By the close of today, November 21, 2023, Civista Bancshares CIVB will issue a dividend payout of $0.16 per share, resulting in an annualized dividend yield of 4.25%. This payout is exclusively for shareholders who held the stock before the ex-dividend date on November 06, 2023.

Civista Bancshares Recent Dividend Payouts

| Ex-Date | Payments per year | Dividend | Yield | Announced | Record | Payable |

|---|---|---|---|---|---|---|

| 2023-11-06 | 4 | $0.16 | 4.25% | 2023-10-26 | 2023-11-07 | 2023-11-21 |

| 2023-08-07 | 4 | $0.16 | 3.25% | 2023-07-27 | 2023-08-08 | 2023-08-22 |

| 2023-05-08 | 4 | $0.15 | 4.05% | 2023-04-28 | 2023-05-09 | 2023-05-24 |

| 2023-02-13 | 4 | $0.14 | 2.51% | 2023-02-03 | 2023-02-14 | 2023-03-01 |

| 2022-11-07 | 4 | $0.14 | 2.48% | 2022-10-28 | 2022-11-08 | 2022-11-22 |

| 2022-08-08 | 4 | $0.14 | 2.53% | 2022-07-29 | 2022-08-09 | 2022-08-23 |

| 2022-05-09 | 4 | $0.14 | 2.55% | 2022-04-29 | 2022-05-10 | 2022-05-25 |

| 2022-02-14 | 4 | $0.14 | 2.35% | 2022-02-04 | 2022-02-15 | 2022-03-01 |

| 2021-10-18 | 4 | $0.14 | 2.24% | 2021-10-08 | 2021-10-19 | 2021-11-01 |

| 2021-07-19 | 4 | $0.14 | 2.6% | 2021-07-09 | 2021-07-20 | 2021-08-02 |

| 2021-04-19 | 4 | $0.12 | 2.06% | 2021-04-09 | 2021-04-20 | 2021-05-01 |

| 2021-01-15 | 4 | $0.12 | 2.55% | 2021-01-08 | 2021-01-19 | 2021-02-01 |

When comparing Civista Bancshares's dividend yield against its industry peers, the company sits comfortably in the middle, with its peer First of Long Island FLIC having the highest annualized dividend yield at 7.19%.

Analyzing Civista Bancshares Financial Health

Companies that pay out steady cash dividends are attractive to income-seeking investors, and companies that are financially healthy tend to maintain their dividend payout schedule. For this reason, investors can find it insightful to see if a company has been increasing or decreasing their dividend payout schedule and if their earnings are growing.

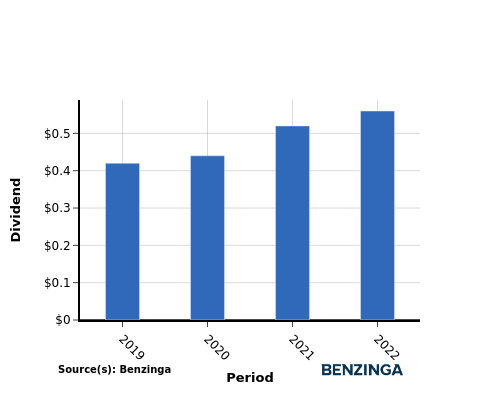

YoY Growth in Dividend Per Share

From 2019 to 2022, the company's dividend per share showed a positive trend, increasing steadily from $0.42 in 2019 to $0.56 in 2022. This demonstrates the company's commitment to rewarding shareholders by consistently raising dividends.

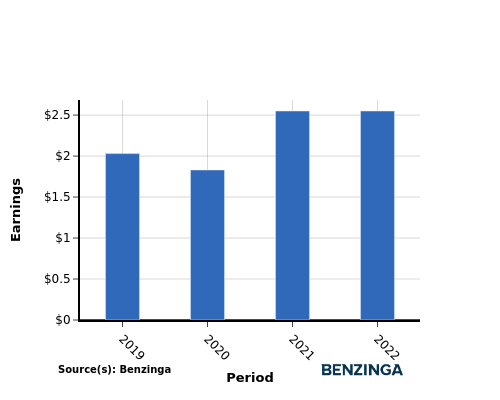

YoY Earnings Growth For Civista Bancshares

From 2019 to 2022, Civista Bancshares has demonstrated an upward trend in earnings, with earnings per share rising from $2.03 to $2.55. This positive earnings growth bodes well for investors looking to generate income through cash dividend payouts.

Recap

In this article, we explore the recent dividend payout of Civista Bancshares and its significance for shareholders. The company has decided to distribute a dividend of $0.16 per share today, which equates to an annualized dividend yield of 4.25%.

When comparing Civista Bancshares's dividend yield against its industry peers, the company sits comfortably in the middle, with its peer First of Long Island having the highest annualized dividend yield at 7.19%.

The increase in both dividend per share and earnings per share from 2019 to 2022 for Civista Bancshares indicates a positive financial trend, suggesting their capacity to continue distributing profits to shareholders.

To remain updated on any changes in financials or dividend disbursements, investors should closely observe the company's performance in the coming quarters.

\To stay up-to-date with the companies that are announcing their dividends, click here to visit our Dividends Calendar.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.