Zinger Key Points

- PDD Holdings' Q4 revenue soars 123% Y/Y to $12.52B, surpassing estimates with earnings spike.

- Stock jumps as Pinduoduo reports significant gains in online marketing and transaction services revenue.

- Every week, our Whisper Index uncovers five overlooked stocks with big breakout potential. Get the latest picks today before they gain traction.

PDD Holdings Inc PDD reported fourth-quarter fiscal 2023 revenue growth of 123% year-on-year to $12.52 billion (CNY88.88 billion), beating the consensus of $11.01 billion.

The Chinese online retailer’s adjusted earnings per ADS of $2.40 (CNY17.32) increased from CNY8.34 Y/Y, beating the consensus of $1.60. The stock price climbed after the results.

Revenues from online marketing services and others rose 57% Y/Y to $6.86 billion.

Revenues from transaction services jumped 357% Y/Y to $5.66 billion.

Also Read: Alibaba’s Strategic Shift – New CEO for Grocery Arm and Bold Move to Enhance HarmonyOS with Huawei

The Alibaba Group Holding Limited BABA rival posted an adjusted operating profit of $3.46 billion, up 112% Y/Y.

Pinduoduo held $30.6 billion in cash and equivalents as of December 31, 2023, and generated $5.2 billion in operating cash flow.

“In the fourth quarter, we saw growing demand driven by encouraging consumer sentiment,” said Jiazhen Zhao, Executive Director and Co-Chief Executive Officer of PDD Holdings.

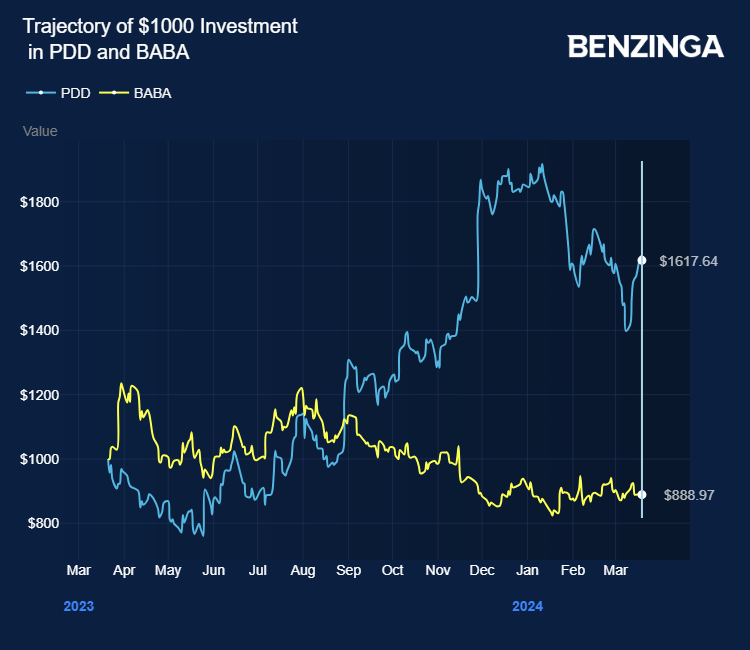

The stock gained 62% last year. Investors can gain exposure to the stock via Global X MSCI China Consumer Discretionary ETF CHIQ and Invesco China Technology ETF CQQQ.

Price Action: PDD shares traded higher by 15.7% at $147.52 in the premarket on the last check Wednesday.

Also Read: Alibaba Unveils New Processor and Open-Source Laptop Based On RISC-V Processors

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.