Zinger Key Points

- Palantir's stock has soared 188% this year on robust growth and the promise of AI, but an Army contract could cast a shadow.

- The potential fallout from the U.S. Army's inclination toward open-source vendors could be the stumbling block in Palantir's way.

- Get access to your new suite of high-powered trading tools, including real-time stock ratings, insider trades, and government trading signals.

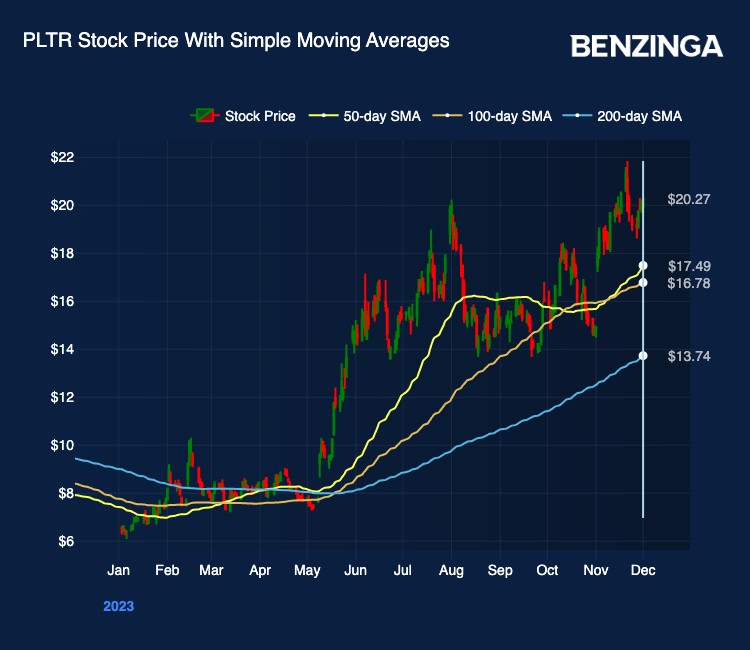

Palantir Technologies Inc PLTR stock has been on a tear this year. The stock is up 188% year-to-date. Moreover, the technical chart for the stock appears bullish with a Golden Cross created in mid-November.

However, a recent development could pause the rally in PLTR stock.

Palantir Stock’s Technical & Fundamental Strength

The chart above indicates a bullish tone set in for PLTR stock. The 50-day SMA recently crossed above the 100-day SMA, indicating good times ahead.

On the fundamental front as well, Palantir’s business shows strength. The company has experienced significant financial growth over the past six years, with an average revenue growth rate of 42.81%, operational profitability, margin expansion, strong balance sheet, positive cash flows and 21.9% free cash flow margin.

Robust growth in government contracts coupled by the optimism surrounding AI, have been fueling Palantir’s stock rally.

Also Read: Spotify Stock Up 10% On Layoff News, Golden Cross Indicates Rally Could Extend Further

An Issue That May Pause The Rally

However, last week, U.S. Army officials raised concerns about Palantir’s four-year $458 million contract with the Army Data Platform, according to William Blair analysts. Comments made in an Army presentation suggested there may be potential disagreements over data ownership. The contract is due to expire in a few weeks.

The U.S. Army is a significant client for Palantir. The U.S. government alone accounted for over 40% of Palantir’s aggregate revenue in Q3 2023. At $229 million, it was up 10% from Q3 2022.

According to some reports, there is a possibility that the U.S. Army is considering a move away from proprietary data solutions. This potential shift towards open-source vendors might indicate a reduced reliance on Palantir's services. Such a change, if it occurs, could potentially impact Palantir's revenue, particularly with an upcoming contract renewal on the horizon.

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.