Zinger Key Points

- Safe havens are those assets that retain their value or grow in value during economic downturns.

- Tech bulls sees the rally in tech stocks to continue, with Daniel Ives from Wedbush calling it as a '1995 moment.'

- Learn how to trade volatility during Q1 earnings season, live with Matt Maley on Wednesday, April 2 at 6 PM ET. Register for free now.

The broader market, as represented by the S&P 500 Index, and major tech gauges retreated for a second straight session on Tuesday, but Nvidia Corp. NVDA and Super Micro Computer, Inc. SMCI – two AI-focused tech stocks bucked the downtrend.

This begs the question whether these stocks are assuming the traits of safe havens?

What Is Safe Haven Asset: Safe havens are those assets that retain their value or grow in value during economic downturns due to their lack of, or loose correlation with the overall economy. Bonds, gold, the U.S. dollar, Japanese yen and the Swiss franc are typical safe haven bets.

Gold, for one, has been considered a store of value. Given its limited supply, it is often considered a hedge against inflation and an asset whose value is less likely to fluctuate with the vagaries of the economy. Similarly, bonds, with their steady returns in the form of interest income as well as principal repayment, are less volatile and are often considered risk-free assets.

On Tuesday, the tech-heavy Nasdaq Composite fell 1.65% and the Nasdaq 100, an index of 100 biggest non-financial names, ended down a steeper 1.80%. Even as Apple, Tesla, Alphabet, Amazon, Meta, and Microsoft all ended notably lower, Nvidia stood tall and towering amid the ruins.

The Santa Clara, California-based company’s stock added 0.86% on Tuesday before ending at $859.64. Smaller AI plays Super Micro gained 1.53% to $1,090.82, tacking on to its 18.7% surge on Monday in reaction to the news of its S&P 500 inclusion.

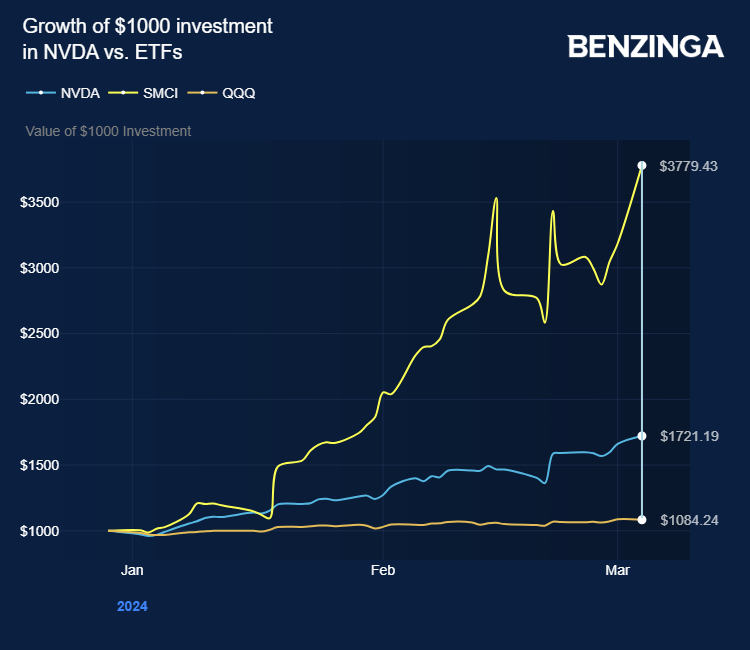

Source: Benzinga

More importantly, as the tech socks and the market are poised to bounce back, these two stocks are outperforming the rest of the large-cap tech stocks in premarket trading.

See Also: Best Tech Stocks Right Now

Nvidia, Super Micro – Picks Among AI Plays? Nvidia’s visionary leader Jensen Huang spotted the opportunity early on, giving the company a head start in the AI race. Following the unveiling of ChatGPT demand for AI accelerators meant for training and inferencing for generative AI rose exponentially, benefiting Nvidia, which has a full-suite of products for the purpose.

The results were there for everyone to see as the company reported back-to-back earnings and revenue outperformances. Following another blowout quarter from Nvidia last month, Rosenblatt Securities analyst Hans Mosesmann said, “The shift to accelerated compute away from general compute is reaching a tipping point, and a disruptive new app, generative AI, is creating a whole new industry.”

Some of Nvidia’s customers, mainly the biggies, have embarked on making in-house AI chips. The efforts are a long shot, and the viability of going downstream is also a moot point.

Meanwhile, Super Micro Computer designs and manufactures high-performance server and storage solutions for demanding computational tasks. Notably, 71% of its revenue comes from the U.S., with Asia, Europe, and Others contributing 18%, 8%, and 3%, respectively.

The overbought levels of these two stocks could serve as pushbacks for investors. Going by comments from tech analysts, the AI revolution is just getting started and it has several legs to play out. Deepwater Asset Management’s Gene Munster conceded that we are in an AI bubble but he expects the bubble to last at least for the next three to five years.

Wedbush analyst Daniel Ives said in a note released on Tuesday that he expects the tech bull run to continue this year. “This is a 1995 Moment as now the AI Revolution and $1 trillion of incremental spending over the next decade is hitting the software ecosystem and rest of tech sector,” he said.

In premarket trading, Nvidia climbed 1.61% to $873.51 and Super Micro Computer gained 2.82% to $1,121.54, according to Benzinga Pro data.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.