In the latest quarter, 8 analysts provided ratings for Alkami Technology ALKT, showcasing a mix of bullish and bearish perspectives.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 1 | 5 | 0 | 0 |

| Last 30D | 1 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 3 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

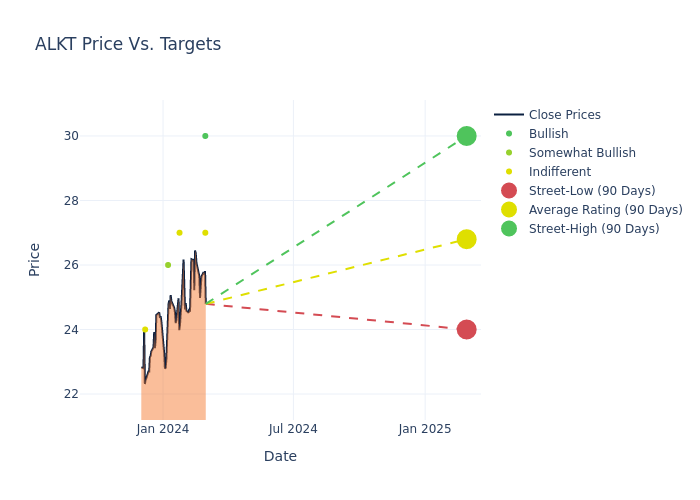

Analysts have recently evaluated Alkami Technology and provided 12-month price targets. The average target is $27.12, accompanied by a high estimate of $30.00 and a low estimate of $24.00. Witnessing a positive shift, the current average has risen by 17.05% from the previous average price target of $23.17.

Deciphering Analyst Ratings: An In-Depth Analysis

A clear picture of Alkami Technology's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Saket Kalia | Barclays | Raises | Equal-Weight | $27.00 | $26.00 |

| Mayank Tandon | Needham | Maintains | Buy | $30.00 | - |

| Adam Hotchkiss | Goldman Sachs | Raises | Neutral | $27.00 | $23.00 |

| Adam Hotchkiss | Goldman Sachs | Raises | Neutral | $27.00 | $23.00 |

| Josh Beck | Keybanc | Raises | Overweight | $26.00 | $21.00 |

| Mayank Tandon | Needham | Raises | Buy | $30.00 | $24.00 |

| Saket Kalia | Barclays | Raises | Equal-Weight | $26.00 | $22.00 |

| Charles Nabhan | Stephens & Co. | Announces | Equal-Weight | $24.00 | - |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Alkami Technology. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Alkami Technology compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Alkami Technology's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Alkami Technology's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Alkami Technology analyst ratings.

Unveiling the Story Behind Alkami Technology

Alkami is a cloud-based digital banking solutions provider. Alkami Platform, allows FIs to onboard and engage new users, accelerate revenues and meaningfully improve operational efficiency with the support of a proprietary, true cloud-based, multi-tenant architecture.

Alkami Technology's Economic Impact: An Analysis

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Alkami Technology displayed positive results in 3 months. As of 30 September, 2023, the company achieved a solid revenue growth rate of approximately 26.76%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Information Technology sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of -22.86%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of -4.8%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Alkami Technology's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -3.24%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 0.32, Alkami Technology adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: What Are They?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.