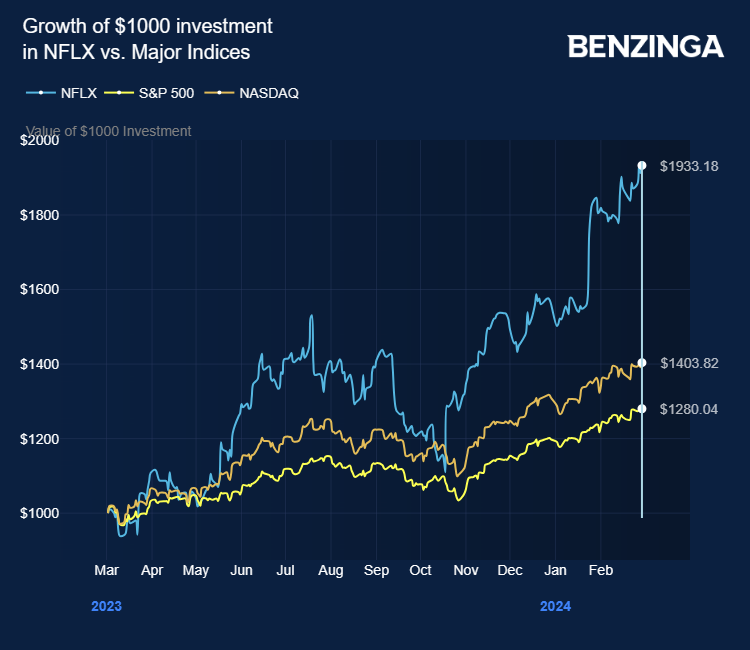

Shares in Netflix Inc NFLX have gained nearly 24% in 2024 and are up 93% over the last year as the video streaming company has taken market share away from traditional movie theaters.

Although Netflix has just announced price increases to its customers, it is still among the cheapest in terms of price per hour consumed.

It has outperformed its rivals in terms of share price, too. Warner Bros Discovery Inc WBD is down 22.7% year-to-date. Earlier this week, the company announced it had ended merger talks with Paramount Global PARA, which would have brought the Paramount+ streaming service into its stable.

Walt Disney Company DIS is only just behind Netflix, with a year-to-date gain of 23.5% thanks to well-received quarterly profits, reported on Feb. 8, driven by growth in its Disney+ streaming service. The company said it expected to add another 5.5-6 million subscribers in the second quarter.

Growth in streaming services, including Amazon.com Inc‘s AMZN Amazon Prime and Apple Inc‘s AAPL Apple TV+, has led to a slide in cinema attendance.

Also Read: Is My Candy Bar Getting Smaller? Yes, A Chocolate Crisis Means Smaller, Pricier Hershey’s

Cinema Hasn’t Fully Recovered From Pandemic

During the global COVID-19 pandemic most lockdown-restricted regular cinemagoers maintained their viewing habits through subscription to streaming services. Cinema operators have never fully recovered.

AMC Entertainment Holdings Inc. AMC, the world’s largest cinema chain, saw its shares hit $393 pre-pandemic.

While it had made financial provisions for closure during the lockdowns, it became an easy target for hedge fund short-selling strategies. Despite sporadic interventions by private investors assembled through social media campaigns, the stock continued to sink, and now stands at a lowly $4.36, having lost 30% since the start of the year.

AMC shares were down more than 13% on Wednesday after the company published its last quarter results. Although they beat Wall Street expectations, investors weren’t sufficiently impressed, given that nearly all the profit growth was thanks to two movies — “Taylor Swift: The Eras Tour” and “Renaissance: A Film By Beyoncé.”

AMC shared in 43% of the profits with Swift, who received the remaining 57%, according to the Los Angeles Times. Both Swift and Beyoncé produced and distributed their respective movies by negotiating directly with AMC. That eliminated the expensive middleman — Hollywood studios.

Deeper Problems Exist

But the problems the cinema industry faces go deeper than the shift in viewing habits. There’s also been a scarcity of big box office winners since last year’s strike by Hollywood actors and writers.

Among the big hopes for cinema operators, which also include Cinemark Holdings Inc. CNK and Imax Corp IMAX, is the second installment of the latest Dune franchise, “Dune: Part Two,” which opens this weekend.

Warner Bros Discovery has a foot in both the streaming and cinema camp, and was the producer of the $190 million film. Its major hit of 2023 was “Barbie,” which grossed $1.4 billion.

“The impact of COVID-19 on movie theaters has accelerated two pre-existing trends,” said analysts at Deloitte in a report on the cinema industry.

“More people are staying home to enjoy movies and other entertainment, and more studios and media distributors are developing their own direct-to-consumer streaming services.”

But major box office winners have become fewer and further between. Warner also had major disappointments in 2023 with The Flash and Aquaman.

For investors, several exchange-traded funds track the streaming sector, including First Trust S-Network Streaming and Gaming ETF BNGE, which is up 5.7% year to date.

Now Read: Apple Customers Are Loyal To iPhone, Say Vision Pro Is Too Pricey

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.