Zinger Key Points

- Milei's election win sparks a significant rally in Argentine ADRs; ARGT ETF surges 13% in premarket trading.

- Milei advocates for major economic reforms, including YPF privatization and stringent fiscal policies.

- Get two weeks of free access to pro-level trading tools, including news alerts, scanners, and real-time market insights.

Javier Milei‘s victory in Argentina’s presidential election sparked a rally in Argentine ADRs trading on major U.S. stock exchanges.

Far-right Milei won by a significant margin of over 11% against center-left candidate and current Finance Minister Sergio Massa, heralding a major shift in Argentina’s political landscape.

Milei is set to succeed President Alberto Fernandez, known for his leftist leanings and alliance with Christina Kirchner.

Markets Welcome Milei’s Victory

Investor optimism about Milei’s potential impact on the Argentine economy was exceptionally strong in the premarket trading on Monday.

The Global X MSCI Argentina ETF ARGT, the sole ETF available to U.S.-based investors focusing on Argentine equities, witnessed a 13% rise, marking its most robust performance since its inception in 2012.

The energy sector, particularly YPF Sociedad Anonima YPF, is among the top gainers. YPF’s shares soared by 24% in the premarket, a record not seen since March 2009. In the financial sector, major players Banco Macro S.A. BMA and Grupo Financiero Galicia S.A. GGAL each recorded a 16% increase.

Milei’s first remarks as president-elect, emphasizing Argentina’s critical situation and the need for reconstruction, have further fueled investor interest.

Argentina’s struggle with hyperinflation, marked by a monthly inflation rate of 8.3% and an annual rate of 142% as of October 2023, underscores the urgency of economic reforms.

During his political campaign, Milei has been a vocal proponent of drastic measures such as the closure of the central bank, dollarization of the economy, reducing public spending, and eliminating stringent trade and capital controls. These proposals, while ambitious, signal a potential overhaul of Argentina’s economic policy.

Milei has expressed his intention to privatize YPF along with other publicly-held companies, including the national television network. Additionally, the President-elect plans to visit the United States and Israel before taking office in December.

In August, Argentina received a disbursement of approximately US$7.5 billion from the International Monetary Fund (IMF). This infusion increased the total amount disbursed under the existing Extended Fund Facility (EFF) to around US$36 billion. The IMF has scheduled a review of this program for November 2023.

Goldman Sachs Flags Stability Risks

Milei’s victory might be a double-edge sword for the exchange rate.

The Argentine peso experienced significant depreciation on Sunday, dropping by up to 10% against the dollar Tether USDT/USD on the Binance cryptocurrency exchange. However, it later recouped some of these losses, rallying by as much as 5% on Monday, following a rally in Argentine ADRs.

The Argentine peso’s wild fluctuation highlights extreme uncertainties over exchange rate policies.

Goldman Sachs’ economist Sergio Arnella cautions about the implementation risks associated with Milei’s proposals, particularly the challenges of dollarization and the need for comprehensive fiscal and structural reforms.

“There is no free lunch and adopting, preserving, and benefiting from dollarization could be challenging,” Arnella said in a note.

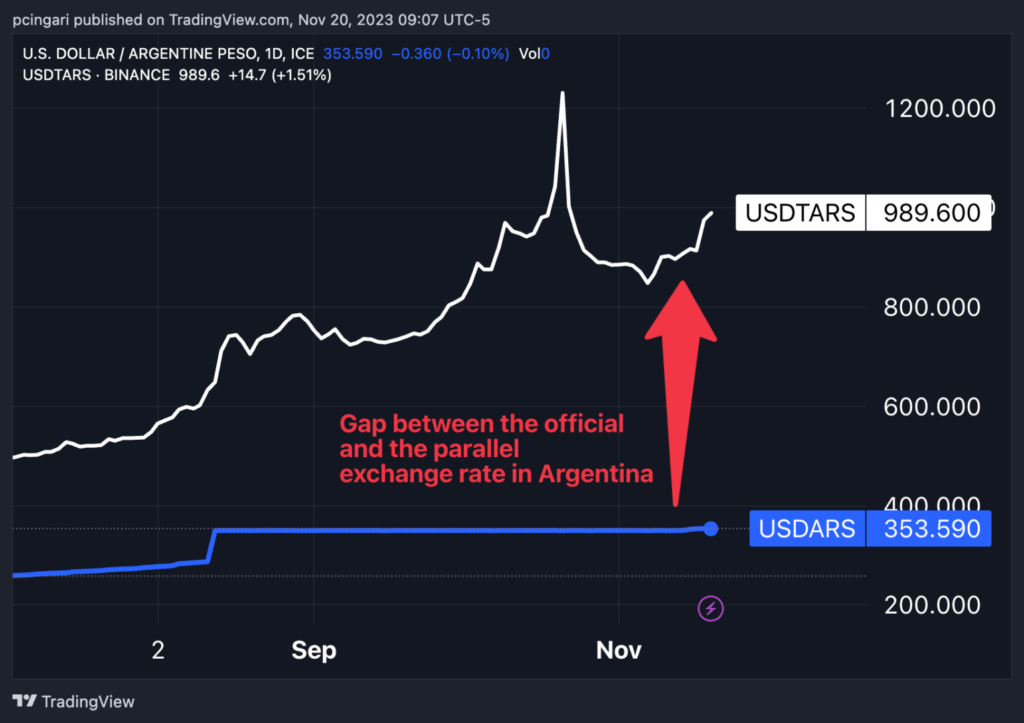

The disparity between the parallel and official exchange rates for the peso, and the potential financial stability risks from continued devaluation, are areas of concern, according to Arnella.

The misalignment in Argentina’s currency market is highlighted by the fact that while 990 pesos are necessary to acquire a Tether dollar at the parallel exchange rate, the official exchange rate only requires 353 pesos for one U.S. dollar.

Chart: Official Exchange Rate Vs. Parallel Exchange Rate In Argentina

Goldman Sachs believes that for Argentina’s economy to embark on a sustainable path, it requires concrete and structural fiscal adjustments, the establishment of an autonomous central bank not influenced by fiscal policies, the liberalization of financial systems, and significant structural reforms.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.