Zinger Key Points

- Walgreens' consideration of Shields Health's sale reflects its commitment to realignment amid financial challenges, market uncertainties.

- Walgreens has already halved its dividend and is revisiting plans to divest its international Boots chain.

Walgreens Boots Alliance Inc WBA is reportedly considering various options for its specialty pharmacy business, Shields Health Solutions.

The potential sale, estimated to exceed $4 billion, is part of Walgreens’ broader strategy to address its financial challenges.

The pharmacy giant has engaged advisers to assess interest in Shields Health, anticipating attention from private equity firms and healthcare companies, Bloomberg noted.

However, the decision is not final, and Walgreens may choose to retain business ownership.

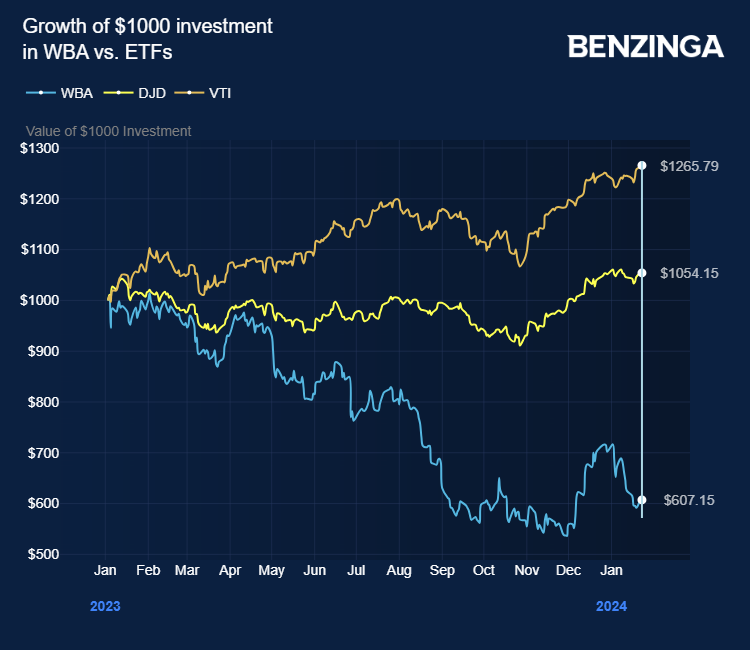

Walgreens’ recent struggles are reflected in its share performance, with a decline of over 38% in the past year.

Also Read: CVS Health Adapts to Market Shifts With Pharmacy Shutdowns Within Target Stores.

CEO Tim Wentworth, who assumed leadership in October, acknowledged the difficulties stemming from a “challenging consumer backdrop.” The company is actively exploring strategic options to reduce costs and boost cash flow.

As part of its cost-cutting measures, Walgreens has already halved its dividend and is revisiting plans to divest its international Boots chain, potentially fetching around $8.8 billion.

“We have made the difficult decision to reduce our quarterly dividend payment to 25 cents per share to strengthen our long-term balance sheet and cash position,” said CEO Tim Wentworth.

The exploration of Shields Health’s sale aligns with the company’s efforts to streamline its operations and focus on core business areas.

Walgreens gained control of Shields Health through a series of transactions under former CEO Roz Brewer. The company initially acquired a minority stake in 2019, secured majority control in 2021, and completed the full takeover by purchasing the remaining 30% for $1.37 billion in 2022.

Read Next: Privacy Risks Flagged: Major Pharmacy Chains Share Customer Data With Authorities Without Warrant.

Price Action: WBA shares are up 1.25% at $22.87 on the last check Wednesday.

Photo via Wikimedia Commons

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.