High-rolling investors have positioned themselves bullish on VMware VMW, and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in VMW often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 21 options trades for VMware. This is not a typical pattern.

The sentiment among these major traders is split, with 95% bullish and 4% bearish. Among all the options we identified, there was one put, amounting to $26,400, and 20 calls, totaling $903,805.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $100.0 to $145.0 for VMware during the past quarter.

Volume & Open Interest Trends

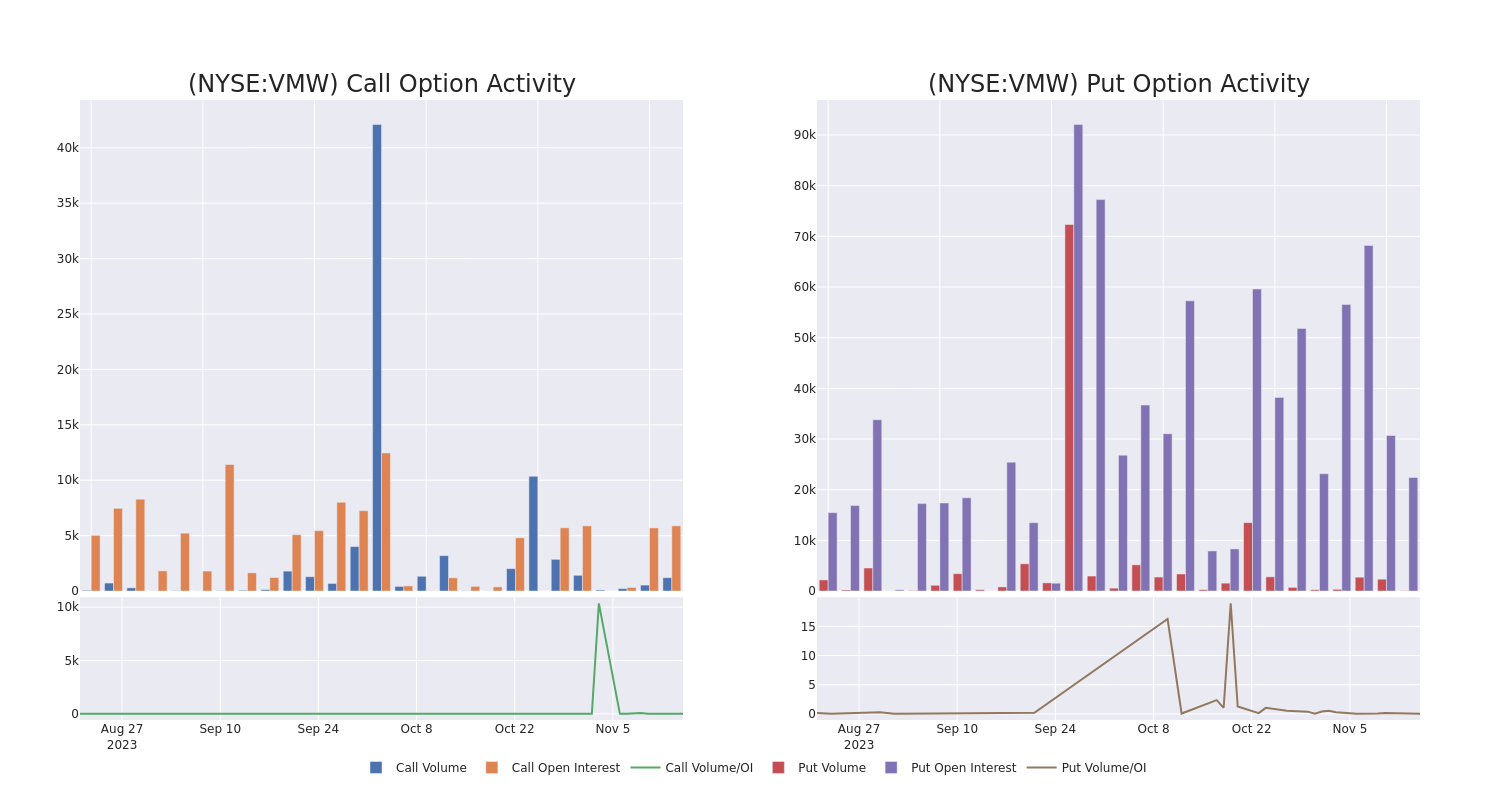

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for VMware's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of VMware's whale trades within a strike price range from $100.0 to $145.0 in the last 30 days.

VMware Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| VMW | CALL | TRADE | BULLISH | 11/17/23 | $100.00 | $53.0K | 1 | 139 |

| VMW | CALL | TRADE | BULLISH | 11/17/23 | $100.00 | $50.5K | 1 | 130 |

| VMW | CALL | TRADE | BULLISH | 11/17/23 | $100.00 | $50.5K | 1 | 110 |

| VMW | CALL | TRADE | BULLISH | 01/19/24 | $100.00 | $50.2K | 217 | 59 |

| VMW | CALL | TRADE | BULLISH | 01/19/24 | $100.00 | $50.2K | 217 | 59 |

About VMware

VMware is an industry titan in virtualizing IT infrastructure and became a stand-alone entity after spinning off from Dell Technologies in November 2021. The software provider operates in three segments: licenses; subscriptions and software as a service; and services. VMware's solutions are used across IT infrastructure, application development, and cybersecurity teams, and the company takes a neutral approach to being the cohesion between cloud environments. The Palo Alto, California, firm operates and sells on a global scale, with about half its revenue from the United States, through direct sales, distributors, and partnerships.

Having examined the options trading patterns of VMware, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of VMware

- Trading volume stands at 162,325, with VMW's price down by 0.0%, positioned at $148.6.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 13 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for VMware with Benzinga Pro for real-time alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.