trading instrument with an internal market, designed to simplify and predict the princess of generating alpha through cyclical trading. The key to wealth accumulation with these tokens lies in timely trades responding to changing supply dynamics.

During halving events, a Seasonal Token's scarcity affects its price. For instance, at Spring halving, 3 Spring tokens could trade for 5 Summer ones. After Summer halving, 5 Summer tokens might yield 7 Spring. This lets traders not only capitalize on price growth but also compound assets through token exchanges.

Positive Sum Environment: Sustainable Returns

The ascent of cryptocurrencies has brought both profits and pitfalls. The industry's design often shifts wealth from the less informed to the savvy, operating on a zero-sum principle. Seasonal tokens counter this by promoting a positive-sum approach. While fixed supplies can limit gains, increasing supplies offer broader profit potential, though trading risks remain.

Unlike cryptocurrencies such as Bitcoin or Litecoin that have a single asset, Seasonal tokens are structured to grow through cyclical trading. Each token follows a pattern, transitioning from being the least to the most valuable. This design allows traders to capitalize on supply changes and trade between tokens without causing losses for others. Essentially, trades are driven by the relative worth of tokens, not just their monetary value.

Stabilizing Miner Returns: Boosted Profits

While media attention gravitates towards traders' losses, miners in PoW systems like Bitcoin and Litecoin often bear the brunt of volatility, especially during halving events. This is because their cryptocurrency earnings (rewarded in the native asset) are vital to offset mining expenses.

Unlike single-asset PoW cryptos like Bitcoin, the Seasonal Token system features four unique tokens. This flexibility lets miners alternate between tokens, maintaining profitability even when token issuance reductions impact short-term gains.

Smart Diversification: Minimizing Risks

Lastly, the distinct seasonal cycles of Seasonal Tokens provide an alternative to conventional crypto investments tied to a specific business or team's performance. Seasonal Tokens offer returns anchored to events like the nine-month halving intervals, aiding in portfolio diversification.

The Next Chapter In Cryptocurrency Trading: Embracing Seasonal Tokens

Overall, Seasonal Tokens are a new approach to crypto investment that can help investors generate stable, sustainable and ethical returns without causing harm to others.

To get started, simply exchange your USDT on a cryptocurrency exchange like Coinstore.com or CoinsBit.io, or through a software wallet like MetaMask.

Featured photo by Scott Graham on Unsplash.

This post contains sponsored content. This content is for informational purposes only and is not intended to be investing advice.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.