Analysts' ratings for UDR UDR over the last quarter vary from bullish to bearish, as provided by 4 analysts.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 3 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 1 | 1 | 0 | 0 |

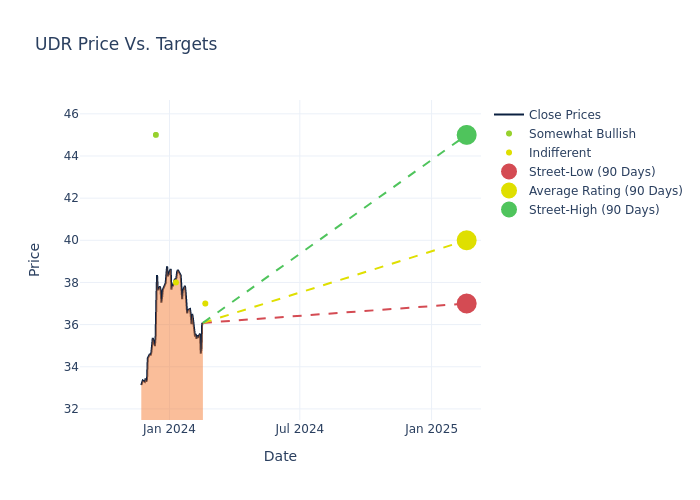

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $38.5, with a high estimate of $45.00 and a low estimate of $34.00. Observing a downward trend, the current average is 7.23% lower than the prior average price target of $41.50.

Interpreting Analyst Ratings: A Closer Look

The analysis of recent analyst actions sheds light on the perception of UDR by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Anthony Powell | Barclays | Lowers | Equal-Weight | $37.00 | $46.00 |

| Vikram Malhorta | Mizuho | Raises | Neutral | $38.00 | $34.00 |

| Todd Thomas | Keybanc | Lowers | Overweight | $45.00 | $48.00 |

| Haendel St. Juste | Mizuho | Lowers | Neutral | $34.00 | $38.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to UDR. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of UDR compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of UDR's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into UDR's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on UDR analyst ratings.

Unveiling the Story Behind UDR

UDR is a real estate investment trust that owns, operates, acquires, renovates, develops, redevelops, disposes of, and manages multifamily apartment communities in targeted markets located in the United States. The company has two reportable segments; Same-Store Communities segment represents those communities acquired, developed, and stabilized prior to January 1, 2021, and held as of December 31, 2022, and Non-Mature Communities/Other segment represents those communities that do not meet the criteria to be included in Same-Store Communities, including, but not limited to, recently acquired, developed and redeveloped communities, and the non-apartment components of mixed-use properties. The company generates key revenue from Same-Store Communities.

A Deep Dive into UDR's Financials

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: UDR's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 0.77%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Real Estate sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: UDR's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 7.69% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): UDR's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 0.79%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.28%, the company showcases effective utilization of assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 1.52.

Understanding the Relevance of Analyst Ratings

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.