Throughout the last three months, 7 analysts have evaluated California Resources CRC, offering a diverse set of opinions from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 3 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 1 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 1 | 0 | 0 |

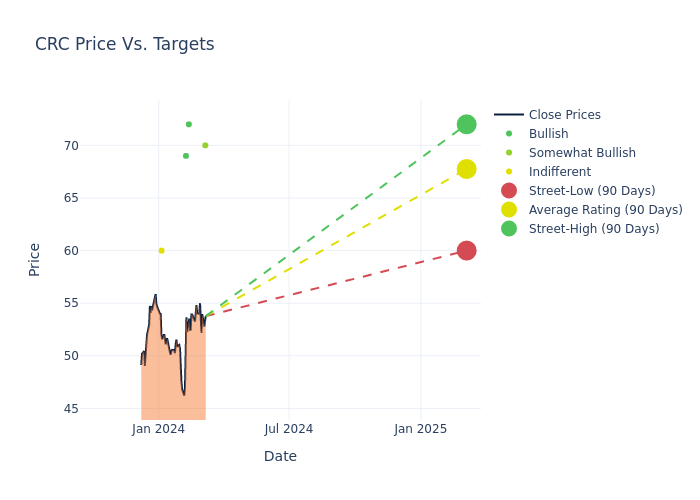

In the assessment of 12-month price targets, analysts unveil insights for California Resources, presenting an average target of $67.0, a high estimate of $72.00, and a low estimate of $60.00. Surpassing the previous average price target of $65.40, the current average has increased by 2.45%.

Analyzing Analyst Ratings: A Detailed Breakdown

The analysis of recent analyst actions sheds light on the perception of California Resources by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Scott Hanold | RBC Capital | Maintains | Outperform | $70.00 | - |

| Derrick Whitfield | Stifel | Raises | Buy | $72.00 | $68.00 |

| Nitin Kumar | Mizuho | Raises | Buy | $69.00 | $63.00 |

| Scott Hanold | RBC Capital | Raises | Outperform | $70.00 | $65.00 |

| Derrick Whitfield | Stifel | Raises | Buy | $68.00 | $67.00 |

| Kalei Akamine | B of A Securities | Lowers | Neutral | $60.00 | $64.00 |

| Scott Hanold | RBC Capital | Maintains | Outperform | $60.00 | - |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to California Resources. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of California Resources compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for California Resources's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of California Resources's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on California Resources analyst ratings.

About California Resources

California Resources Corp is an independent oil and natural gas exploration and production company operating properties exclusively within California. It provides affordable and reliable energy in a safe and responsible manner, to support and enhance the quality of life of Californians and the local communities in which the company operates. It has some of the lowest carbon intensity production in the United States and is focused on maximizing the value of its land, mineral, and technical resources for decarbonization by developing carbon capture and storage (CCS) and other emissions-reducing projects.

California Resources: Delving into Financials

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Challenges: California Resources's revenue growth over 3 months faced difficulties. As of 31 December, 2023, the company experienced a decline of approximately -25.43%. This indicates a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Energy sector.

Net Margin: California Resources's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 30.97% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): California Resources's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 8.81%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): California Resources's ROA stands out, surpassing industry averages. With an impressive ROA of 4.73%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: With a below-average debt-to-equity ratio of 0.27, California Resources adopts a prudent financial strategy, indicating a balanced approach to debt management.

How Are Analyst Ratings Determined?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.