Zinger Key Points

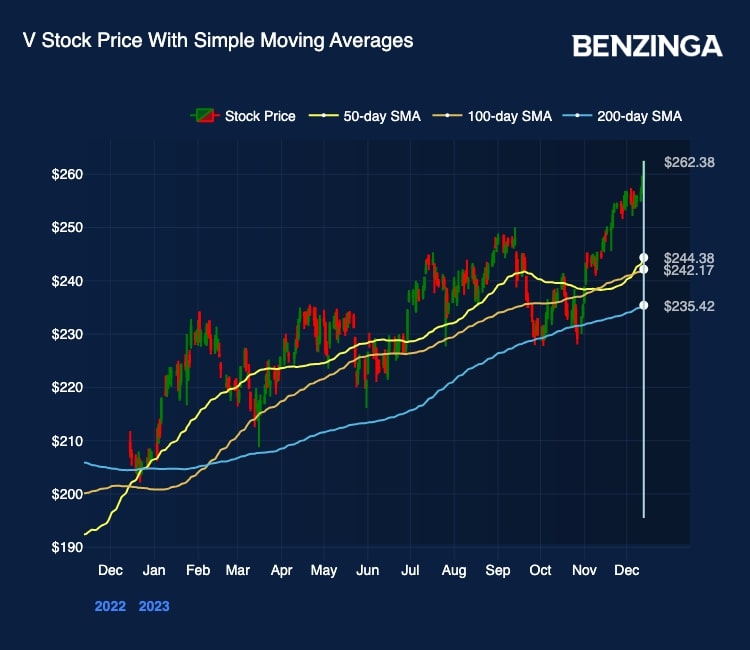

- Visa stock hit a new all-time high on Dec. 13 when it was trading at $262.48 per share.

- While many fundamental factors have been driving business performance, technicals indicate a continuing trend.

- Our government trade tracker caught Pelosi’s 169% AI winner. Discover how to track all 535 Congress member stock trades today.

Visa Inc V stock recorded an all-time-high (ATH) on Wednesday. The stock was seen trading at a high of $262.48 during intraday trading, marking a new high in the stock’s history.

The stock has returned 26.52% to investors so far this year. The surge has been propelled by a combination of strategic moves, financial prowess, and industry dynamics, solidifying Visa’s position as a key player in the market.

Factors Driving Visa Stock

Factors that have been driving performance for Visa so far this year include:

- Visa is one of the key beneficiaries of the switch from cash to electronic payments, globally.

- The business has demonstrated operating leverage and successful buyback initiatives, which have led to significant EPS growth.

- Visa’s scale and low net debt allow M&A to preserve its technological superiority, giving it an advantage versus Mastercard Inc. MA.

- Visa reported better-than-expected fiscal Q4 earnings, which indicated the business has resilient consumers.

Read: Visa, PaySafe Extend Relationship in Europe, Visa Network Tokens Add Level Of Payment Security

What Does The Chart Say?

Technical analysis suggests a potential upward trajectory for Visa’s stock. The recent formation of a golden cross, where the 50-day SMA has crossed above the 100-day SMA, hints at a possible bullish trend.

Recent analyst ratings rate Visa stock a Buy and Outperform, with their price targets in the range of $280 to $295.

Price Action: Visa stock was down 1.17% to $259.31 at the time of publication Thursday.

Read Next: Growth Stocks Outpace Value By 10% As 2023 Nears End: Will The Trend Continue?

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.