Deep-pocketed investors have adopted a bullish approach towards Unity Software U, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in U usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 12 extraordinary options activities for Unity Software. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 50% bearish. Among these notable options, 8 are puts, totaling $687,984, and 4 are calls, amounting to $158,372.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $17.5 and $40.0 for Unity Software, spanning the last three months.

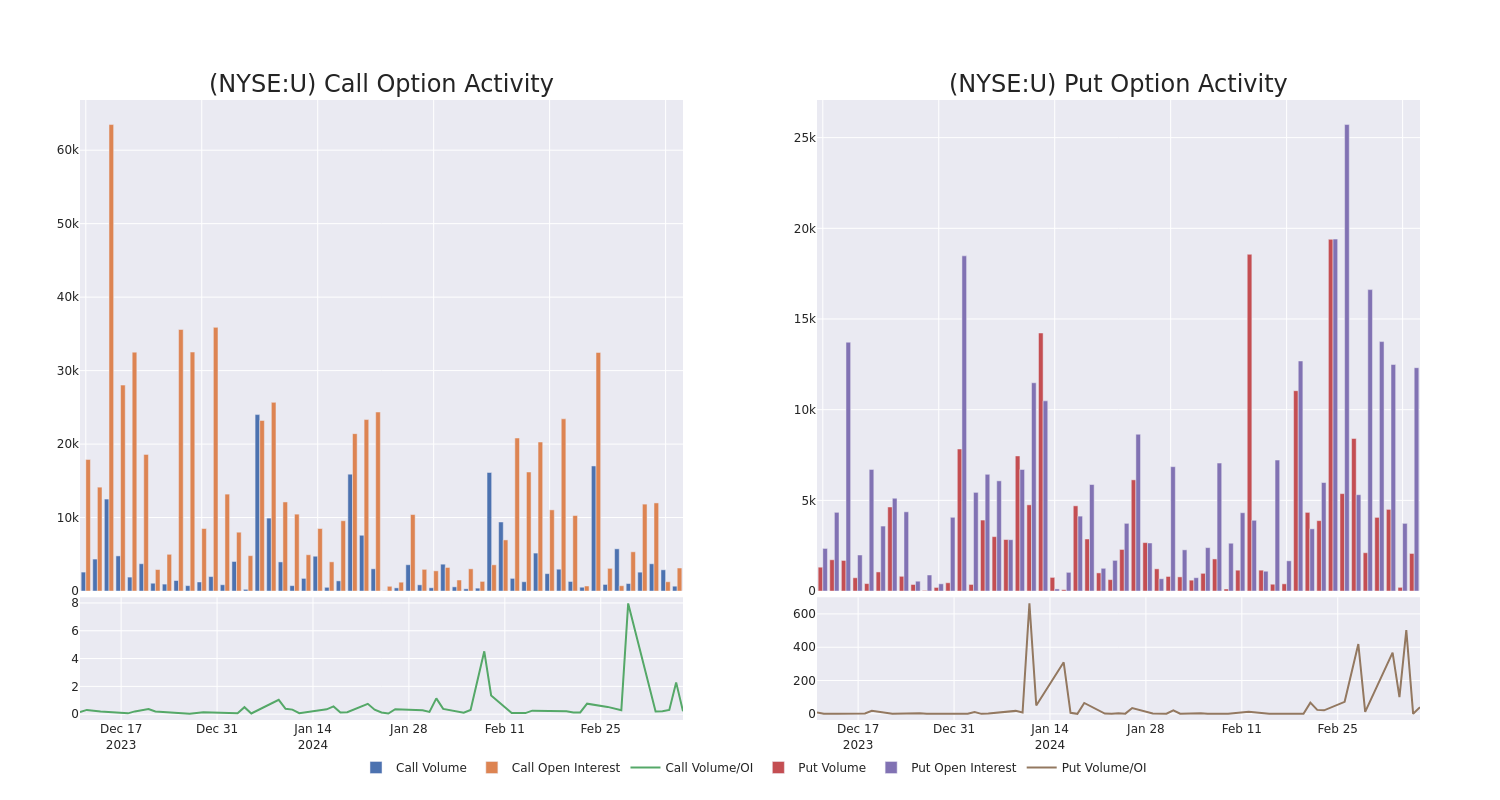

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Unity Software's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Unity Software's whale activity within a strike price range from $17.5 to $40.0 in the last 30 days.

Unity Software Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| U | PUT | SWEEP | BEARISH | 06/21/24 | $35.00 | $252.6K | 5.7K | 300 |

| U | PUT | TRADE | BULLISH | 01/17/25 | $17.50 | $133.2K | 973 | 900 |

| U | PUT | SWEEP | BULLISH | 12/20/24 | $32.00 | $96.8K | 16 | 206 |

| U | PUT | TRADE | BULLISH | 03/15/24 | $28.00 | $66.0K | 2.8K | 188 |

| U | CALL | SWEEP | BEARISH | 12/20/24 | $40.00 | $61.5K | 1.8K | 251 |

About Unity Software

Unity Software Inc provides a software platform for creating and operating interactive, real-time 3D content. The platform can be used to create, run, and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. The business is spread across the United States, Greater China, EMEA, APAC, and Other Americas, of which key revenue is derived from the EMEA region. The products are used in the gaming industry, architecture and construction sector, animation industry, and designing sector.

Where Is Unity Software Standing Right Now?

- With a trading volume of 4,089,931, the price of U is up by 0.77%, reaching $27.55.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 61 days from now.

What Analysts Are Saying About Unity Software

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $32.6.

- Consistent in their evaluation, an analyst from Stifel keeps a Buy rating on Unity Software with a target price of $35.

- Consistent in their evaluation, an analyst from Needham keeps a Buy rating on Unity Software with a target price of $31.

- Maintaining their stance, an analyst from Stifel continues to hold a Buy rating for Unity Software, targeting a price of $32.

- Maintaining their stance, an analyst from Stifel continues to hold a Buy rating for Unity Software, targeting a price of $35.

- Showing optimism, an analyst from Piper Sandler upgrades its rating to Neutral with a revised price target of $30.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Unity Software options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.