Throughout the last three months, 8 analysts have evaluated Charter Communications CHTR, offering a diverse set of opinions from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 1 | 3 | 1 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 2 | 0 | 2 | 1 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

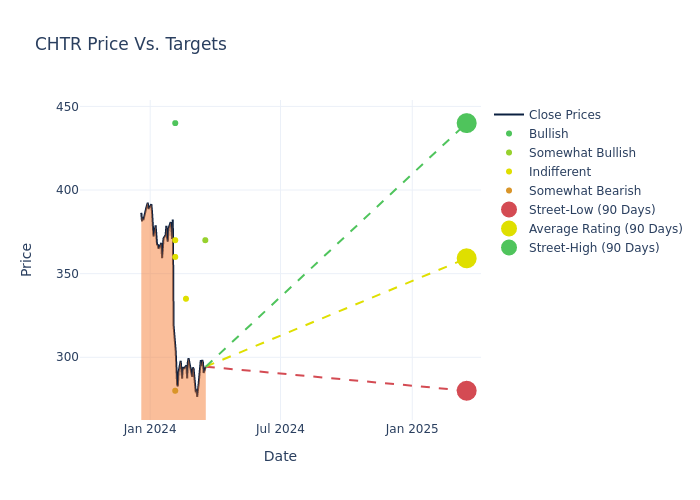

In the assessment of 12-month price targets, analysts unveil insights for Charter Communications, presenting an average target of $387.75, a high estimate of $475.00, and a low estimate of $280.00. Observing a downward trend, the current average is 12.56% lower than the prior average price target of $443.43.

Analyzing Analyst Ratings: A Detailed Breakdown

The standing of Charter Communications among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Laurent Yoon | Bernstein | Announces | Outperform | $370.00 | - |

| Barton Crockett | Rosenblatt | Lowers | Neutral | $335.00 | $472.00 |

| Barton Crockett | Rosenblatt | Lowers | Buy | $472.00 | $475.00 |

| John Hodulik | UBS | Lowers | Neutral | $360.00 | $415.00 |

| Matthew Harrigan | Benchmark | Lowers | Buy | $440.00 | $490.00 |

| Kannan Venkateshwar | Barclays | Lowers | Underweight | $280.00 | $325.00 |

| Sebastiano Petti | JP Morgan | Lowers | Neutral | $370.00 | $445.00 |

| Barton Crockett | Rosenblatt | Lowers | Buy | $475.00 | $482.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Charter Communications. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Charter Communications compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Charter Communications's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Charter Communications's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Charter Communications analyst ratings.

Unveiling the Story Behind Charter Communications

Charter is the product of the 2016 merger of three cable companies, each with a decades-long history in the business: Legacy Charter, Time Warner Cable, and Bright House Networks. The firm now holds networks capable of providing television, internet access, and phone services to roughly 56 million U.S. homes and businesses, around 40% of the country. Across this footprint, Charter serves 30 million residential and 2 million commercial customer accounts under the Spectrum brand, making it the second-largest U.S. cable company behind Comcast. The firm also owns, in whole or in part, sports and news networks, including Spectrum SportsNet (long-term local rights to Los Angeles Lakers games), SportsNet LA (Los Angeles Dodgers), SportsNet New York (New York Mets), and Spectrum News NY1.

Charter Communications: Financial Performance Dissected

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Positive Revenue Trend: Examining Charter Communications's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 0.27% as of 31 December, 2023, showcasing a substantial increase in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Communication Services sector.

Net Margin: Charter Communications's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 7.72% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Charter Communications's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 9.54%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Charter Communications's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.72%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 8.82, caution is advised due to increased financial risk.

Understanding the Relevance of Analyst Ratings

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.