Zinger Key Points

- Tesla's bullish signal contrasts with prevailing pessimism, prompting investors to ponder buying during market dips.

- Despite negative sentiment, Tesla's bullish divergence might just be presenting a strategic buy-the-dip opportunity for investors.

- Get Wall Street's Hottest Chart Every Morning

Shares of Tesla Inc. TSLA jumped by 6.25% on Monday after the company announced a price increase for the Model Y.

Tesla intends to raise prices for its Model Y electric SUV in the U.S. by $1,000 starting April 1. Additionally, prices for Model Y in several European countries will increase by about 2,000 euros on March 22.

Tesla Stock Down 30% YTD

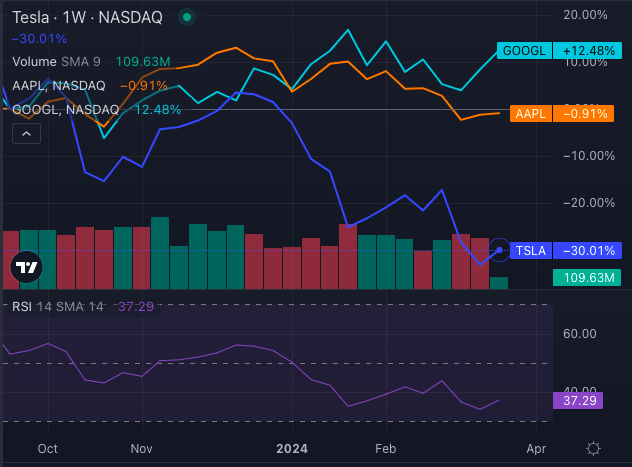

Tesla stock is down 30% YTD. The company’s overall profit margins have suffered over the past year due to an ongoing price war within the EV industry initiated over a year ago. This was further compounded by decreased consumer demand for electric vehicles.

News of the price increase may have, thus, been interpreted by investors as a move towards better margins leading to improved profitability. However, the stock reversed some gains pre-market on Tuesday, March 19.

Also Read: Tesla Stock Trades Lower Premarket: What’s Weighing Down On EV Giant Today

As the company makes strategic moves to improve its outlook for 2024, investors and traders are considering whether now is the right time to buy the dip.

Time To Buy-The-Dip?

Benzinga looked at some technical indicators for Tesla (TSLA) stock:

- Bullish Divergence in RSI: The presence of bullish divergences in the RSI indicator suggests potential upward momentum building for Tesla stock. The RSI, at 37.29, is also indicating oversold conditions, potentially signaling a reversal in the stock’s price.

- Time for Higher Low: With limited downside potential without breaking down, now could be an opportune time for Tesla stock to establish a higher low, indicating a potential reversal in the current bearish trend.

- Contrarian Opportunity: Despite negative sentiment and a tumultuous newsfeed, contrarian investors may find opportunity in Tesla stock’s underperformance compared to other stocks like Apple Inc AAPL and Alphabet Inc GOOG GOOGL.

- Double Bottom Formation: Both Tesla stock and Nasdaq are showing a double bottom formation with bullish divergences further supporting the potential for a reversal in the stock’s price trajectory.

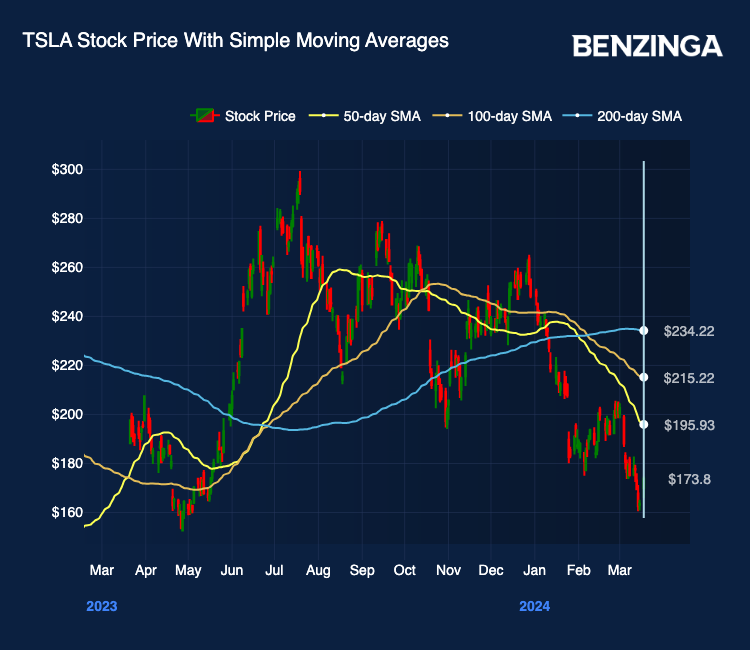

- Moving Averages: While Tesla’s share price is currently below its short-term (5-day, 20-day) and long-term (50-day, 200-day) moving averages, buying pressure is evident, indicating a potential bullish movement ahead.

While Tesla faces negative sentiments, technical indicators are signaling the presence of a bullish divergence. Oversold conditions, and potential contrarian opportunities also seem to suggest a possible reversal and upward movement in the stock’s price in the near future.

Investors should closely monitor key support and resistance levels for confirmation of a trend reversal.

Image created using artificial intelligence with Midjourney.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.