5 analysts have expressed a variety of opinions on Align Tech ALGN over the past quarter, offering a diverse set of opinions from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 2 | 0 | 1 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 1 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

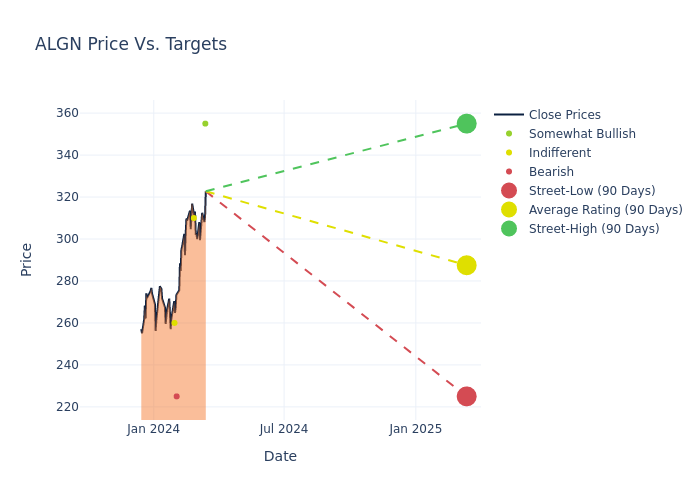

In the assessment of 12-month price targets, analysts unveil insights for Align Tech, presenting an average target of $297.0, a high estimate of $355.00, and a low estimate of $225.00. Observing a 16.24% increase, the current average has risen from the previous average price target of $255.50.

Understanding Analyst Ratings: A Comprehensive Breakdown

The perception of Align Tech by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jason Bednar | Piper Sandler | Raises | Overweight | $355.00 | $335.00 |

| Michael Cherny | Leerink Partners | Announces | Market Perform | $310.00 | - |

| Nathan Rice | Goldman Sachs | Raises | Sell | $225.00 | $197.00 |

| Jason Bednar | Piper Sandler | Raises | Overweight | $335.00 | $290.00 |

| Kevin Caliendo | UBS | Raises | Neutral | $260.00 | $200.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Align Tech. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Align Tech compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Align Tech's stock. This comparison reveals trends in analysts' expectations over time.

To gain a panoramic view of Align Tech's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Align Tech analyst ratings.

All You Need to Know About Align Tech

Align Technology is the leading manufacturer of clear aligners. Invisalign, its main product, was approved by the FDA in 1998, and it has since dominated, controlling over 90% of the market. Invisalign can treat roughly 90% of all malocclusion cases (misaligned teeth), and there are over 230,000 Invisalign-trained dentists and orthodontists. In 2022, Invisalign treated over 2 million cases, or roughly 10% of all orthodontic cases for the year, and it has treated over 14 million patients since its launch. Align also sells intraoral scanners under the brand iTero, which captures digital impressions of patients' teeth and illustrates treatment plans. Over 85% of Invisalign cases are submitted by digital scans and iTero scans make up over half of these scans.

A Deep Dive into Align Tech's Financials

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Align Tech's remarkable performance in 3 months is evident. As of 31 December, 2023, the company achieved an impressive revenue growth rate of 6.12%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Align Tech's net margin is impressive, surpassing industry averages. With a net margin of 12.96%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Align Tech's ROE excels beyond industry benchmarks, reaching 3.34%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Align Tech's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.0% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Align Tech's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.03.

Analyst Ratings: Simplified

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.