In the preceding three months, 4 analysts have released ratings for Cummins CMI, presenting a wide array of perspectives from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 1 | 2 | 0 |

| Last 30D | 0 | 0 | 0 | 1 | 0 |

| 1M Ago | 0 | 1 | 0 | 1 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

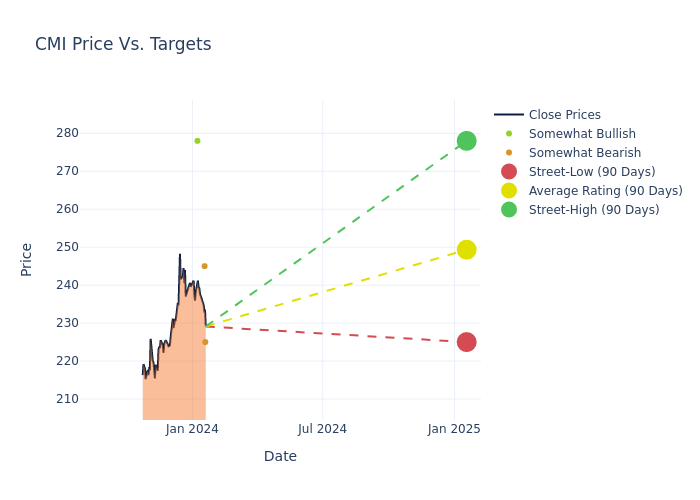

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $247.75, a high estimate of $278.00, and a low estimate of $225.00. This current average represents a 0.5% decrease from the previous average price target of $249.00.

Breaking Down Analyst Ratings: A Detailed Examination

A clear picture of Cummins's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ross Gilardi | B of A Securities | Lowers | Underperform | $225.00 | $243.00 |

| Tami Zakaria | JP Morgan | Lowers | Underweight | $245.00 | $255.00 |

| Angel Castillo | Morgan Stanley | Announces | Overweight | $278.00 | - |

| Ross Gilardi | B of A Securities | Announces | Neutral | $243.00 | - |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Cummins. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Cummins compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Cummins's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Cummins's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Cummins analyst ratings.

Delving into Cummins's Background

Cummins is the top manufacturer of diesel engines used in commercial trucks, off-highway equipment, and railroad locomotives, in addition to standby and prime power generators. The company also sells powertrain components, which include transmissions, turbochargers, aftertreatment systems, and fuel systems. Cummins is in the unique position of competing with its primary customers, heavy-duty truck manufacturers, who make and aggressively market their own engines. Despite robust competition across all its segments and increasing government regulation of carbon emissions, Cummins has maintained its leadership position in the industry.

Cummins's Economic Impact: An Analysis

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Cummins's remarkable performance in 3 months is evident. As of 30 September, 2023, the company achieved an impressive revenue growth rate of 14.97%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Cummins's net margin excels beyond industry benchmarks, reaching 7.78%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Cummins's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 6.25%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Cummins's ROA excels beyond industry benchmarks, reaching 2.06%. This signifies efficient management of assets and strong financial health.

Debt Management: Cummins's debt-to-equity ratio is below the industry average at 0.75, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Basics of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.