During the last three months, 5 analysts shared their evaluations of Sea SE, revealing diverse outlooks from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 2 | 2 | 0 | 0 |

| Last 30D | 0 | 2 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

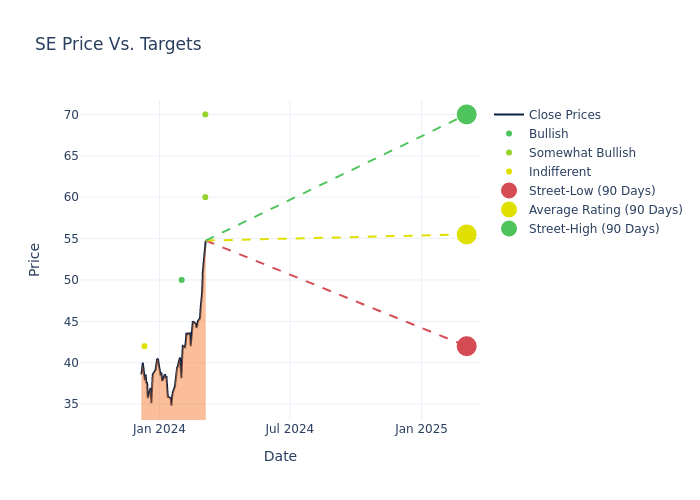

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $53.0, along with a high estimate of $70.00 and a low estimate of $42.00. Surpassing the previous average price target of $44.25, the current average has increased by 19.77%.

Interpreting Analyst Ratings: A Closer Look

A comprehensive examination of how financial experts perceive Sea is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ranjan Sharma | JP Morgan | Raises | Overweight | $70.00 | $43.00 |

| Venugopal Garre | Bernstein | Raises | Outperform | $60.00 | $50.00 |

| Ranjan Sharma | JP Morgan | Raises | Neutral | $43.00 | $40.00 |

| Alicia Yap | Citigroup | Raises | Buy | $50.00 | $44.00 |

| Sachin Mittal | DBS Bank | Announces | Hold | $42.00 | - |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Sea. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Sea compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Sea's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Sea's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Sea analyst ratings.

Unveiling the Story Behind Sea

Sea operates Southeast Asia's largest e-commerce company, Shopee, in terms of gross merchandise value and number of transactions. Sea started as a gaming business, Garena, but in 2015 expanded into e-commerce, which is now the main growth driver. Shopee is a hybrid C2C and B2C marketplace platform operating in eight core markets. Indonesia accounts for 35% of GMV, with the rest split mainly among Taiwan, Vietnam, Thailand, Malaysia, and the Philippines. For Garena, Free Fire was the most downloaded game in January 2022 and accounted for 74% of gaming revenue in 2021. Sea's third business, SeaMoney, provides mostly credit lending.

Understanding the Numbers: Sea's Finances

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Sea displayed positive results in 3 months. As of 30 September, 2023, the company achieved a solid revenue growth rate of approximately 4.89%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Communication Services sector.

Net Margin: Sea's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -4.35%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Sea's ROE excels beyond industry benchmarks, reaching -2.22%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of -0.81%, the company showcases effective utilization of assets.

Debt Management: Sea's debt-to-equity ratio is below the industry average. With a ratio of 0.71, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Significance of Analyst Ratings Explained

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.