4 analysts have shared their evaluations of Genpact G during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 0 | 3 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

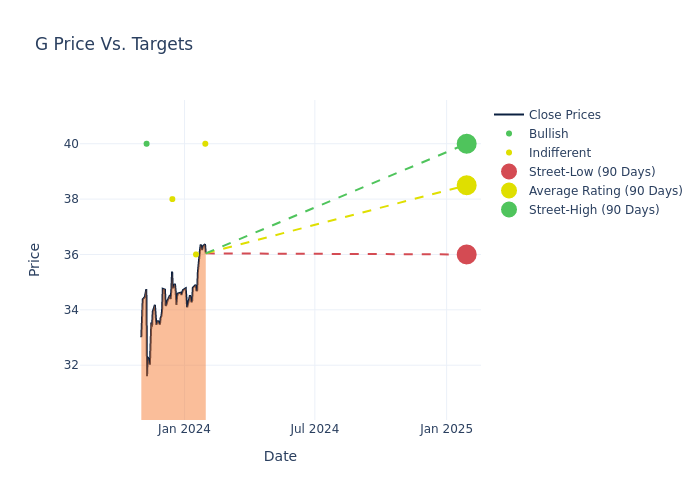

In the assessment of 12-month price targets, analysts unveil insights for Genpact, presenting an average target of $38.5, a high estimate of $40.00, and a low estimate of $36.00. A 9.41% drop is evident in the current average compared to the previous average price target of $42.50.

Understanding Analyst Ratings: A Comprehensive Breakdown

An in-depth analysis of recent analyst actions unveils how financial experts perceive Genpact. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Dan Dolev | Mizuho | Announces | Neutral | $40.00 | - |

| Ashwin Shirvaikar | Citigroup | Raises | Neutral | $36.00 | $35.00 |

| David Koning | Baird | Announces | Neutral | $38.00 | - |

| Mayank Tandon | Needham | Lowers | Buy | $40.00 | $50.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Genpact. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Genpact compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Genpact's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Genpact analyst ratings.

Unveiling the Story Behind Genpact

Genpact Ltd is a provider of business process management services. Clients are industry verticals and operate in banking and financial services, insurance, capital markets, consumer product goods, life sciences, infrastructure, manufacturing and services, healthcare, and high-tech. Genpact's services include aftermarket, direct procurement, risk and compliance, human resources, IT, industrial solutions, collections, finance and accounting, and media services. Genpact's end market by revenue is India. The company is a General Electric spin-off, which is still a large source of revenue for Genpact.

Genpact's Financial Performance

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Positive Revenue Trend: Examining Genpact's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 2.23% as of 30 September, 2023, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Genpact's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 10.35% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Genpact's ROE stands out, surpassing industry averages. With an impressive ROE of 5.97%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Genpact's ROA excels beyond industry benchmarks, reaching 2.59%. This signifies efficient management of assets and strong financial health.

Debt Management: Genpact's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.77.

The Core of Analyst Ratings: What Every Investor Should Know

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.