Zinger Key Points

- Disney's stock hasn't been able to move the needle in 2023, though Wall Street is optimistic about CEO Bob Iger's turnaround plan.

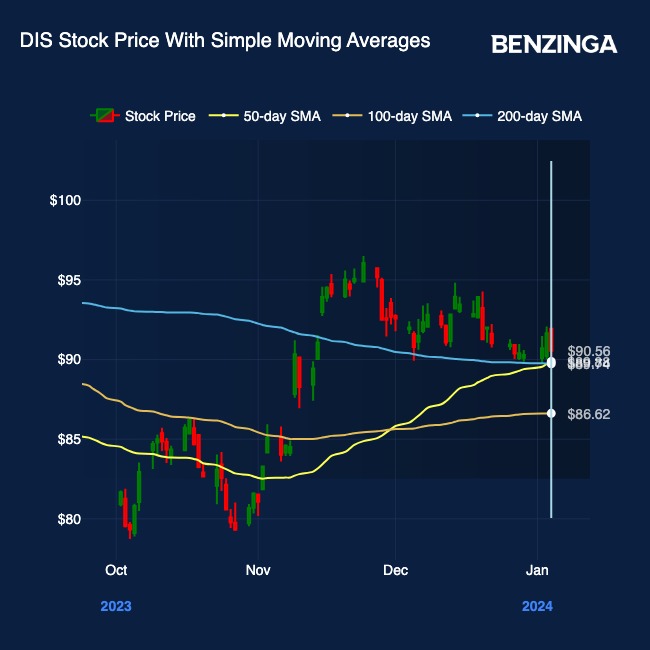

- The reinstatement of dividends after a 3-year hiatus and a Golden Cross appear to indicate recovery.

- Every week, our Whisper Index uncovers five overlooked stocks with big breakout potential. Get the latest picks today before they gain traction.

The Walt Disney Co DIS has not been able to move the needle much in 2023. The stock rose just 1.5% as compared to the 25% stride that the broad U.S. stock market took. The S&P 500-tracking SPDR S&P 500 ETF SPY, iShares Core S&P 500 ETF IVV and Vanguard S&P 500 ETF VOO, all ended 2023 up about 25%.

Executing On Bob Iger’s Turnaround Plan

However, as the company begins to implement CEO Bob Iger‘s ambitious strategic turnaround plan, Wall Street observers are eager to see if Disney can shift the tide in its favor in 2024.

A significant indicator of its recovery is the reinstatement of dividends after a three-year hiatus. It serves as a testament to the management’s confidence in generating robust cash flows.

While concerns linger about the reliance on legacy content for revenue, confidence is emerging. Disney’s strategic shifts towards bolstering the streaming business with renowned franchises like Marvel and Star Wars, is signalling a proactive approach to diversifying content.

Disney’s proactive measures are also extending beyond streaming. The company is investing towards enhancing its theme park experiences and acquiring full ownership of Hulu from Comcast.

Also Read: Reliance, Disney Engage Legal Teams & Begin Antitrust Due Diligence For Indian Media Merger: Report

Golden Cross Signals Investor Optimism

Disney’s stock just made a Golden Cross, which is a bullish indicator from a technical perspective. The 50-day SMA crossing over the 200-day SMA is often interpreted as a potential buy signal, suggesting that there might be an upward trend ahead.

Wall Street too appears bullish on the stock. On Dec. 22, 2023, analyst Barton Crockett of Rosenblatt Securities maintained a Buy on DIS stock with a price target of $112. The stock currently trades around $90, indicating upside potential.

Enticing Opportunity Or Risky Bet?

Investors eyeing Disney have an enticing opportunity, as the company navigates through challenges. Disney’s stock is currently trading at levels 23% below its 52-week-high. Driven by a clear vision and sound strategic repositioning, the company could be setting the stage for future growth and profitability.

Despite the hurdles in creativity and operational changes, there’s optimism about Disney’s path under Iger’s leadership. The company’s commitment to strategic acquisitions and a relentless focus on direct-to-consumer streaming services could potentially position Disney as a promising long-term investment prospect.

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.