7 analysts have expressed a variety of opinions on Extra Space Storage EXR over the past quarter, offering a diverse set of opinions from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 1 | 3 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 2 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

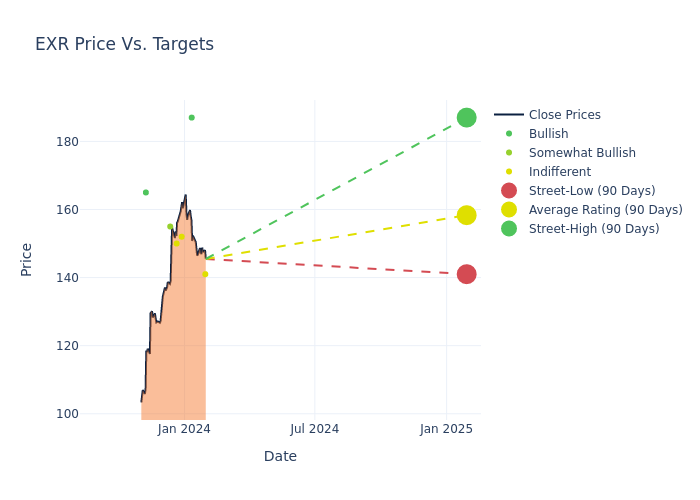

Analysts have recently evaluated Extra Space Storage and provided 12-month price targets. The average target is $159.71, accompanied by a high estimate of $187.00 and a low estimate of $141.00. This current average has increased by 9.52% from the previous average price target of $145.83.

Investigating Analyst Ratings: An Elaborate Study

The analysis of recent analyst actions sheds light on the perception of Extra Space Storage by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Omotayo Okusanya | Deutsche Bank | Announces | Hold | $141.00 | - |

| Caitlin Burrows | Goldman Sachs | Raises | Buy | $187.00 | $168.00 |

| Ki Bin Kim | Truist Securities | Raises | Hold | $152.00 | $138.00 |

| Caitlin Burrows | Goldman Sachs | Raises | Buy | $168.00 | $149.00 |

| Ronald Kamdem | Morgan Stanley | Raises | Equal-Weight | $150.00 | $115.00 |

| Eric Luebchow | Wells Fargo | Raises | Overweight | $155.00 | $120.00 |

| Steve Manaker | Stifel | Lowers | Buy | $165.00 | $185.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Extra Space Storage. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Extra Space Storage compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Extra Space Storage's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Extra Space Storage's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Extra Space Storage analyst ratings.

Discovering Extra Space Storage: A Closer Look

Extra Space Storage is a fully integrated real estate investment trust that owns, operates, and manages almost 2,400 self-storage properties in 41 states, with over 180 million net rentable square feet of storage space. Of these properties, approximately one half is wholly owned, while some facilities are owned through joint ventures and others are owned by third parties and managed by Extra Space Storage in exchange for a management fee.

A Deep Dive into Extra Space Storage's Financials

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Extra Space Storage's revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2023, the company achieved a revenue growth rate of approximately 49.94%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Real Estate sector.

Net Margin: Extra Space Storage's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 25.14% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 2.11%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Extra Space Storage's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.94% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: With a below-average debt-to-equity ratio of 0.77, Extra Space Storage adopts a prudent financial strategy, indicating a balanced approach to debt management.

What Are Analyst Ratings?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.