Zinger Key Points

- Applied Materials displays a strong bullish trend, with the stock consistently above key moving averages, signaling a buy.

- The bullish momentum ahead of its Q1 earnings print, is a welcome sign for investors looking at the stock closely.

Applied Materials Inc AMAT, will be reporting its first-quarter earnings on Feb. 15 after market hours.

Wall Street expects $1.91 in EPS and $6.48 billion in revenues.

The technical analysis setup of Applied Materials signals a strongly bullish trend, supported by the share price consistently above its 5, 20, and 50-day exponential moving averages.

Applied Materials is also experiencing slight buying pressure, contributing to a positive market sentiment.

The company, known for engineering solutions used to produce new semiconductor chips, plays a crucial role in the manufacturing processes of various electronic devices.

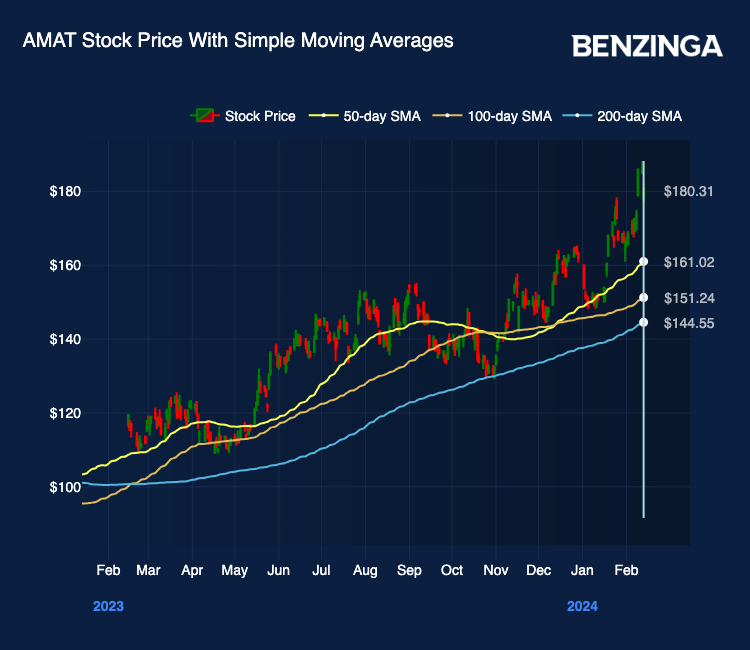

Its eight-day simple moving average (SMA) stands at $175.56; the 20-day SMA at $170.06; and the 50-day SMA at $161.02—all below the current stock price of ~$180-$182, reinforcing buy signals.

The 200-day SMA is at $144.55, further supporting the overall buy sentiment.

Additionally, the eight, 20, and 50-day exponential moving averages are also all indicating a bullish trend. The Moving Average Convergence Divergence (MACD) indicator is 5.92, affirming the buy signal.

Furthermore, both the Bollinger Bands (25) and Bollinger Bands (100) indicators, with ranges of ($156.40 – $176.32) and ($138.26 – $164.22) respectively, support the overall buy outlook for Applied Materials.

Overall, technical indicators signal a robust bullish trend for Applied Materials stock.

Also Read: Applied Mat Earnings Preview

Applied Materials Analyst Consensus Ratings

Ratings & Consensus Estimates: Consensus analyst ratings on Applied Materials stock stand at a Buy currently with a price target of $144.16.

Price Action: Applied Materials stock was trading at $180.31 at the end of market day on Feb. 13.

Read Next: Critical Insights From Applied Mat Analyst Ratings: What You Need To Know

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.